3SBio (SEHK:1530) Profit Margin Surges to 26%, Challenging Bearish Outlooks

Reviewed by Simply Wall St

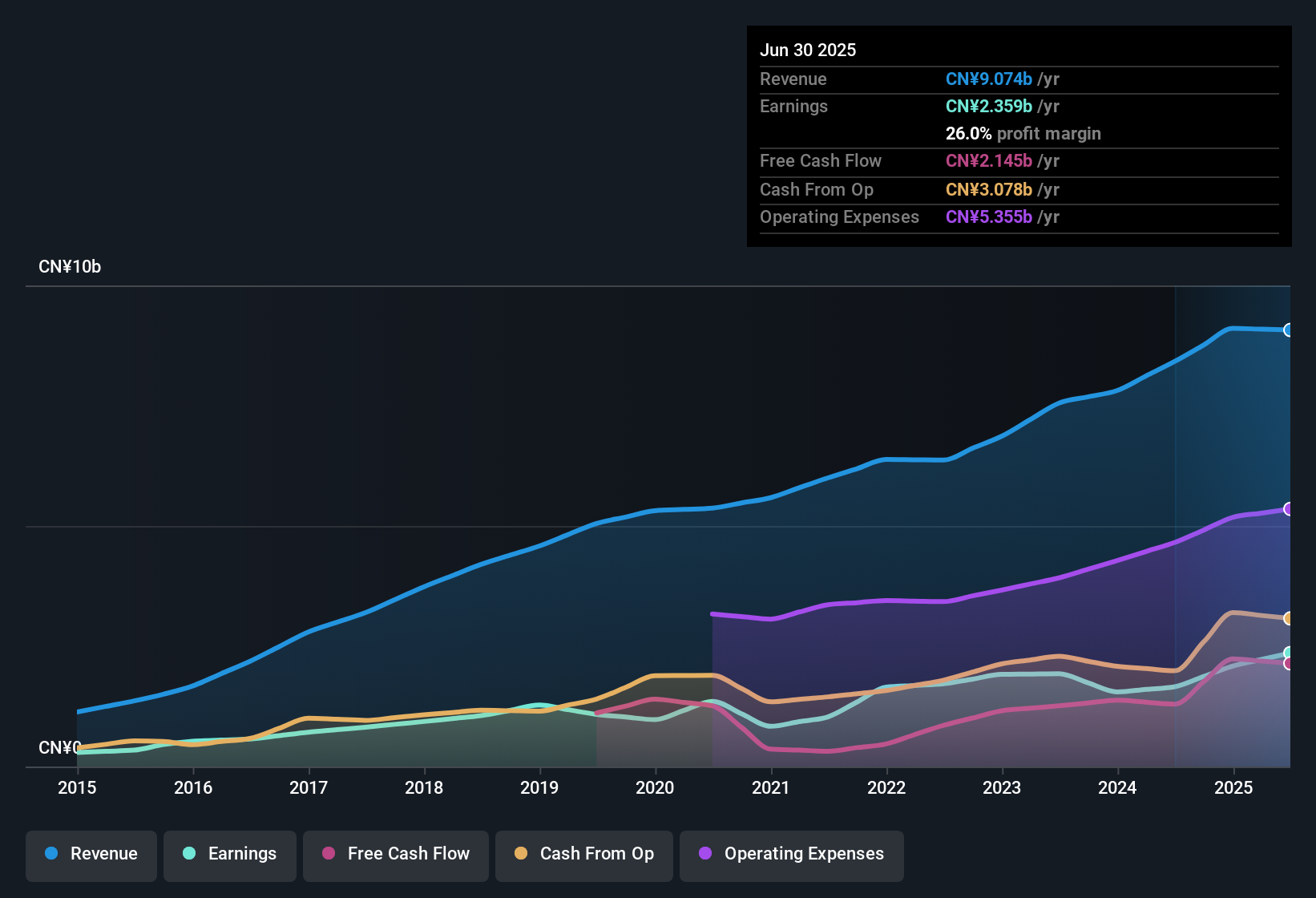

3SBio (SEHK:1530) delivered standout numbers this past year, posting earnings growth of 42.2% year-over-year, which is significantly ahead of its 5-year average of 13.4% per year. Net profit margins have expanded to 26%, up from 19.7% last year. The recent share price of HK$30.86 sits well below the estimated fair value of HK$52.74. Investors are weighing this surge in profitability and attractive valuation against forecasts for an 11% annual decline in earnings and slower-than-market revenue growth going forward.

See our full analysis for 3SBio.The next section compares these results with the current narratives around 3SBio, highlighting where expectations match reality and where surprises lie.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Expansion Defies Regional Slowdown

- Net profit margin reached 26%, a step up from 19.7% last year, even as biopharma revenue growth in Hong Kong is projected at just 4.8% per year, trailing the market average of 8.7%.

- What is surprising, given sector headwinds, is that management maintained high-quality earnings and delivered superior margin expansion. This strongly supports the optimistic camp’s claim that 3SBio is executing above its peers.

- This margin growth occurs as peers face sluggish top-line expansion, highlighting operational discipline rather than just sector tailwinds.

- Bulls argue this margin outperformance should cushion valuation as growth slows, challenging the idea that sector trends alone dictate the company's outlook.

Profit Growth Outpaces Five-Year Trend

- Earnings grew by 42.2% year-over-year, notably stronger than the 5-year average of 13.4% annual growth. Yet market forecasts expect an 11% annual decline in earnings for the next three years.

- Optimists see this profit surge as evidence of underlying business strength, but the looming reversal in forecasts calls into question whether the positive momentum can last.

- While rapid growth this year exceeds the historical run rate, analysts suggest investors should not extrapolate one stellar period when industry expectations price in a downturn.

- This creates a tension for bullish investors seeking momentum plays, as consensus expects the upcoming years to look very different from the past five.

Substantial Valuation Discount to Fair Value

- 3SBio trades at a Price-to-Earnings Ratio of 28.6x, well below the biotech industry average of 45.3x and its peer group average of 55.7x. With a share price of HK$30.86, it sits meaningfully under its DCF fair value of HK$52.74.

- The prevailing view is that this relative discount offers meaningful upside for value-seeking investors, as the company’s strong profits are not fully reflected in its valuation metrics.

- Several metrics such as the P/E ratio, peer comparison, and DCF fair value show a significant valuation gap that remains open, even as forward estimates turn cautious.

- Investors attuned to price-to-value mismatches may see 3SBio’s current levels as a strategic entry point if long-range fundamentals stabilize.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on 3SBio's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite standout profit growth, 3SBio faces a projected 11% annual earnings decline and slower-than-market revenues. This raises doubts about future consistency.

If you would rather find companies with steady expansion and predictable performance, check out stable growth stocks screener for stocks consistently delivering through business cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if 3SBio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1530

3SBio

An investment holding company, develops, produces markets, and sells biopharmaceutical products in Mainland China and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives