- Hong Kong

- /

- Life Sciences

- /

- SEHK:1548

Why Genscript Biotech (SEHK:1548) Is Up 8.0% After Legend Biotech’s CARVYKTI Drives Smaller Q3 Loss

Reviewed by Sasha Jovanovic

- Earlier this week, Genscript Biotech Corporation announced that its associate, Legend Biotech Corporation, reported a significant reduction in net losses for the third quarter of 2025, alongside strong sales growth for its CARVYKTI product.

- This disclosure, released around Genscript’s Analyst/Investor Day, places enhanced focus on the financial ties between the two companies and the implications for Genscript’s broader business outlook.

- We’ll now explore how Legend Biotech’s improved operational results and CARVYKTI performance may impact Genscript’s investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Genscript Biotech Investment Narrative Recap

To invest in Genscript Biotech, you need to believe in the long-term growth of biologics and cell/gene therapy platforms, driven by ongoing innovation and expansion into global markets. The recent improvement in Legend Biotech’s CARVYKTI sales supports sentiment around this central catalyst, but it does not fundamentally alter the immediate risks tied to Genscript’s dependence on Legend’s performance or structural pressures on margins in its wider services and CDMO segments.

Among recent announcements, the June 2025 release of strong long-term clinical data for CARVYKTI is particularly relevant here, as it reinforces enthusiasm for Legend’s core product and bolsters one of Genscript’s key growth drivers. However, investors should still weigh this progress against risks such as market competition and the challenge of converting innovation into sustainable, scalable revenue streams.

By contrast, investors should not overlook the risk that high R&D and capacity expansion costs may not always translate into commercial product success and...

Read the full narrative on Genscript Biotech (it's free!)

Genscript Biotech is projected to reach $943.5 million in revenue and $376.0 million in earnings by 2028. This outlook is based on a 4.4% annual revenue growth rate and an earnings increase of about $371.4 million from current earnings of $4.6 million.

Uncover how Genscript Biotech's forecasts yield a HK$23.52 fair value, a 36% upside to its current price.

Exploring Other Perspectives

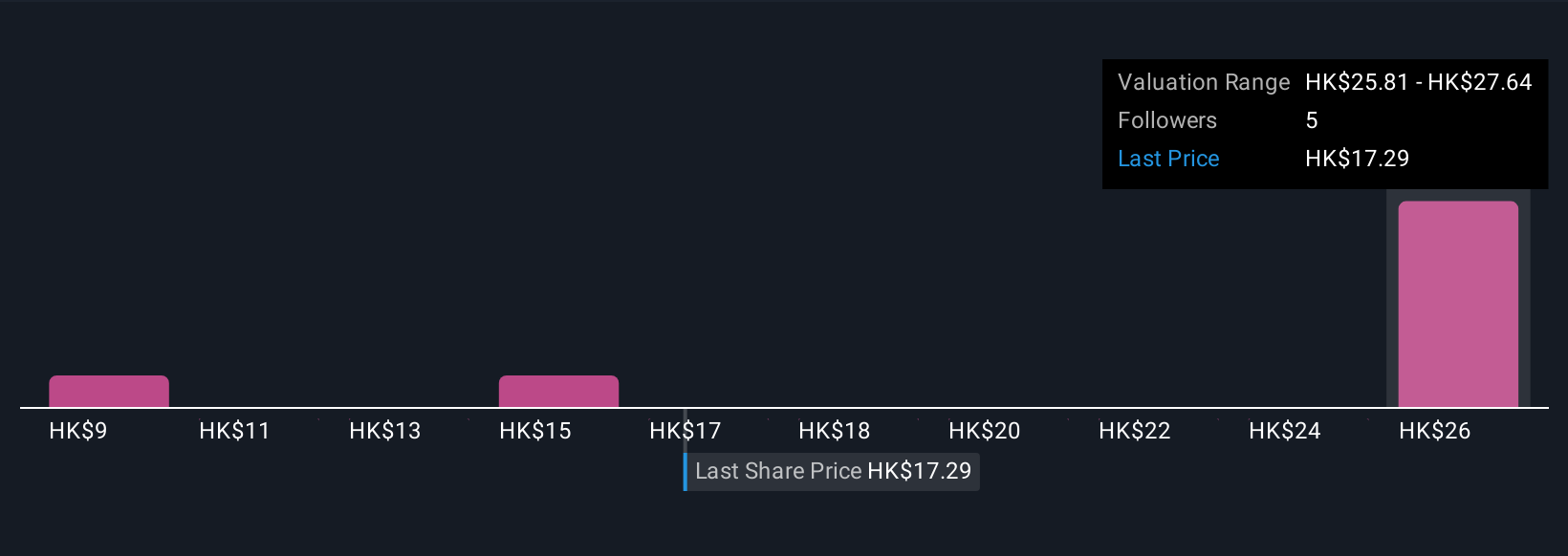

The Simply Wall St Community fair value estimates for Genscript Biotech range from HK$9.34 to HK$27.63, based on 3 different perspectives. While optimism about CARVYKTI’s market performance persists, market participants should stay alert to persistent margin pressures and changing global conditions that could affect returns.

Explore 3 other fair value estimates on Genscript Biotech - why the stock might be worth as much as 60% more than the current price!

Build Your Own Genscript Biotech Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Genscript Biotech research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Genscript Biotech research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Genscript Biotech's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1548

Genscript Biotech

An investment holding company, engages in the manufacture and sale of life science research products and services in the United States of America, Europe, Mainland China, Europe, Asia Pacific, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives