- Japan

- /

- Specialty Stores

- /

- TSE:262A

Exploring 3 Undiscovered Gems with Compelling Potential

Reviewed by Simply Wall St

Amidst the backdrop of global market fluctuations, with U.S. stocks retracting some gains due to uncertainty around policy changes and economic indicators like inflation remaining a focal point, small-cap stocks have been experiencing mixed performances as reflected by indices such as the S&P 600. In this environment, identifying promising investments requires careful consideration of companies that demonstrate resilience and adaptability to shifting economic landscapes. As we explore three lesser-known stocks with intriguing potential, it's crucial to focus on their unique strengths and how they might navigate current market dynamics effectively.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Primadaya Plastisindo | 12.52% | 18.29% | 26.12% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Tethys Petroleum | NA | 29.98% | 44.48% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

YiChang HEC ChangJiang Pharmaceutical (SEHK:1558)

Simply Wall St Value Rating: ★★★★★★

Overview: YiChang HEC ChangJiang Pharmaceutical Co., Ltd. is engaged in the development, manufacturing, and sale of pharmaceutical products with a market cap of HK$8.37 billion.

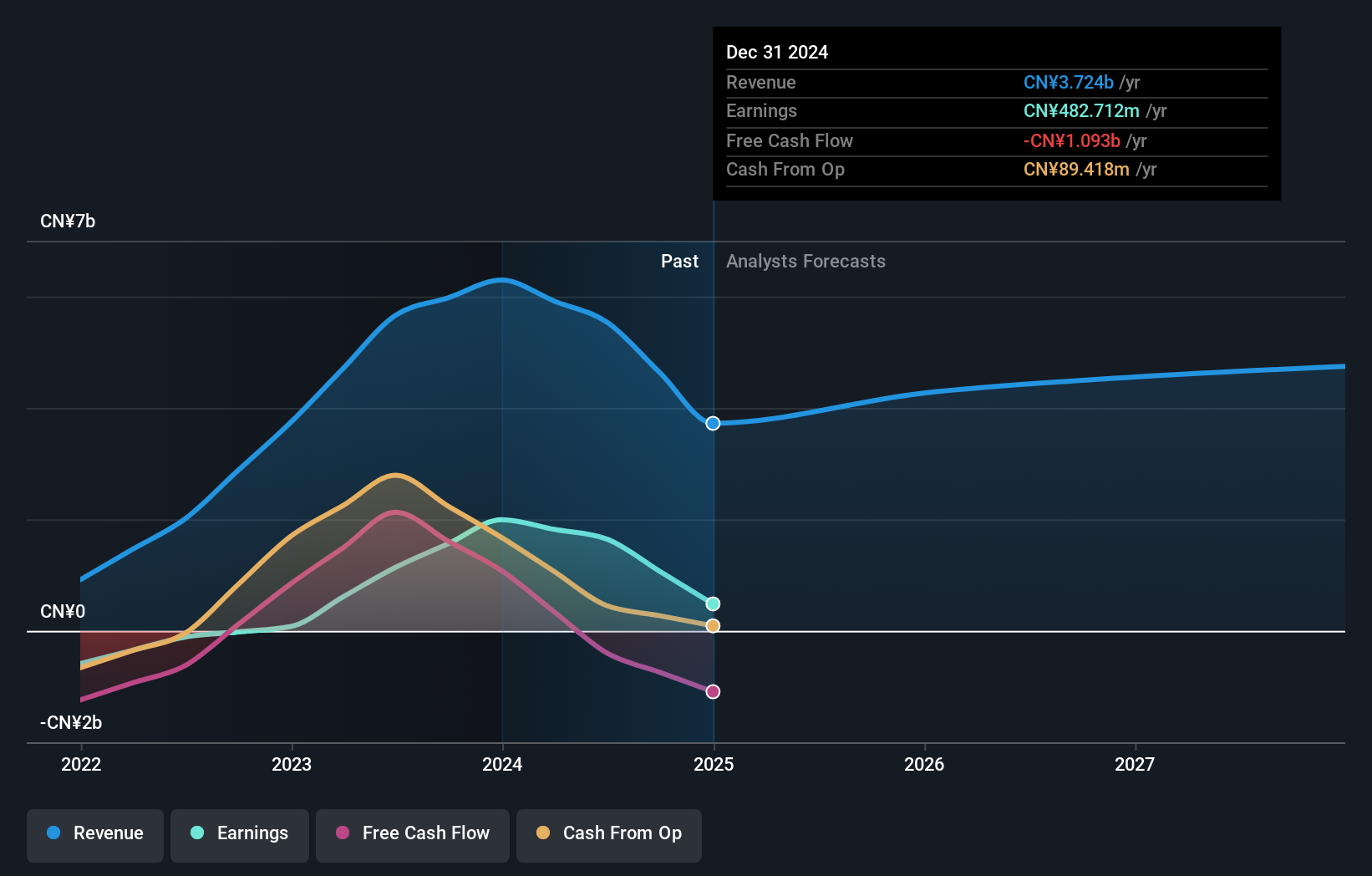

Operations: YiChang HEC ChangJiang Pharmaceutical generates revenue primarily through the sale of pharmaceutical products, amounting to CN¥5.54 billion. The company's financial performance is highlighted by a focus on its core product sales.

YiChang HEC ChangJiang Pharmaceutical, a smaller player in the pharmaceutical industry, has shown an impressive earnings growth of 44.7% over the past year, outpacing the industry's 6.4%. Despite this recent performance spike, its earnings have decreased by 2.1% annually over five years. The company trades at a substantial discount of 52.3% below its estimated fair value and maintains a satisfactory net debt to equity ratio of 6.3%, having reduced from 74.6% over five years. Recent amendments to company bylaws and revised annual caps suggest active strategic adjustments in response to financial challenges indicated by declining sales and net income for the first half of 2024 compared to last year.

Intermestic (TSE:262A)

