How Much Did Bison Finance Group's(HKG:888) Shareholders Earn From Share Price Movements Over The Last Three Years?

This month, we saw the Bison Finance Group Limited (HKG:888) up an impressive 37%. But the last three years have seen a terrible decline. Indeed, the share price is down a whopping 85% in the last three years. So it's about time shareholders saw some gains. Only time will tell if the company can sustain the turnaround.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Check out our latest analysis for Bison Finance Group

Bison Finance Group wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

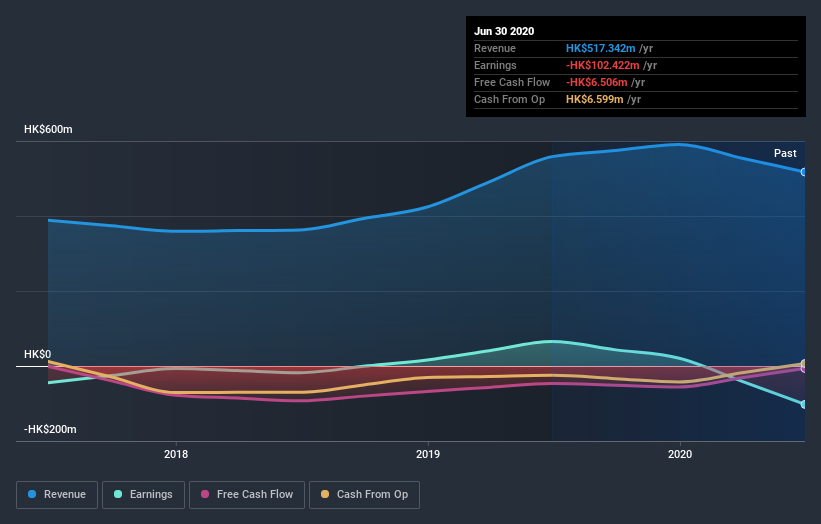

In the last three years, Bison Finance Group saw its revenue grow by 18% per year, compound. That's a pretty good rate of top-line growth. So it's hard to believe the share price decline of 23% per year is due to the revenue. It could be that the losses were much larger than expected. This is exactly why investors need to diversify - even when a loss making company grows revenue, it can fail to deliver for shareholders.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Bison Finance Group's financial health with this free report on its balance sheet.

A Different Perspective

While the broader market gained around 26% in the last year, Bison Finance Group shareholders lost 9.2%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. However, the loss over the last year isn't as bad as the 8% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Bison Finance Group is showing 2 warning signs in our investment analysis , you should know about...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade Bison Finance Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bison Finance Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:888

Bison Finance Group

An investment holding company, provides media sales, design services, and production of advertisements for transit vehicle exteriors and interiors, shelters, and outdoor signage advertising business in Hong Kong.

Excellent balance sheet very low.

Market Insights

Community Narratives