Here's Why Tong Ren Tang Technologies (HKG:1666) Can Manage Its Debt Responsibly

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Tong Ren Tang Technologies Co. Ltd. (HKG:1666) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Tong Ren Tang Technologies

What Is Tong Ren Tang Technologies's Net Debt?

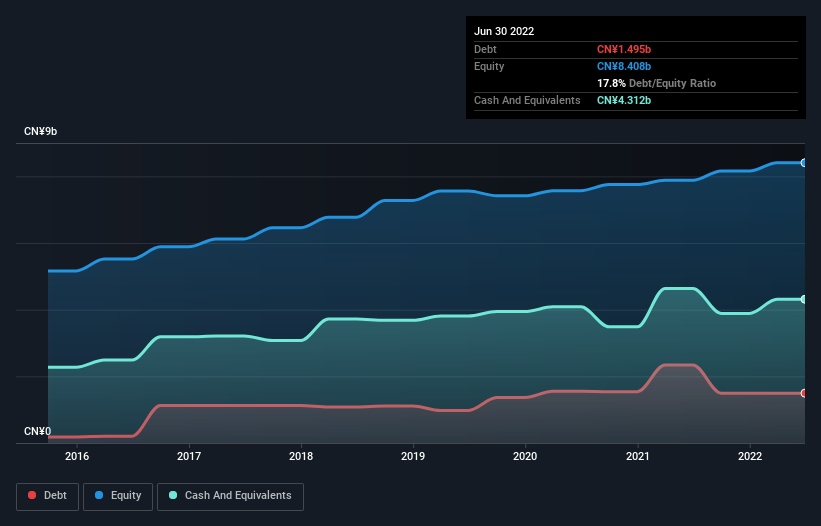

The image below, which you can click on for greater detail, shows that Tong Ren Tang Technologies had debt of CN¥1.50b at the end of June 2022, a reduction from CN¥2.34b over a year. But on the other hand it also has CN¥4.31b in cash, leading to a CN¥2.82b net cash position.

A Look At Tong Ren Tang Technologies' Liabilities

According to the last reported balance sheet, Tong Ren Tang Technologies had liabilities of CN¥2.78b due within 12 months, and liabilities of CN¥1.16b due beyond 12 months. On the other hand, it had cash of CN¥4.31b and CN¥1.53b worth of receivables due within a year. So it actually has CN¥1.90b more liquid assets than total liabilities.

This excess liquidity is a great indication that Tong Ren Tang Technologies' balance sheet is almost as strong as Fort Knox. With this in mind one could posit that its balance sheet means the company is able to handle some adversity. Succinctly put, Tong Ren Tang Technologies boasts net cash, so it's fair to say it does not have a heavy debt load!

Tong Ren Tang Technologies's EBIT was pretty flat over the last year, but that shouldn't be an issue given the it doesn't have a lot of debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Tong Ren Tang Technologies can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. While Tong Ren Tang Technologies has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. In the last three years, Tong Ren Tang Technologies's free cash flow amounted to 49% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Summing Up

While we empathize with investors who find debt concerning, you should keep in mind that Tong Ren Tang Technologies has net cash of CN¥2.82b, as well as more liquid assets than liabilities. So is Tong Ren Tang Technologies's debt a risk? It doesn't seem so to us. Given Tong Ren Tang Technologies has a strong balance sheet is profitable and pays a dividend, it would be good to know how fast its dividends are growing, if at all. You can find out instantly by clicking this link.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Tong Ren Tang Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1666

Tong Ren Tang Technologies

Produces and distributes Chinese medicine products in Mainland China and Hong Kong.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.