Simply Wall St Value Rating: ★★★★☆☆

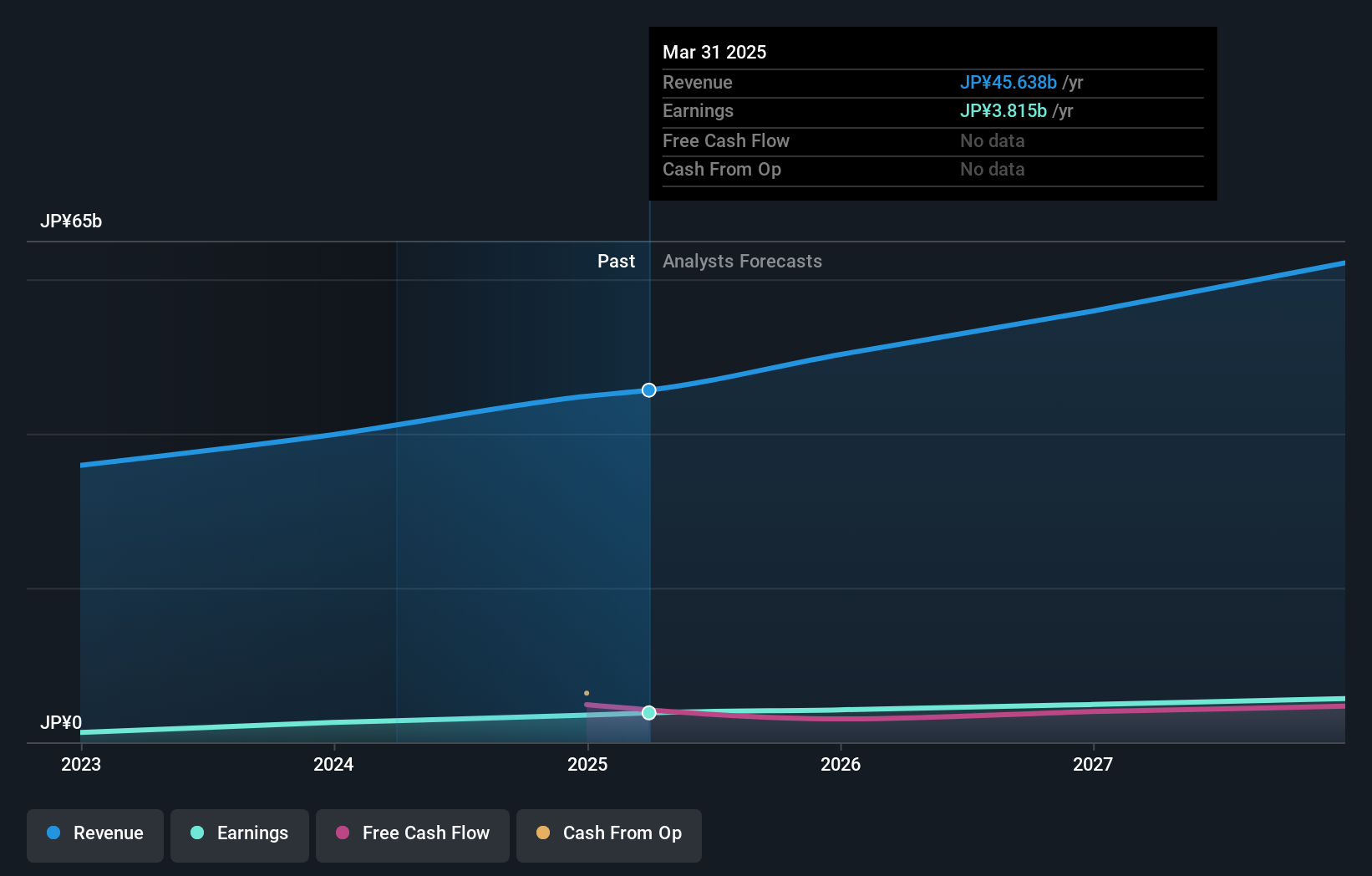

Overview: Intermestic Inc. operates retail and online platforms for selling eyeglasses and sunglasses in Japan, with a market cap of ¥53.61 billion.

Operations: Intermestic Inc. generates revenue primarily from its Domestic Business segment, contributing ¥38.17 billion, while the Overseas Segment adds ¥2.09 billion. The company's gross profit margin is not specified here, but it is an important metric for assessing profitability trends over time.

Intermestic's recent IPO raised ¥17.48 billion, offering 7.88 million shares at ¥1630 each, with a discount of ¥97.8 per share, highlighting its emerging market presence. Over the past year, earnings surged by 102%, outpacing the Specialty Retail industry's growth of 3%. The company enjoys high-quality earnings and a satisfactory net debt to equity ratio of 9.5%, indicating financial stability despite limited historical data availability. Though shares are highly illiquid, interest payments are well-covered by EBIT at 112 times coverage, suggesting robust operational efficiency and potential for future growth in this niche sector.

- Click to explore a detailed breakdown of our findings in Intermestic's health report.

Gain insights into Intermestic's historical performance by reviewing our past performance report.

Bic Camera (TSE:3048)

