- Taiwan

- /

- Semiconductors

- /

- TWSE:3653

Asian Market Value Opportunities: Three Stocks To Watch In September 2025

Reviewed by Simply Wall St

As global markets navigate a landscape of cautious monetary policies and fluctuating economic indicators, Asian equities have shown resilience with notable gains in key indices such as Japan's Nikkei 225 and China's CSI 300. In this environment, identifying undervalued stocks becomes crucial for investors seeking opportunities amidst the broader market dynamics, where factors like liquidity levels and regional economic developments play a significant role.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥84.05 | CN¥165.09 | 49.1% |

| Tibet GaoZheng Explosive (SZSE:002827) | CN¥38.57 | CN¥76.87 | 49.8% |

| Takara Bio (TSE:4974) | ¥932.00 | ¥1829.46 | 49.1% |

| Taiwan Union Technology (TPEX:6274) | NT$314.50 | NT$621.14 | 49.4% |

| Samyang Foods (KOSE:A003230) | ₩1529000.00 | ₩3006664.22 | 49.1% |

| Nippon Chemi-Con (TSE:6997) | ¥1635.00 | ¥3218.06 | 49.2% |

| Kolmar Korea (KOSE:A161890) | ₩77800.00 | ₩154609.93 | 49.7% |

| HAESUNG DS (KOSE:A195870) | ₩30800.00 | ₩61085.55 | 49.6% |

| Dajin Heavy IndustryLtd (SZSE:002487) | CN¥47.21 | CN¥93.80 | 49.7% |

| Chanjet Information Technology (SEHK:1588) | HK$10.87 | HK$21.51 | 49.5% |

We're going to check out a few of the best picks from our screener tool.

Innovent Biologics (SEHK:1801)

Overview: Innovent Biologics, Inc. is a biopharmaceutical company focused on the research and development of antibody and protein medicine products in China, the United States, and internationally, with a market cap of HK$165.11 billion.

Operations: Innovent Biologics, Inc. generates revenue through the development and commercialization of antibody and protein-based therapeutics across China, the United States, and international markets.

Estimated Discount To Fair Value: 20%

Innovent Biologics is trading at approximately HK$96.4, below its estimated fair value of HK$120.43, suggesting it may be undervalued based on cash flows. Recent approval of mazdutide for type 2 diabetes in China highlights potential revenue growth, while earnings are forecast to grow significantly over the next three years. The company's strategic partnerships and robust pipeline further support its growth trajectory in the competitive Asian biopharmaceutical market.

- In light of our recent growth report, it seems possible that Innovent Biologics' financial performance will exceed current levels.

- Get an in-depth perspective on Innovent Biologics' balance sheet by reading our health report here.

