With EPS Growth And More, Tong Ren Tang Technologies (HKG:1666) Makes An Interesting Case

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Tong Ren Tang Technologies (HKG:1666). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Tong Ren Tang Technologies with the means to add long-term value to shareholders.

Check out our latest analysis for Tong Ren Tang Technologies

How Fast Is Tong Ren Tang Technologies Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. It certainly is nice to see that Tong Ren Tang Technologies has managed to grow EPS by 27% per year over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

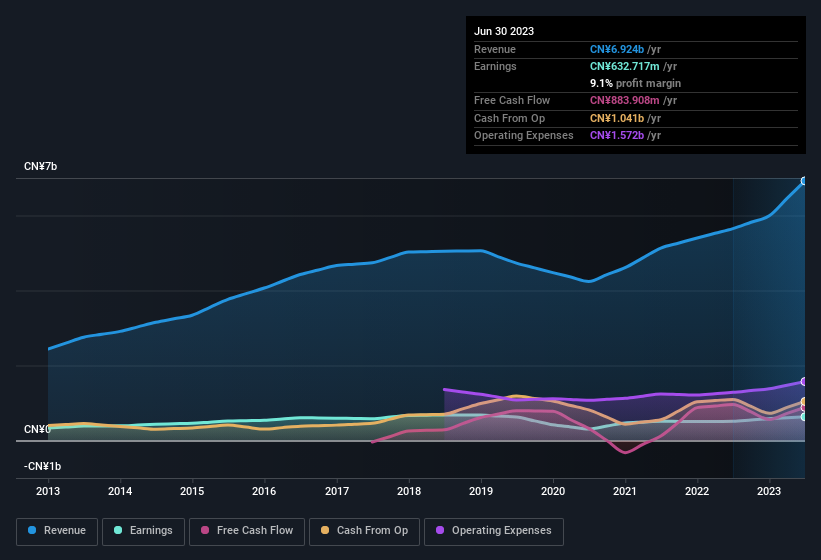

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Tong Ren Tang Technologies maintained stable EBIT margins over the last year, all while growing revenue 23% to CN¥6.9b. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Tong Ren Tang Technologies' future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Tong Ren Tang Technologies Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. Tong Ren Tang Technologies followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. As a matter of fact, their holding is valued at CN¥219m. That shows significant buy-in, and may indicate conviction in the business strategy. Even though that's only about 2.8% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Does Tong Ren Tang Technologies Deserve A Spot On Your Watchlist?

For growth investors, Tong Ren Tang Technologies' raw rate of earnings growth is a beacon in the night. With EPS growth rates like that, it's hardly surprising to see company higher-ups place confidence in the company through continuing to hold a significant investment. Fast growth and confident insiders should be enough to warrant further research, so it would seem that it's a good stock to follow. Now, you could try to make up your mind on Tong Ren Tang Technologies by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

Although Tong Ren Tang Technologies certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of Hong Kong companies that not only boast of strong growth but have also seen recent insider buying..

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Tong Ren Tang Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1666

Tong Ren Tang Technologies

Produces and distributes Chinese medicine products in Mainland China and Hong Kong.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026