Asian Market Insights: Sino Biopharmaceutical And 2 Other Prominent Penny Stocks

Reviewed by Simply Wall St

Amidst a backdrop of global economic uncertainty and fluctuating market indices, Asian markets are capturing attention with their unique investment opportunities. Penny stocks, often associated with smaller or newer companies, continue to intrigue investors due to their potential for growth and affordability. While the term may seem outdated, these stocks remain relevant as they offer a mix of financial strength and promising prospects; this article will explore three such penny stocks that stand out in the Asian market landscape.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Interlink Telecom (SET:ITEL) | THB1.46 | THB2.03B | ✅ 4 ⚠️ 5 View Analysis > |

| Chumporn Palm Oil Industry (SET:CPI) | THB2.80 | THB1.77B | ✅ 2 ⚠️ 2 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.215 | SGD42.83M | ✅ 4 ⚠️ 3 View Analysis > |

| Anchun International Holdings (SGX:BTX) | SGD0.32 | SGD14.99M | ✅ 2 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.36 | SGD9.32B | ✅ 5 ⚠️ 0 View Analysis > |

| Jiumaojiu International Holdings (SEHK:9922) | HK$3.28 | HK$4.58B | ✅ 3 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.13 | HK$47.34B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.29 | HK$818.88M | ✅ 4 ⚠️ 1 View Analysis > |

| China Zheshang Bank (SEHK:2016) | HK$2.56 | HK$83.02B | ✅ 4 ⚠️ 1 View Analysis > |

| Xiamen Hexing Packaging Printing (SZSE:002228) | CN¥3.09 | CN¥3.58B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,151 stocks from our Asian Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Sino Biopharmaceutical (SEHK:1177)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sino Biopharmaceutical Limited is a research and development pharmaceutical conglomerate operating in the People's Republic of China, with a market cap of approximately HK$66.19 billion.

Operations: The company generates revenue primarily from its Modernised Chinese Medicines and Chemical Medicines segment, amounting to CN¥27.45 billion.

Market Cap: HK$66.19B

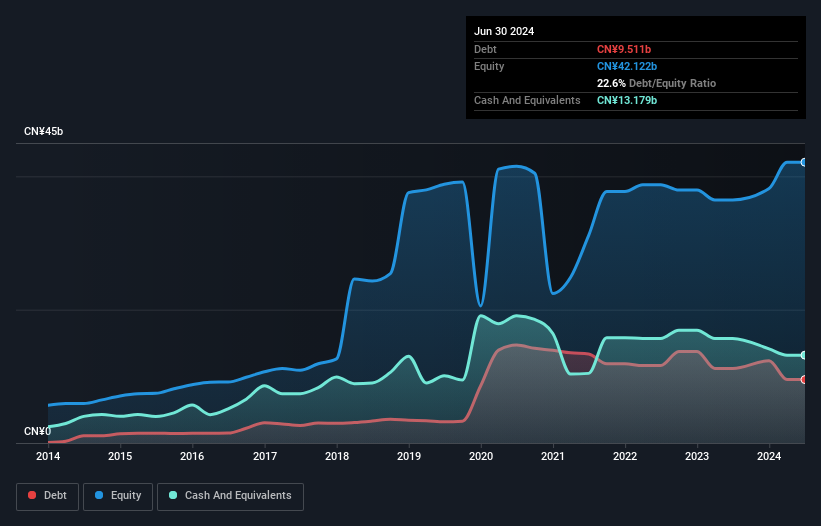

Sino Biopharmaceutical Limited, with a market cap of HK$66.19 billion, has shown robust earnings growth of 70.9% over the past year, surpassing the industry average. The company's net profit margins improved to 7.7%, and its debt is well covered by operating cash flow. Recent developments include promising clinical trial results for Rovadicitinib, a novel drug for chronic graft-versus-host disease, and strategic alliances to expand its drug pipeline in respiratory treatments with QP001 and CPX102 projects. However, the company faces challenges such as increased debt-to-equity ratio and recent removal from the Hang Seng China Enterprises Index.

- Get an in-depth perspective on Sino Biopharmaceutical's performance by reading our balance sheet health report here.

- Understand Sino Biopharmaceutical's earnings outlook by examining our growth report.

China Zheshang Bank (SEHK:2016)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: China Zheshang Bank Co., Ltd. offers a range of commercial banking products and services in Mainland China, with a market capitalization of HK$83.02 billion.

Operations: The bank generates CN¥38.47 billion in revenue from its operations in Mainland China.

Market Cap: HK$83.02B

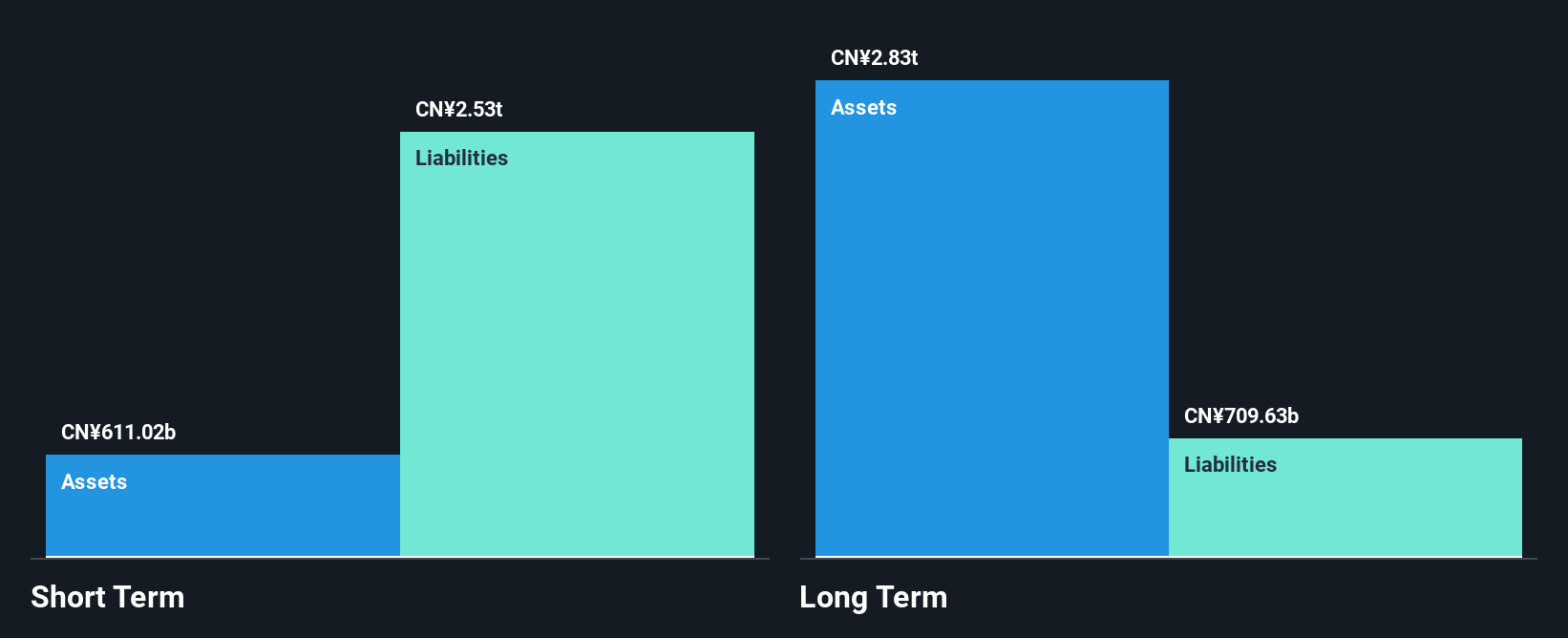

China Zheshang Bank, with a market cap of HK$83.02 billion, presents a mixed picture for penny stock investors. The bank's earnings have grown by 9.2% over the past year, outpacing industry averages and showing accelerated growth compared to its five-year average. It maintains an appropriate level of non-performing loans at 1.5%, and its funding is primarily low-risk through customer deposits, which are less risky than external borrowing. However, the management team is relatively inexperienced with an average tenure of 1.3 years, and while trading at good value below fair estimates, it has an unstable dividend track record.

- Click here to discover the nuances of China Zheshang Bank with our detailed analytical financial health report.

- Examine China Zheshang Bank's earnings growth report to understand how analysts expect it to perform.

Zhejiang Reclaim Construction Group (SZSE:002586)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zhejiang Reclaim Construction Group Co., Ltd. operates in the construction industry and has a market cap of CN¥3.27 billion.

