- Hong Kong

- /

- Entertainment

- /

- SEHK:8172

Lajin Entertainment Network Group (HKG:8172) Is In A Good Position To Deliver On Growth Plans

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

Given this risk, we thought we'd take a look at whether Lajin Entertainment Network Group (HKG:8172) shareholders should be worried about its cash burn. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). Let's start with an examination of the business' cash, relative to its cash burn.

View our latest analysis for Lajin Entertainment Network Group

Does Lajin Entertainment Network Group Have A Long Cash Runway?

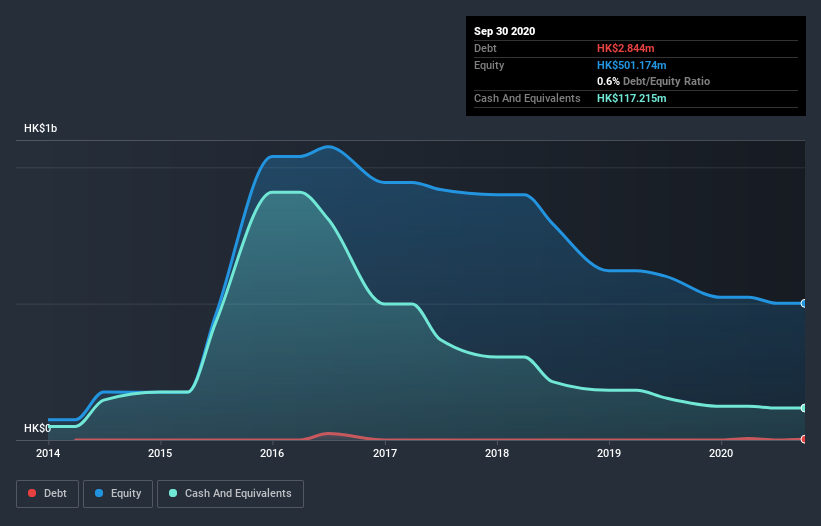

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. As at June 2020, Lajin Entertainment Network Group had cash of HK$117m and no debt. In the last year, its cash burn was HK$32m. So it had a cash runway of about 3.6 years from June 2020. There's no doubt that this is a reassuringly long runway. You can see how its cash balance has changed over time in the image below.

How Well Is Lajin Entertainment Network Group Growing?

It was fairly positive to see that Lajin Entertainment Network Group reduced its cash burn by 46% during the last year. But it makes us pessimistic to see that operating revenue slid 52% in that time. Considering both these factors, we're not particularly excited by its growth profile. In reality, this article only makes a short study of the company's growth data. You can take a look at how Lajin Entertainment Network Group has developed its business over time by checking this visualization of its revenue and earnings history.

Can Lajin Entertainment Network Group Raise More Cash Easily?

Even though it seems like Lajin Entertainment Network Group is developing its business nicely, we still like to consider how easily it could raise more money to accelerate growth. Companies can raise capital through either debt or equity. Commonly, a business will sell new shares in itself to raise cash and drive growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Lajin Entertainment Network Group has a market capitalisation of HK$295m and burnt through HK$32m last year, which is 11% of the company's market value. Given that situation, it's fair to say the company wouldn't have much trouble raising more cash for growth, but shareholders would be somewhat diluted.

Is Lajin Entertainment Network Group's Cash Burn A Worry?

Even though its falling revenue makes us a little nervous, we are compelled to mention that we thought Lajin Entertainment Network Group's cash runway was relatively promising. Based on the factors mentioned in this article, we think its cash burn situation warrants some attention from shareholders, but we don't think they should be worried. Taking a deeper dive, we've spotted 4 warning signs for Lajin Entertainment Network Group you should be aware of, and 1 of them is concerning.

Of course Lajin Entertainment Network Group may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you decide to trade Lajin Entertainment Network Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:8172

Lajin Entertainment Network Group

An investment holding company, provides movies, TV program, and internet content services in Mainland China.

Excellent balance sheet with low risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026