Ascletis Pharma (HKG:1672) dips 10% this week as increasing losses might not be inspiring confidence among its investors

Investors can approximate the average market return by buying an index fund. But if you buy individual stocks, you can do both better or worse than that. Unfortunately the Ascletis Pharma Inc. (HKG:1672) share price slid 37% over twelve months. That's well below the market return of 8.0%. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 13% in three years. In the last ninety days we've seen the share price slide 37%. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

If the past week is anything to go by, investor sentiment for Ascletis Pharma isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Check out our latest analysis for Ascletis Pharma

SWOT Analysis for Ascletis Pharma

- Currently debt free.

- Expensive based on P/S ratio compared to estimated Fair P/S ratio.

- Forecast to reduce losses next year.

- Has sufficient cash runway for more than 3 years based on current free cash flows.

- No apparent threats visible for 1672.

Ascletis Pharma wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In just one year Ascletis Pharma saw its revenue fall by 30%. That's not what investors generally want to see. The stock price has languished lately, falling 37% in a year. That seems pretty reasonable given the lack of both profits and revenue growth. It's hard to escape the conclusion that buyers must envision either growth down the track, cost cutting, or both.

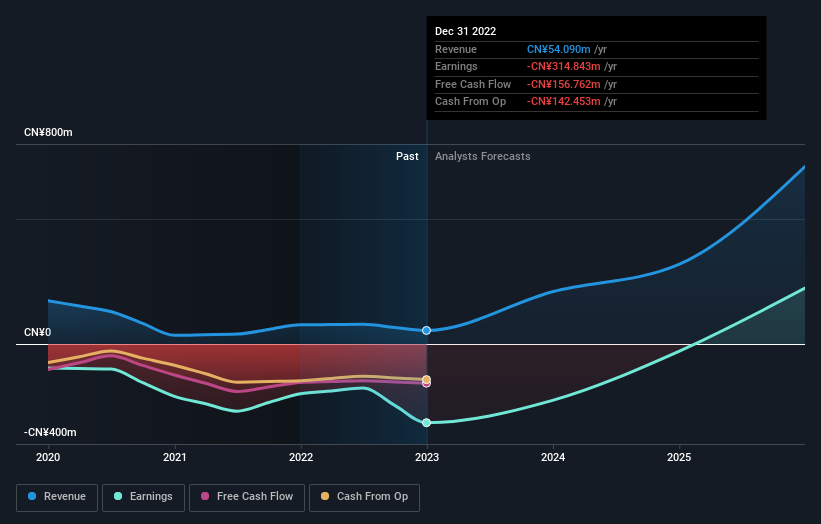

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Ascletis Pharma stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Over the last year, Ascletis Pharma shareholders took a loss of 37%. In contrast the market gained about 8.0%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The three-year loss of 4% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1672

Ascletis Pharma

A biotechnology company, engages in the research and development, manufacture, marketing, and sale of pharmaceutical products in Mainland China.

Flawless balance sheet low.

Market Insights

Community Narratives