- Hong Kong

- /

- Entertainment

- /

- SEHK:9999

Evaluating NetEase (SEHK:9999): Is the Current Stock Rally Supported by Fundamentals?

Reviewed by Simply Wall St

If you follow NetEase (SEHK:9999), you might have noticed the stock’s recent climb. While there isn’t a single major event this week driving the action, the steady gains may have investors wondering if this momentum holds deeper meaning or if it is just market noise. For anyone trying to decide their next move with NetEase, now feels like the right time to pause and ask what is truly driving the stock and whether it still has room to run.

Looking at the bigger picture, NetEase’s shares have seen impressive growth, delivering a near 91% uptick over the past year and gaining more than 9% over the past month. This trend builds on several positive updates across the business, including steady increases in annual revenue and net income. The sustained momentum suggests that investors are getting more comfortable with NetEase’s growth outlook, but also raises questions about whether the market is already pricing in further gains.

With this run-up, is NetEase now undervalued based on its fundamentals, or is the current price a reflection of the market’s expectations for future growth?

Most Popular Narrative: 4.6% Undervalued

The most widely followed narrative currently views NetEase shares as undervalued, suggesting that the market price does not fully reflect the company’s long-term global expansion potential and robust digital entertainment growth.

NetEase is accelerating global expansion with self-developed and licensed games that have performed strongly in overseas markets. This is increasing the company's addressable market and diversifying revenue streams beyond China, supporting higher long-term revenue growth and earnings stability.

Curious what powers this bullish outlook? The analysts behind this view believe NetEase is embarking on an ambitious global growth journey, banking on a big shift in revenue mix and a fresh approach to profitability. What bold financial projections are giving them such confidence? There is a key set of quantitative predictions embedded here that might surprise you. You’ll want to see exactly what expectations are driving such a quick price target climb.

Result: Fair Value of $233.99 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, heavy reliance on China and tough overseas competition could limit NetEase’s growth story if global expansion does not deliver as expected.

Find out about the key risks to this NetEase narrative.Another View: Discounted Cash Flow Perspective

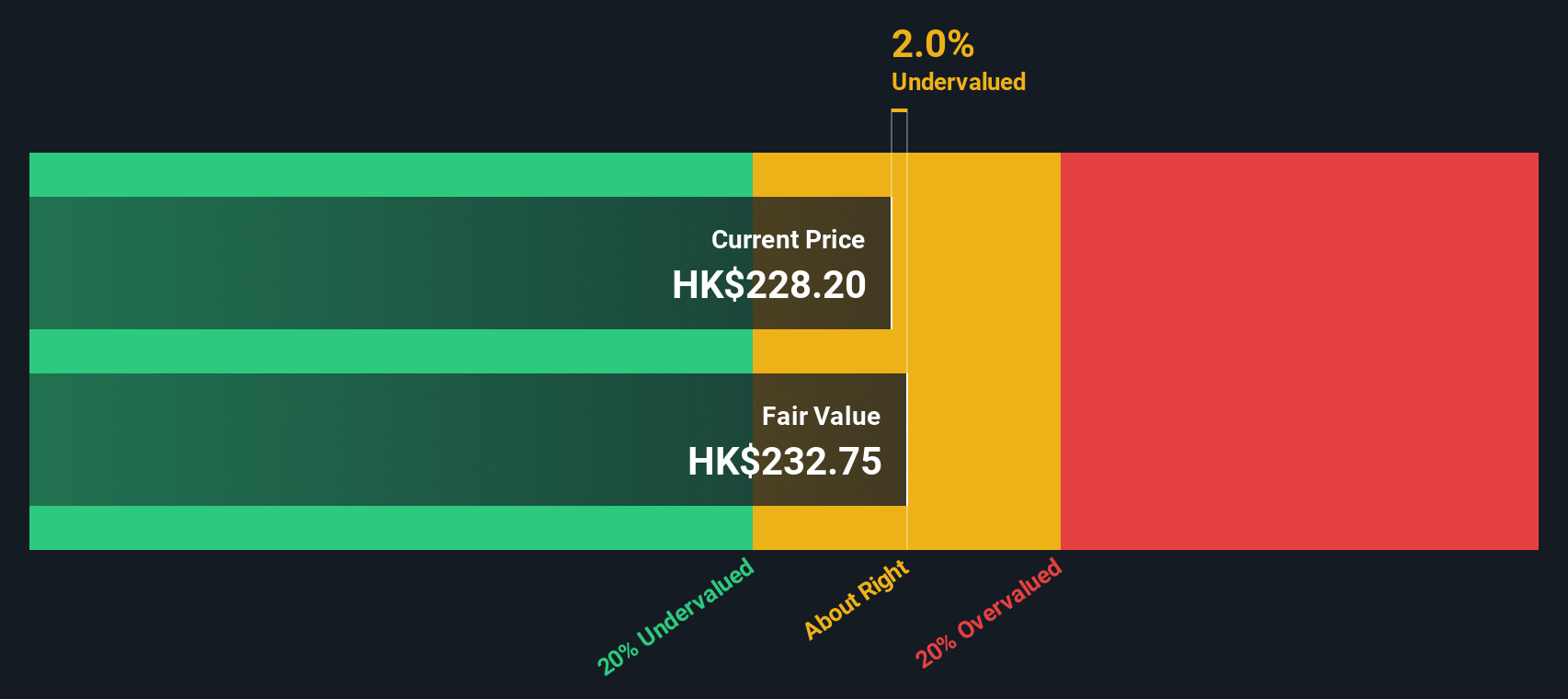

Taking a look from another angle, our DCF model offers a second opinion on NetEase’s value. Interestingly, it does not see the shares as undervalued, despite the optimism in the previous method. Could the market be closer to fair value than some expect?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own NetEase Narrative

If you think there’s more to the story or want to check the numbers yourself, you can craft your own perspective in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding NetEase.

Looking for More Investment Ideas?

Unlock even more smart investment angles by checking out our tailored stock screeners. Each one highlights emerging opportunities that could supercharge your portfolio and help you stay ahead of the crowd.

- Tap into game-changing breakthroughs in quantum computing by accessing quantum computing stocks to see which companies are pushing technology to new heights.

- Capture reliable returns with dividend stocks with yields > 3% to spot companies offering strong yields and a proven history of rewarding shareholders.

- Spot bargains others might miss by scanning undervalued stocks based on cash flows and uncovering stocks that stand out for their healthy fundamentals and attractive pricing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NetEase might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About SEHK:9999

NetEase

Engages in online games, music streaming, online intelligent learning services, and internet content services businesses in China and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives