Encouraging Early Data for IBI3016 Could Be a Game Changer for Innovent Biologics (SEHK:1801)

Reviewed by Sasha Jovanovic

- Innovent Biologics and SanegeneBio recently reported encouraging preliminary results from the first-in-human Phase 1 trial of IBI3016, an experimental siRNA therapy for hypertension, at the 2025 American Heart Association conference.

- The study showed favorable safety, sustained AGT inhibition, and early antihypertensive effects, underscoring potential progress for innovative treatments in a large unmet market.

- We'll look at how promising early clinical results with IBI3016 may reshape Innovent Biologics' investment narrative in cardiovascular innovation.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Innovent Biologics' Investment Narrative?

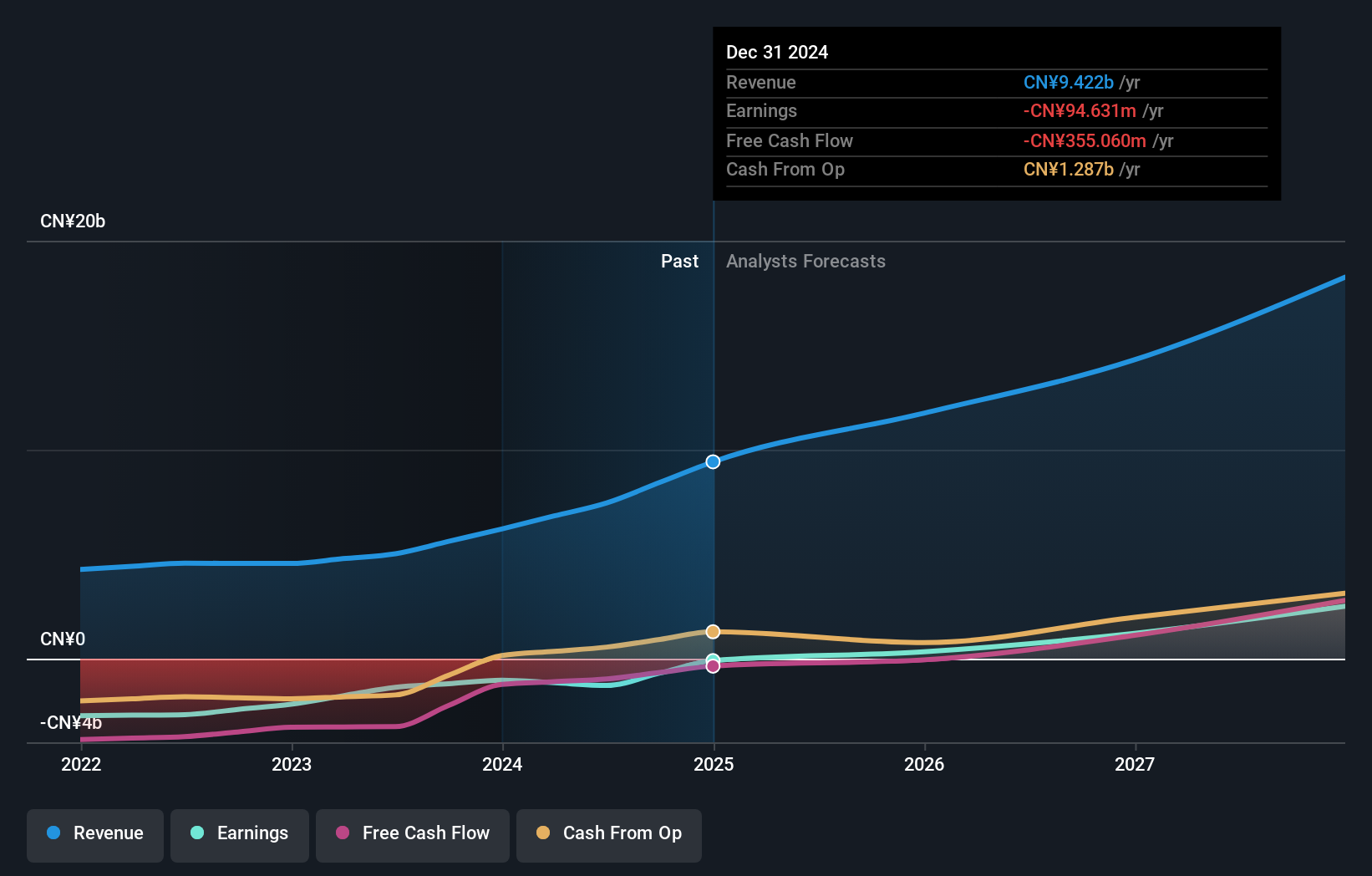

At this point, owning shares in Innovent Biologics means believing in its ability to transform pipeline momentum into real commercial value, especially as the company expands beyond oncology into cardiometabolic diseases. The recent positive Phase 1 results for IBI3016, a siRNA therapy targeting hypertension, build on a string of late-stage milestones, mazdutide's regulatory approval, strong diabetes data, and new partnerships in both oncology and metabolic care. The new hypertension data could become an important near-term catalyst if subsequent studies progress well, though it remains early. Investors will be weighing the size of the addressable hypertension market against the risks: Innovent trades on a high price-to-earnings ratio, faces execution hurdles with a newer management team, and the need to prove out sustainability of profitable growth. How IBI3016 develops could shift short-term focus to cardiovascular innovation and add a new dimension to Innovent’s growth story, helping mitigate but not eliminate current risks.

But rapid growth often comes with volatility that investors should pay close attention to. Innovent Biologics' shares have been on the rise but are still potentially undervalued by 14%. Find out what it's worth.Exploring Other Perspectives

Explore 3 other fair value estimates on Innovent Biologics - why the stock might be worth less than half the current price!

Build Your Own Innovent Biologics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Innovent Biologics research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Innovent Biologics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Innovent Biologics' overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 28 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1801

Innovent Biologics

A biopharmaceutical company, engages in the research and development of antibody and protein medicine products in the People’s Republic of China, the United States, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives