Sino Biopharm (SEHK:1177): Evaluating Valuation After Recent Share Price Pullback

Reviewed by Kshitija Bhandaru

Sino Biopharmaceutical (SEHK:1177) shares have caught investors’ attention after their recent price move. The stock has seen a modest pullback this month, which has sparked interest in how its fundamentals and outlook might be weighing on current sentiment.

See our latest analysis for Sino Biopharmaceutical.

While Sino Biopharmaceutical’s share price pulled back 11.97% over the past month and slipped nearly 5% in one day, its longer-term momentum remains clear, with a 135.6% share price return year-to-date and a 95.3% total shareholder return over the past year. Despite occasional dips, investors are watching to see if growth prospects can maintain current optimism.

If this kind of momentum makes you curious about other drugmakers on the move, take the opportunity to explore the latest See the full list for free..

With recent volatility and impressive year-to-date gains, many are asking whether Sino Biopharmaceutical’s shares remain undervalued or if the rally means future growth is already reflected in the current price. Could there still be a buying opportunity, or is the market fully pricing in what comes next?

Price-to-Earnings of 30.6x: Is it justified?

With Sino Biopharmaceutical trading at a price-to-earnings ratio of 30.6x compared to the industry’s 13x, its recent closing price of HK$7.28 suggests investors are paying a considerable premium for expected growth.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay for each dollar of the company’s earnings. It is a common way to evaluate whether a stock is overvalued or undervalued compared to peers and industry standards, with higher multiples often reflecting stronger growth prospects or higher perceived quality.

This elevated P/E signals that the market expects Sino Biopharmaceutical’s future earnings to outpace those of its industry, potentially due to recent earnings growth and recovery. However, compared to the industry average (13x) and the estimated fair P/E ratio (25.2x), this premium appears significant and leaves little room for error if earnings growth moderates. The current multiple is not only above the peer group but also exceeds the estimated fair value level, raising questions about whether the stock can sustain these valuations.

Explore the SWS fair ratio for Sino Biopharmaceutical

Result: Price-to-Earnings of 30.6x (OVERVALUED)

However, slower revenue and net income growth rates or a market correction could challenge the recent optimism around Sino Biopharmaceutical’s share price momentum.

Find out about the key risks to this Sino Biopharmaceutical narrative.

Another View: What Does the DCF Model Suggest?

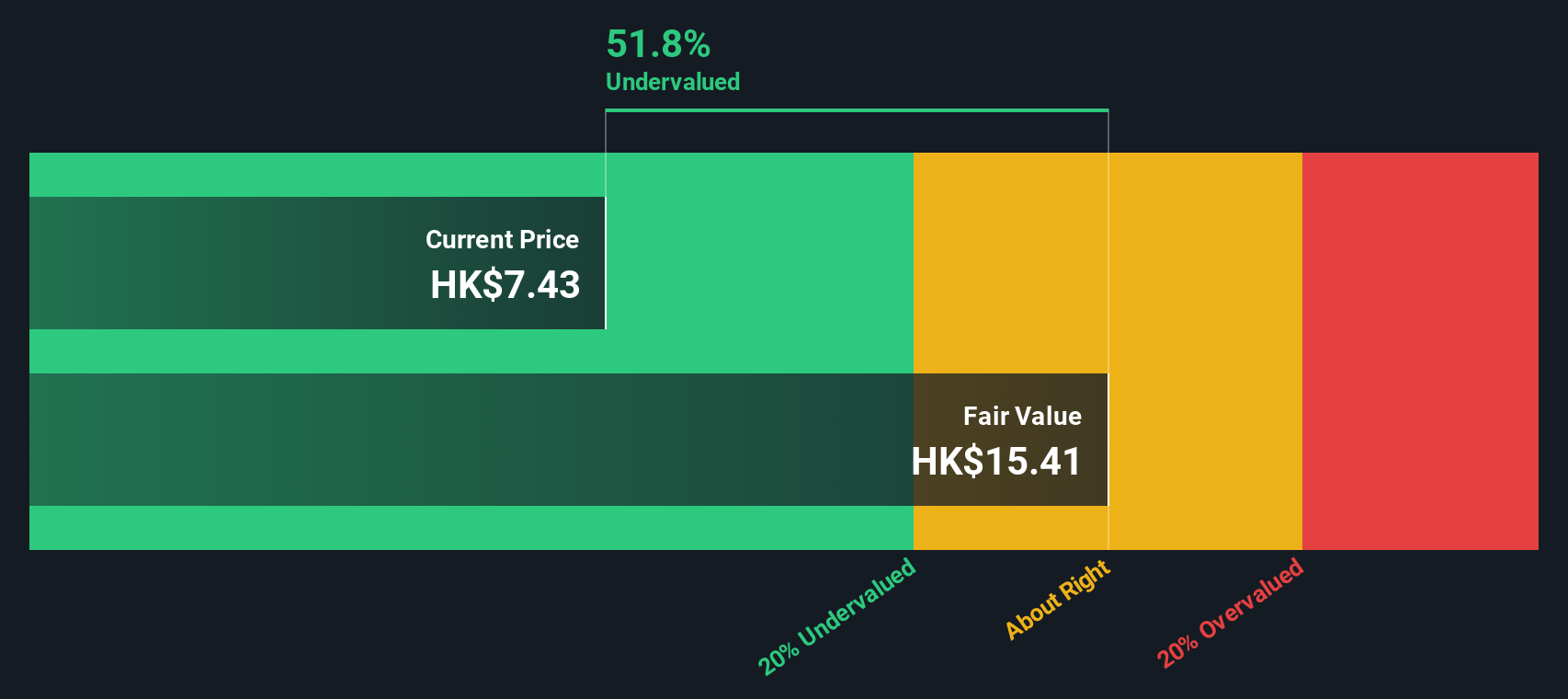

While the stock’s price-to-earnings ratio implies Sino Biopharmaceutical may be overvalued compared to peers, our SWS DCF model offers a very different perspective. According to this cash flow analysis, the shares are trading at a 52.7% discount to their estimated fair value. This suggests they could be undervalued at current prices. With these two views diverging so widely, it remains to be seen which approach will align more closely with future results as new information becomes available.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sino Biopharmaceutical for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sino Biopharmaceutical Narrative

If you want to analyse the numbers for yourself or see things from a different angle, you can build your own perspective in just a few minutes, and Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Sino Biopharmaceutical.

Looking for More Investment Ideas?

Missing out on promising stocks could mean leaving potential gains behind. Check out these fresh opportunities and seize your next smart investing move today:

- Target companies reinventing healthcare by tapping into breakthroughs. Kick off your search with these 33 healthcare AI stocks and find those poised for medical innovation.

- Boost your portfolio’s resilience by considering stable income choices. See what’s possible among these 20 dividend stocks with yields > 3% that consistently reward shareholders with steady yields.

- Start ahead with leading-edge players in artificial intelligence. Uncover tomorrow’s standouts with these 24 AI penny stocks and capture the momentum of a rapidly advancing sector.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1177

Sino Biopharmaceutical

An investment holding company, operates as a research and development pharmaceutical conglomerate in the People’s Republic of China.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives