Some Confidence Is Lacking In Jacobio Pharmaceuticals Group Co., Ltd. (HKG:1167) As Shares Slide 25%

The Jacobio Pharmaceuticals Group Co., Ltd. (HKG:1167) share price has softened a substantial 25% over the previous 30 days, handing back much of the gains the stock has made lately. Regardless, last month's decline is barely a blip on the stock's price chart as it has gained a monstrous 346% in the last year.

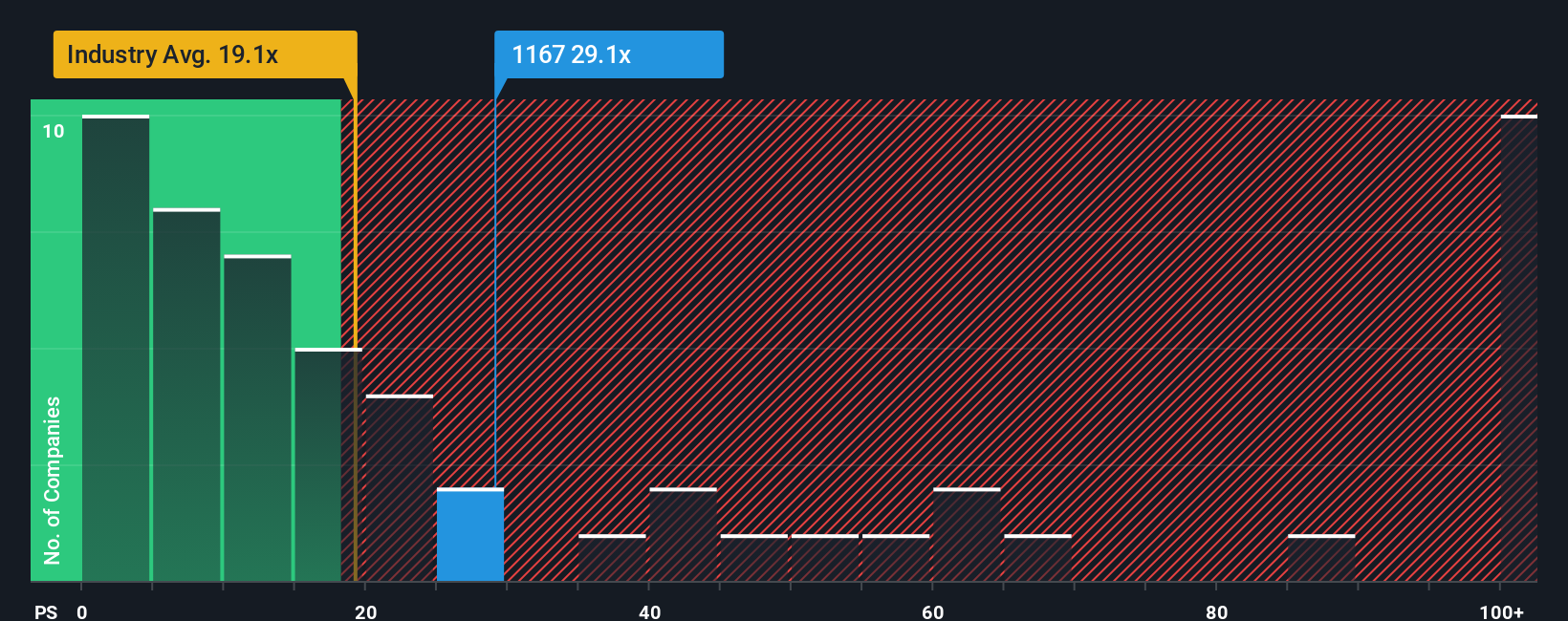

Although its price has dipped substantially, Jacobio Pharmaceuticals Group's price-to-sales (or "P/S") ratio of 29.1x might still make it look like a strong sell right now compared to other companies in the Biotechs industry in Hong Kong, where around half of the companies have P/S ratios below 19.1x and even P/S below 7x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Jacobio Pharmaceuticals Group

How Jacobio Pharmaceuticals Group Has Been Performing

With revenue growth that's superior to most other companies of late, Jacobio Pharmaceuticals Group has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Jacobio Pharmaceuticals Group will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Jacobio Pharmaceuticals Group?

The only time you'd be truly comfortable seeing a P/S as steep as Jacobio Pharmaceuticals Group's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an explosive gain to the company's top line. The latest three year period has also seen an excellent 34% overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 33% as estimated by the sole analyst watching the company. With the industry predicted to deliver 638% growth, that's a disappointing outcome.

With this in mind, we find it intriguing that Jacobio Pharmaceuticals Group's P/S is closely matching its industry peers. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Key Takeaway

A significant share price dive has done very little to deflate Jacobio Pharmaceuticals Group's very lofty P/S. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Jacobio Pharmaceuticals Group's analyst forecasts revealed that its shrinking revenue outlook isn't drawing down its high P/S anywhere near as much as we would have predicted. In cases like this where we see revenue decline on the horizon, we suspect the share price is at risk of following suit, bringing back the high P/S into the realms of suitability. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It is also worth noting that we have found 1 warning sign for Jacobio Pharmaceuticals Group that you need to take into consideration.

If these risks are making you reconsider your opinion on Jacobio Pharmaceuticals Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1167

Jacobio Pharmaceuticals Group

An investment holding company, engages in the in-house discovery and development of oncology therapies.

Excellent balance sheet with minimal risk.

Market Insights

Community Narratives