Does Sino Biopharm Offer Value After Jumping 135% and Expanding in Asia in 2025?

Reviewed by Bailey Pemberton

If you have been watching Sino Biopharmaceutical, you are probably wondering what to make of this stock after such a rollercoaster ride. The past year has brought a surge that few predicted, with the stock up an eye-catching 135.6% since the start of the year and 95.3% over the last twelve months. Even looking back three years, the company has notched an impressive 83.5% gain. Yet, this momentum hit a speed bump recently, with prices dropping 6.7% in the last week and falling 13.2% over the past month.

Much of this movement has followed broader shifts in the healthcare sector as confidence in pharmaceutical innovation rebounds and investors reassess the risks attached to growth stocks. There has also been positive sentiment around the company’s pipeline and expansion in key Asian markets, factors that stoke both hope and a bit of nervousness among potential investors.

Despite this backdrop, Sino Biopharmaceutical’s valuation is a bit of a mixed bag. Using a standard approach with six common valuation checks, the company is considered undervalued on just two of those measures. That gives it a value score of 2. In other words, there are some strengths here, but nothing on paper that suggests an immediate buy.

So how should you decide what to do next? Let’s break down the different ways analysts measure fair value, what they really mean, and whether they capture the full story. Before we wrap up, I will share a more insightful approach to understanding whether Sino Biopharmaceutical might be a smart buy for you.

Sino Biopharmaceutical scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Sino Biopharmaceutical Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model projects a company’s future cash flows and then discounts those back to today’s value, helping estimate what the business is really worth at present. This approach is useful in determining whether the current share price reflects the potential future profits generated by the company.

