Ascletis Pharma (HKG:1672) shareholders are up 17% this past week, but still in the red over the last five years

It is doubtless a positive to see that the Ascletis Pharma Inc. (HKG:1672) share price has gained some 106% in the last three months. But don't envy holders -- looking back over 5 years the returns have been really bad. In fact, the share price has declined rather badly, down some 60% in that time. So we're not so sure if the recent bounce should be celebrated. However, in the best case scenario (far from fait accompli), this improved performance might be sustained.

While the stock has risen 17% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

View our latest analysis for Ascletis Pharma

We don't think Ascletis Pharma's revenue of CN¥10,090,000 is enough to establish significant demand. We can't help wondering why it's publicly listed so early in its journey. Are venture capitalists not interested? So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. For example, they may be hoping that Ascletis Pharma comes up with a great new product, before it runs out of money.

We think companies that have neither significant revenues nor profits are pretty high risk. There is usually a significant chance that they will need more money for business development, putting them at the mercy of capital markets to raise equity. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. Some Ascletis Pharma investors have already had a taste of the bitterness stocks like this can leave in the mouth.

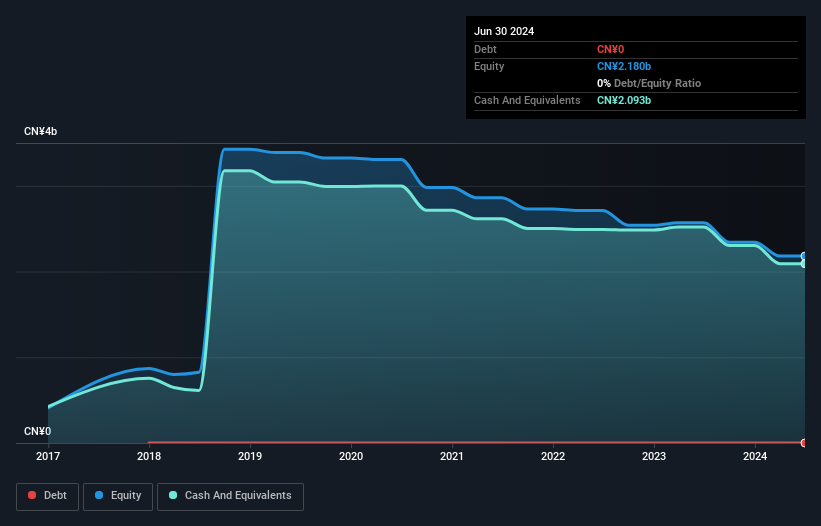

When it last reported its balance sheet in June 2024, Ascletis Pharma could boast a strong position, with cash in excess of all liabilities of CN¥2.0b. That allows management to focus on growing the business, and not worry too much about raising capital. But since the share price has dropped 10% per year, over 5 years , it seems like the market might have been over-excited previously. You can see in the image below, how Ascletis Pharma's cash levels have changed over time (click to see the values).

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. Would it bother you if insiders were selling the stock? I'd like that just about as much as I like to drink milk and fruit juice mixed together. It costs nothing but a moment of your time to see if we are picking up on any insider selling.

A Different Perspective

While the broader market gained around 25% in the last year, Ascletis Pharma shareholders lost 10%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. However, the loss over the last year isn't as bad as the 10% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Ascletis Pharma (at least 1 which is concerning) , and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1672

Ascletis Pharma

A biotechnology company, engages in the research and development, manufacture, marketing, and sale of pharmaceutical products in Mainland China.

Adequate balance sheet low.

Market Insights

Community Narratives