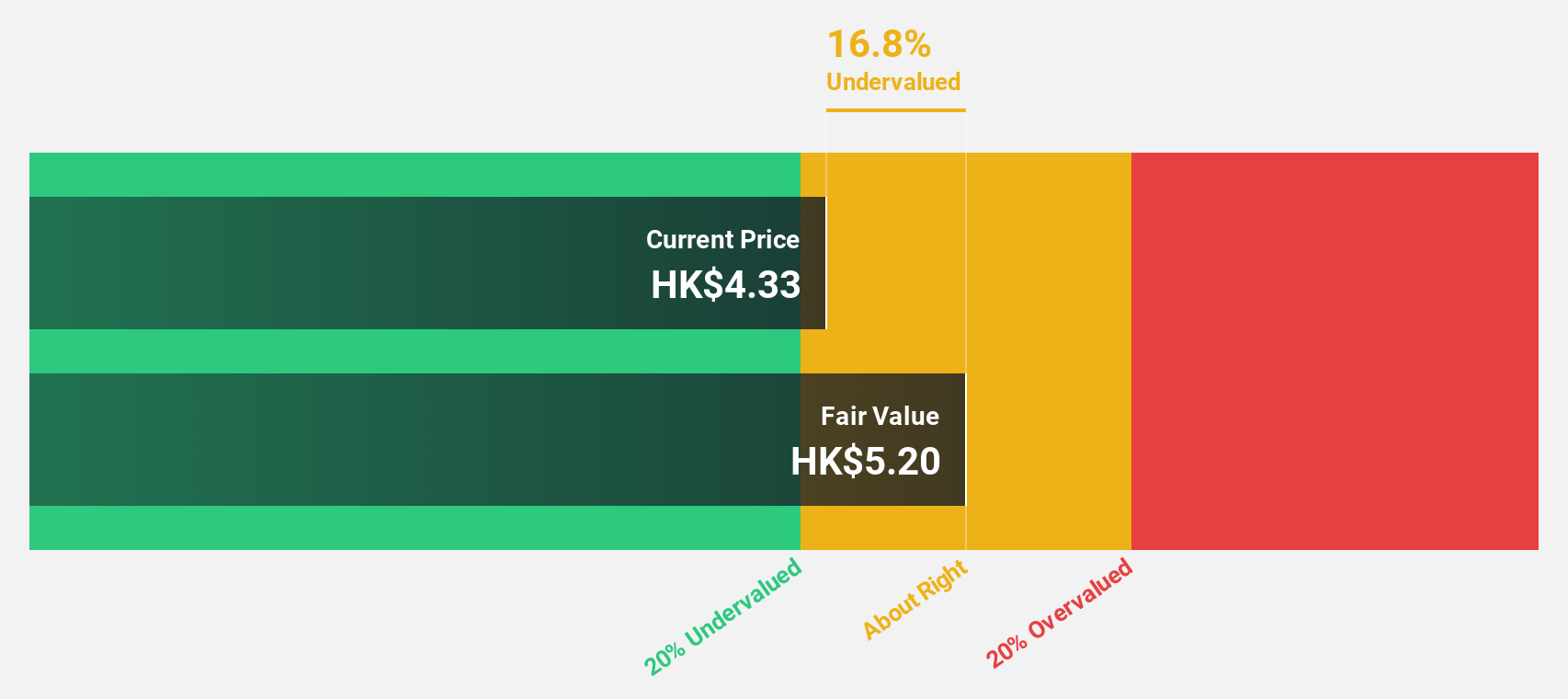

Alibaba Health Information Technology (SEHK:241)

Overview: Alibaba Health Information Technology Limited operates in pharmaceutical direct sales, pharmaceutical e-commerce platforms, and healthcare and digital services in Mainland China and Hong Kong, with a market cap of HK$107.32 billion.

Operations: The company's revenue from the distribution and development of pharmaceutical and healthcare products is CN¥30.60 billion.

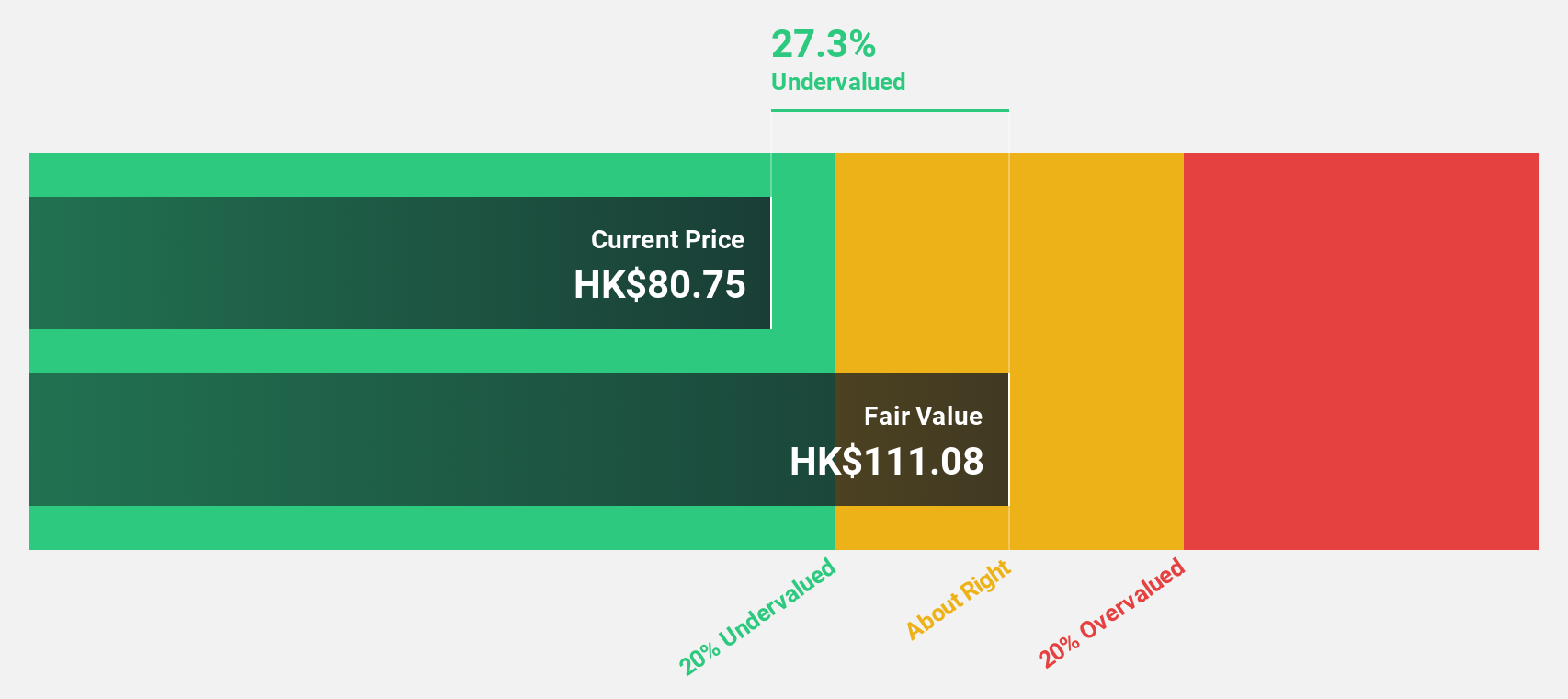

Estimated Discount To Fair Value: 41.1%

Alibaba Health Information Technology is trading at HK$6.66, below its estimated fair value of HK$11.31, highlighting potential undervaluation based on cash flows. Earnings are projected to grow significantly at 20.3% annually over the next three years, outpacing the Hong Kong market's growth rate of 12.6%. Despite large one-off items impacting recent results and a forecasted low return on equity of 14%, revenue growth remains robust at 9.9% per year.