Operations: The company's revenue for the segment in China is CN¥2.23 billion.

Market Cap: CN¥3.27B

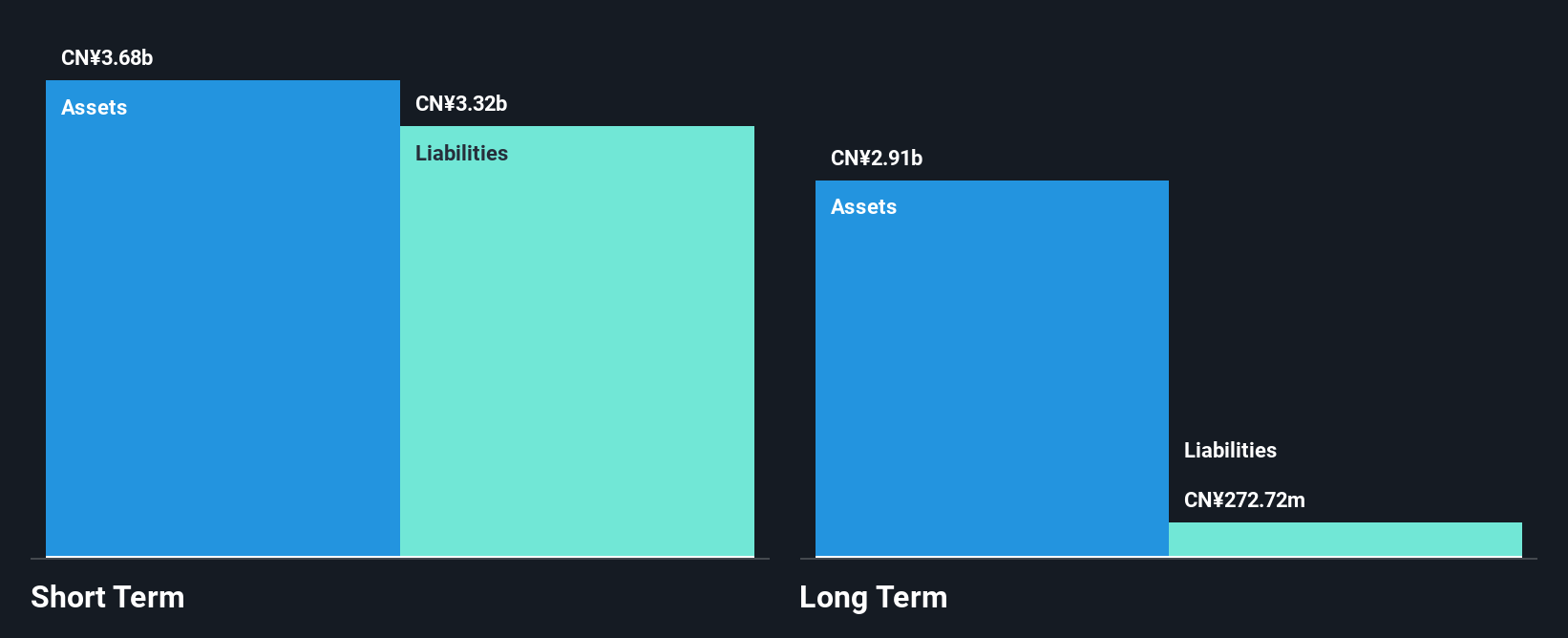

Zhejiang Reclaim Construction Group, with a market cap of CN¥3.27 billion, offers a complex profile for penny stock investors. Despite being unprofitable, it has reduced losses by 38.1% annually over five years and maintains more cash than its total debt. The company's short-term assets match its liabilities at CN¥3.9 billion each, providing some balance sheet stability despite profitability challenges. Its debt to equity ratio has improved to 32.8% from 48.6% in five years, and the board is experienced with an average tenure of 3.1 years, though management's experience remains unclear due to insufficient data.

- Take a closer look at Zhejiang Reclaim Construction Group's potential here in our financial health report.

- Review our historical performance report to gain insights into Zhejiang Reclaim Construction Group's track record.

Where To Now?

- Explore the 1,151 names from our Asian Penny Stocks screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1177

Sino Biopharmaceutical

An investment holding company, operates as a research and development pharmaceutical conglomerate in the People’s Republic of China.

Flawless balance sheet and fair value.

Market Insights

Community Narratives