Simply Wall St Value Rating: ★★★★★★

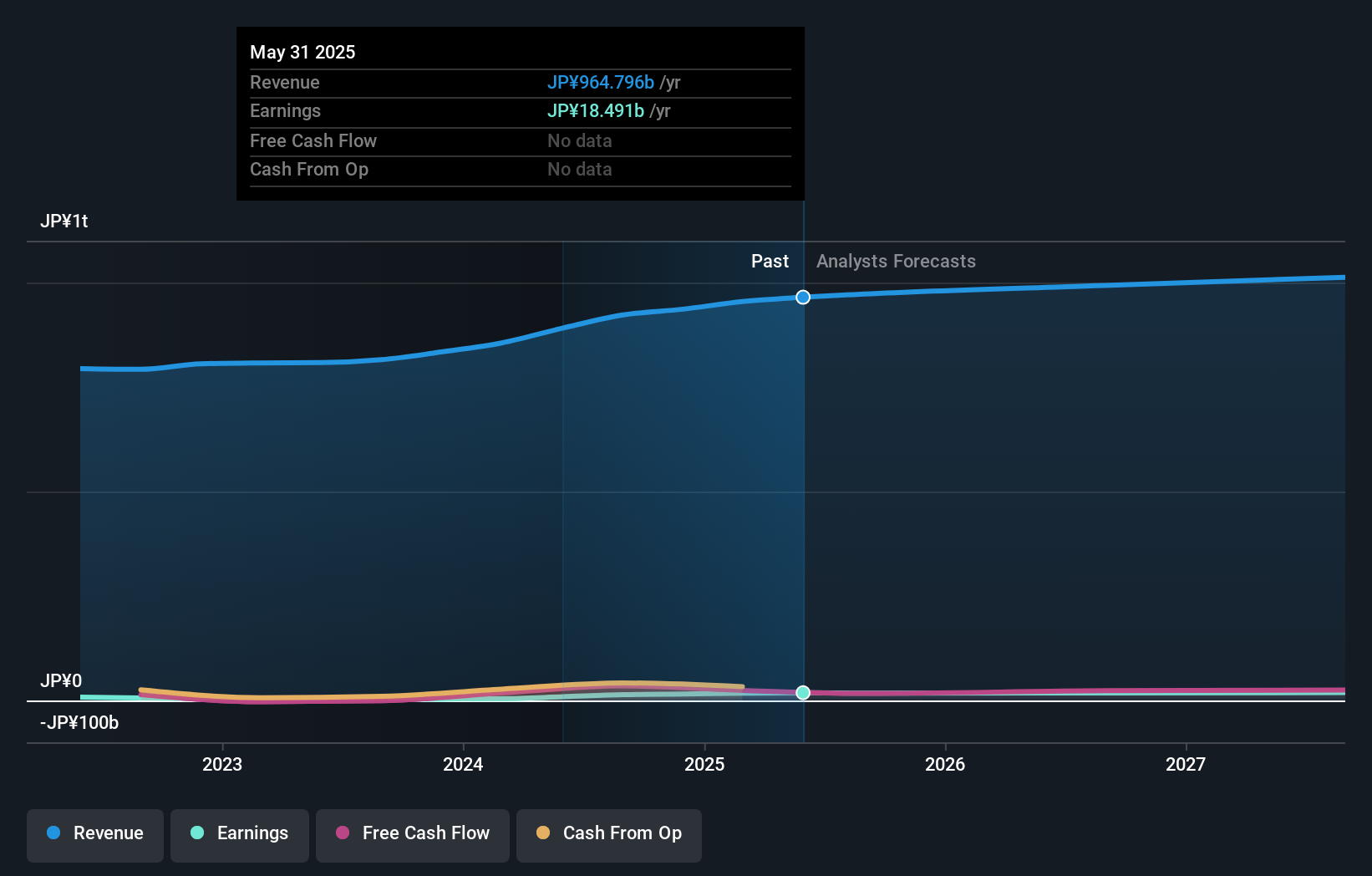

Overview: Bic Camera Inc., with a market cap of ¥293.92 billion, operates in Japan through the manufacture and sale of audiovisual products along with its subsidiaries.

Operations: Bic Camera generates revenue primarily from its Goods Sale Business, which accounts for ¥909.75 billion. The company also has a BS Digital Broadcasting Business contributing ¥11.36 billion to its revenue stream.

Bic Camera, a notable player in the retail sector, is trading at 8.4% below its estimated fair value, suggesting potential undervaluation. The company has demonstrated impressive earnings growth of 373.7% over the past year, significantly outpacing the industry average of 3.6%. This robust performance is underpinned by high-quality earnings and positive free cash flow generation. Despite recent share price volatility, Bic Camera's financial health appears solid with a net debt to equity ratio of 16.7%, deemed satisfactory for its operations. Looking ahead, earnings are forecasted to grow by approximately 3.95% annually, indicating steady progress in the coming years.

- Get an in-depth perspective on Bic Camera's performance by reading our health report here.

Evaluate Bic Camera's historical performance by accessing our past performance report.

Key Takeaways

- Get an in-depth perspective on all 4644 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:262A

Intermestic

Sells eyeglasses and sunglasses through stores and online in Japan.

Flawless balance sheet and good value.

Market Insights

Community Narratives