- The growth report we've compiled suggests that Alibaba Health Information Technology's future prospects could be on the up.

- Navigate through the intricacies of Alibaba Health Information Technology with our comprehensive financial health report here.

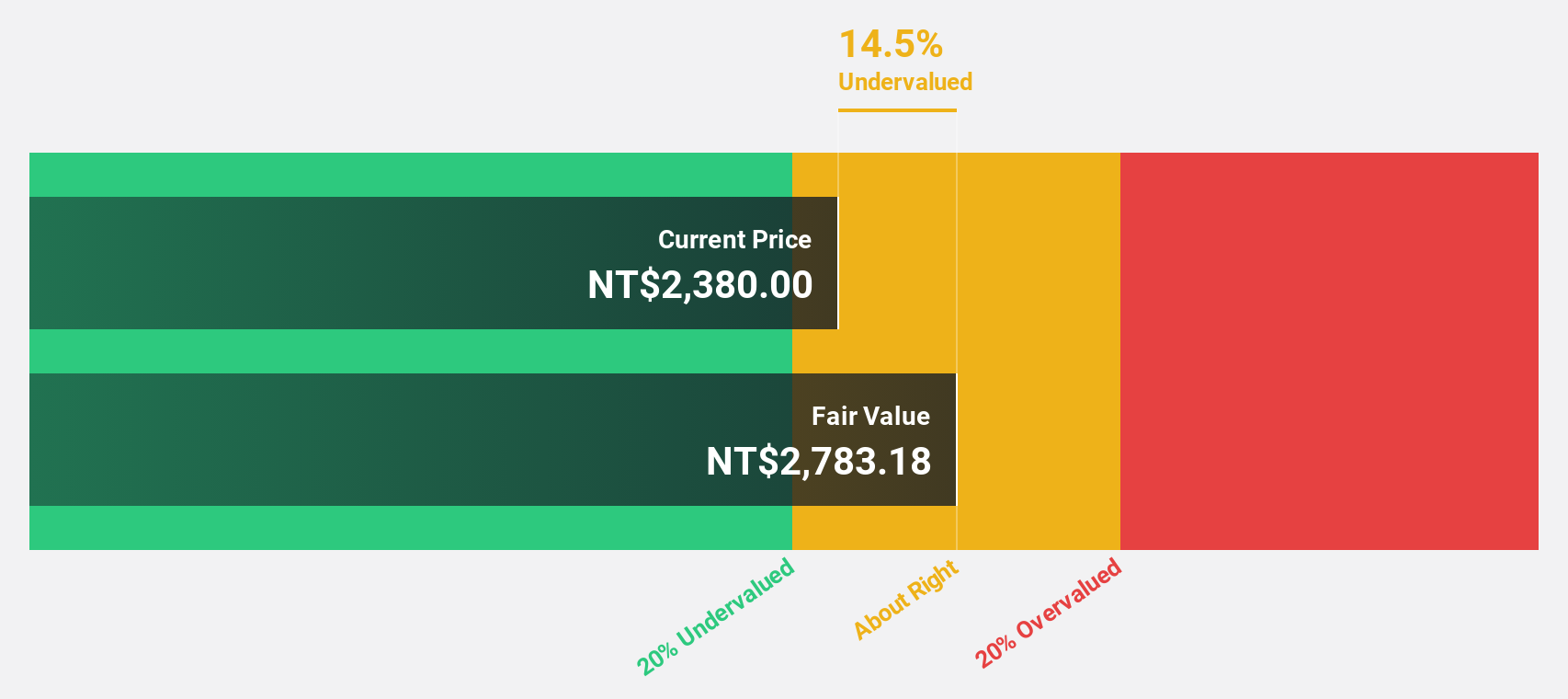

Jentech Precision Industrial (TWSE:3653)

Overview: Jentech Precision Industrial Co., Ltd is a company that manufactures and sells precision molds globally, with a market cap of NT$344.44 billion.

Operations: The Semiconductor Business Group generates NT$14.74 billion in revenue for Jentech Precision Industrial Co., Ltd.

Estimated Discount To Fair Value: 15.9%

Jentech Precision Industrial's stock trades at NT$2,410, below its fair value estimate of NT$2,866. This suggests undervaluation based on cash flows. The company reported robust earnings growth with second-quarter net income rising to NT$1.12 billion from NT$851.57 million a year ago. Forecasts indicate significant annual earnings growth of 62.2%, surpassing the Taiwan market's average, despite recent share price volatility and a high projected return on equity of 51.7%.

- Upon reviewing our latest growth report, Jentech Precision Industrial's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Jentech Precision Industrial with our detailed financial health report.

Next Steps

- Investigate our full lineup of 288 Undervalued Asian Stocks Based On Cash Flows right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3653

Jentech Precision Industrial

Manufactures and sells precision molds worldwide.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Community Narratives