If You Had Bought Icon Culture Global (HKG:8500) Stock A Year Ago, You Could Pocket A 456% Gain Today

For many, the main point of investing in the stock market is to achieve spectacular returns. When you buy and hold the right company, the returns can make a huge difference to both you and your family. In the case of Icon Culture Global Company Limited (HKG:8500), the share price is up an incredible 456% in the last year alone. On top of that, the share price is up 214% in about a quarter. We'll need to follow Icon Culture Global for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

View our latest analysis for Icon Culture Global

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year Icon Culture Global grew its earnings per share, moving from a loss to a profit.

When a company has just transitioned to profitability, earnings per share growth is not always the best way to look at the share price action.

We think that the revenue growth of 9.5% could have some investors interested. We do see some companies suppress earnings in order to accelerate revenue growth.

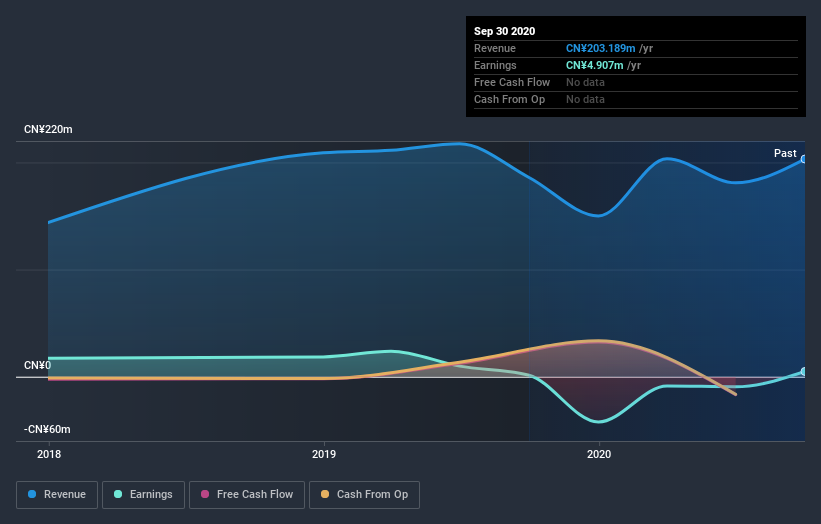

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Icon Culture Global boasts a total shareholder return of 456% for the last year. And the share price momentum remains respectable, with a gain of 214% in the last three months. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. It's always interesting to track share price performance over the longer term. But to understand Icon Culture Global better, we need to consider many other factors. For instance, we've identified 2 warning signs for Icon Culture Global that you should be aware of.

Of course Icon Culture Global may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade Icon Culture Global, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:8500

Icon Culture Global

An investment holding company, engages in the provision of integrated multimedia advertising and marketing solution services in the People’s Republic of China.

Slight risk with mediocre balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026