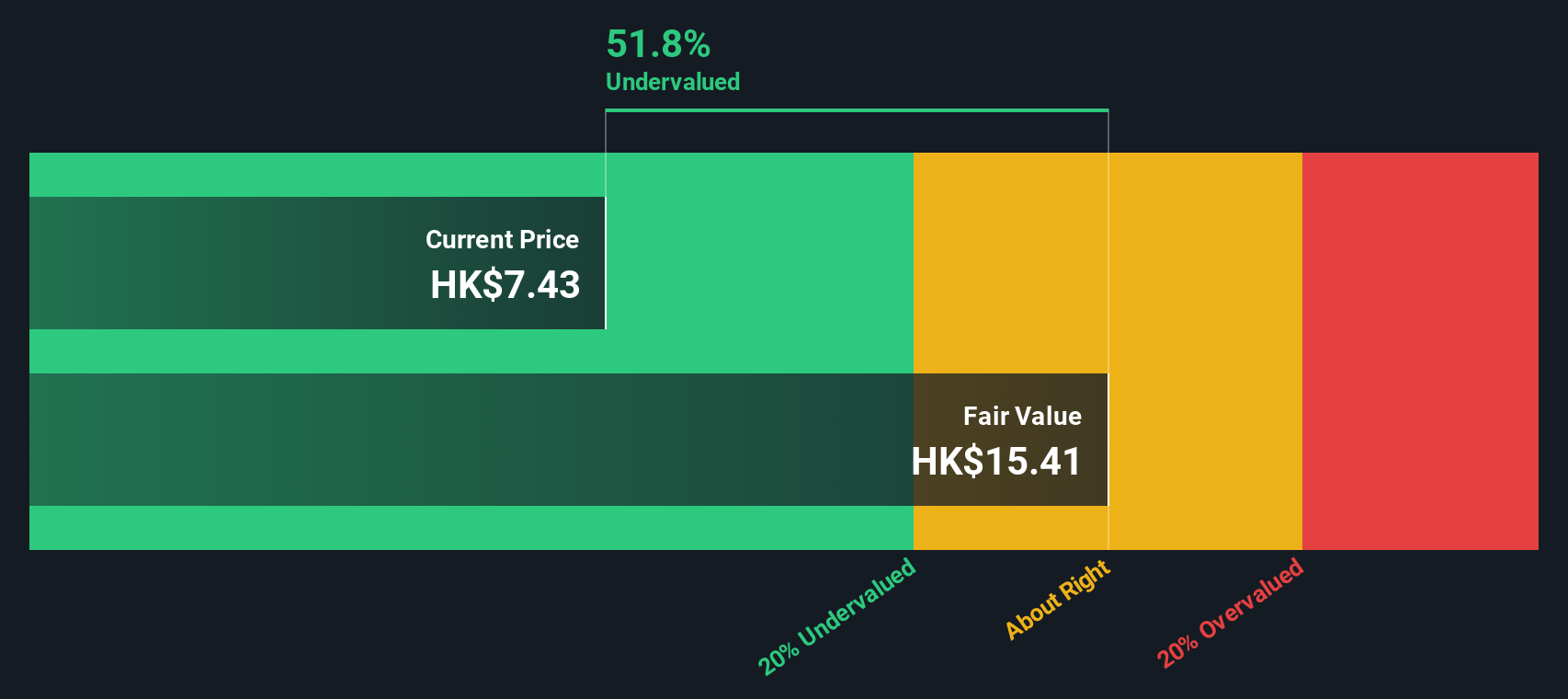

For Sino Biopharmaceutical, the latest reported Free Cash Flow is CN¥5.2 billion. Analyst estimates see this figure growing steadily, rising to CN¥9.8 billion by 2029. While analysts supply data for about five years, additional projections beyond that rely on extrapolation, with expected free cash flows continuing to increase but at slowing rates as the business matures.

Based on these cash flow projections and using the 2 Stage Free Cash Flow to Equity DCF model, the estimated intrinsic value of Sino Biopharmaceutical shares comes in at HK$15.40. That figure is substantially higher than the current traded price, implying a 52.7% discount, which means the stock is considered significantly undervalued according to this model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Sino Biopharmaceutical is undervalued by 52.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

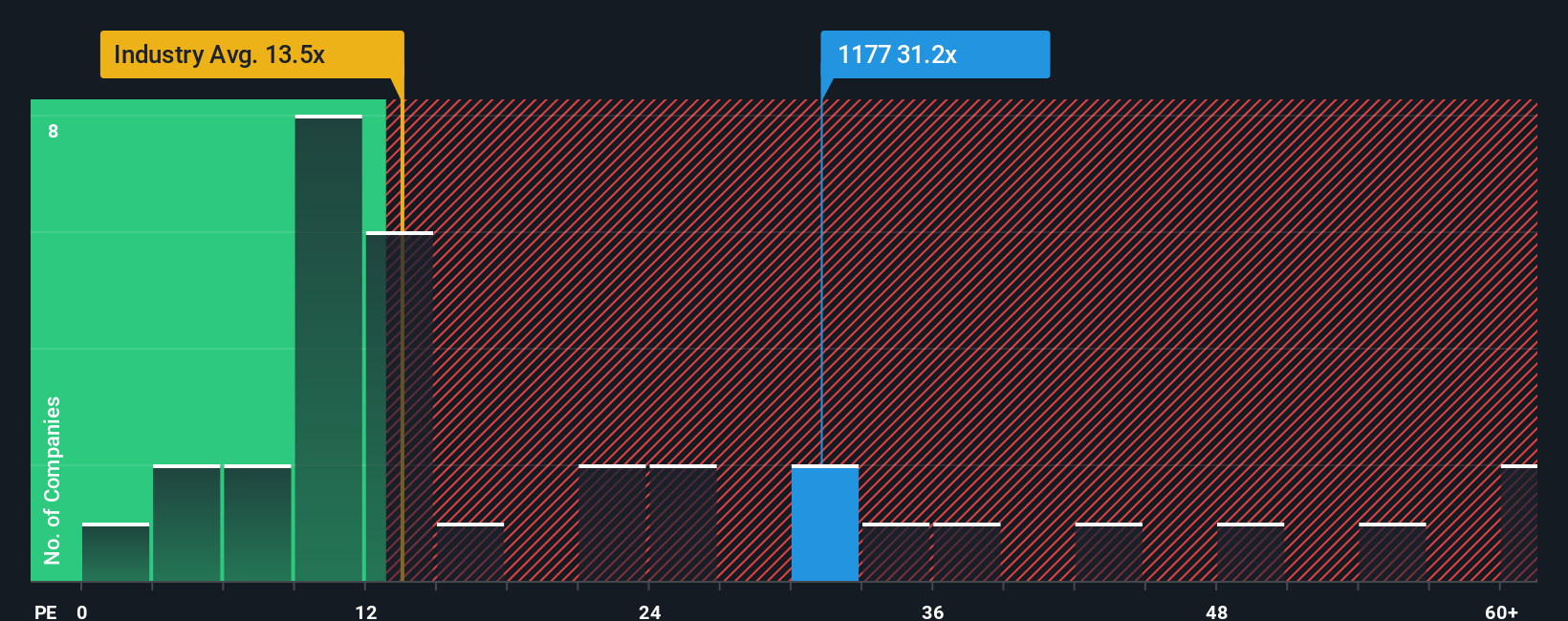

Approach 2: Sino Biopharmaceutical Price vs Earnings

When analyzing a profitable company like Sino Biopharmaceutical, the Price-to-Earnings (PE) ratio is a popular tool for investors. The PE multiple is favored because it ties a company’s market value directly to its earnings, making it easier to assess whether the share price reflects real performance. However, a "normal" or "fair" PE ratio is influenced by expected growth rates and perceived risks. A fast-growing, resilient business will usually justify a higher PE multiple, while a slower or riskier one should trade at a lower multiple.

Currently, Sino Biopharmaceutical trades at a PE ratio of 30.6x. This is higher than the average for the broader pharmaceuticals industry, which stands at 13.3x, and also above its peer average of 27.9x. These benchmarks suggest the company is priced more richly than many of its competitors. But simple comparisons only reveal part of the picture.

That is where Simply Wall St’s Fair Ratio comes in. In this case, it is 25.2x. This figure is uniquely tailored, accounting for the company’s growth prospects, profit margins, market cap, industry dynamics, and risk profile. Unlike broad industry or peer comparisons, the Fair Ratio offers a far more nuanced benchmark, reflecting whether the company’s premium valuation is justified by its underlying fundamentals.

When we compare Sino Biopharmaceutical’s actual PE ratio (30.6x) to its Fair Ratio (25.2x), the gap points to the stock being somewhat overvalued on this metric. The market appears to be pricing in brighter prospects or less risk than what the underlying fundamentals warrant right now.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Sino Biopharmaceutical Narrative

Earlier, we touched on a better way to understand valuation, so let’s introduce you to Narratives. A Narrative lets you tell the story you believe about a company, combining your assumptions about future business performance with your view of what the stock is truly worth.

Put simply, Narratives connect the company’s story, including your expectations for its future revenue, profit margins, and growth, to a transparent financial forecast and ultimately to a calculated fair value. This approach makes investing personal and actionable, and you do not need to be a finance expert to use it.

Narratives are available to everyone in the Simply Wall St Community, where millions of investors share, compare, and refine their perspectives. By tracking how your fair value compares to the current price, Narratives help you decide when a stock is trading at an opportunity or a risk. They update automatically as new data or events unfold.

For example, on Sino Biopharmaceutical, some investors build Narratives with aggressive growth expectations that lead to a much higher fair value, while others are more cautious, estimating a far lower one based on slower revenue growth or greater risk.

With Narratives, you have an accessible, dynamic tool that ties your unique investment outlook directly to real numbers. This helps you make smarter, more confident decisions as markets evolve.

Do you think there's more to the story for Sino Biopharmaceutical? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1177

Sino Biopharmaceutical

An investment holding company, operates as a research and development pharmaceutical conglomerate in the People’s Republic of China.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives