- Hong Kong

- /

- Construction

- /

- SEHK:8262

Promising Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

As the global markets wrap up 2024, major stock indexes have shown moderate gains, despite a dip in U.S. consumer confidence and mixed economic indicators across regions. In this context, penny stocks—though an older term—continue to represent an intriguing segment of the market, highlighting smaller or less-established companies that can offer substantial value. By focusing on those with strong financials and potential for growth, investors may uncover opportunities within these often-overlooked stocks.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$140.36M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.42 | MYR1.17B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.92 | HK$43.17B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.57 | A$65.64M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.976 | £153.96M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.42 | £180.84M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.55 | £67.7M | ★★★★☆☆ |

Click here to see the full list of 5,815 stocks from our Penny Stocks screener.

Let's explore several standout options from the results in the screener.

IGG (SEHK:799)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: IGG Inc is an investment holding company that develops and operates mobile and online games across Asia, North America, Europe, and internationally, with a market cap of HK$4.42 billion.

Operations: The company generates revenue of HK$5.50 billion from its development and operation of online games.

Market Cap: HK$4.42B

IGG Inc has recently turned profitable, overcoming a challenging five-year period of declining earnings. Its market valuation suggests it's trading at a significant discount to its estimated fair value, presenting potential opportunities for investors. The company boasts high-quality earnings and operates without debt, providing financial stability with short-term assets covering both short- and long-term liabilities. Despite an unstable dividend track record, IGG's strong return on equity and experienced board are positive indicators. Recent investor engagements signal active communication with stakeholders as the company navigates future growth prospects amidst forecasted earnings declines.

- Unlock comprehensive insights into our analysis of IGG stock in this financial health report.

- Gain insights into IGG's future direction by reviewing our growth report.

Super Strong Holdings (SEHK:8262)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Super Strong Holdings Limited is an investment holding company that offers property construction services in Hong Kong, with a market capitalization of HK$53.33 million.

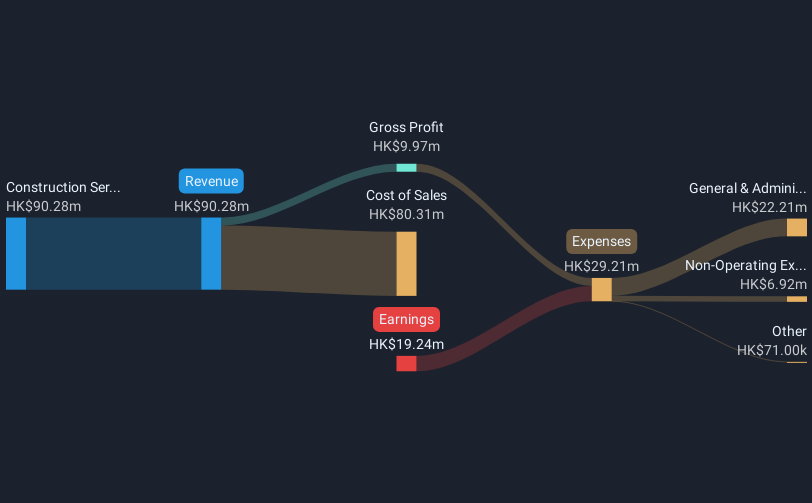

Operations: The company generates revenue of HK$90.28 million from its construction services segment in Hong Kong.

Market Cap: HK$53.33M

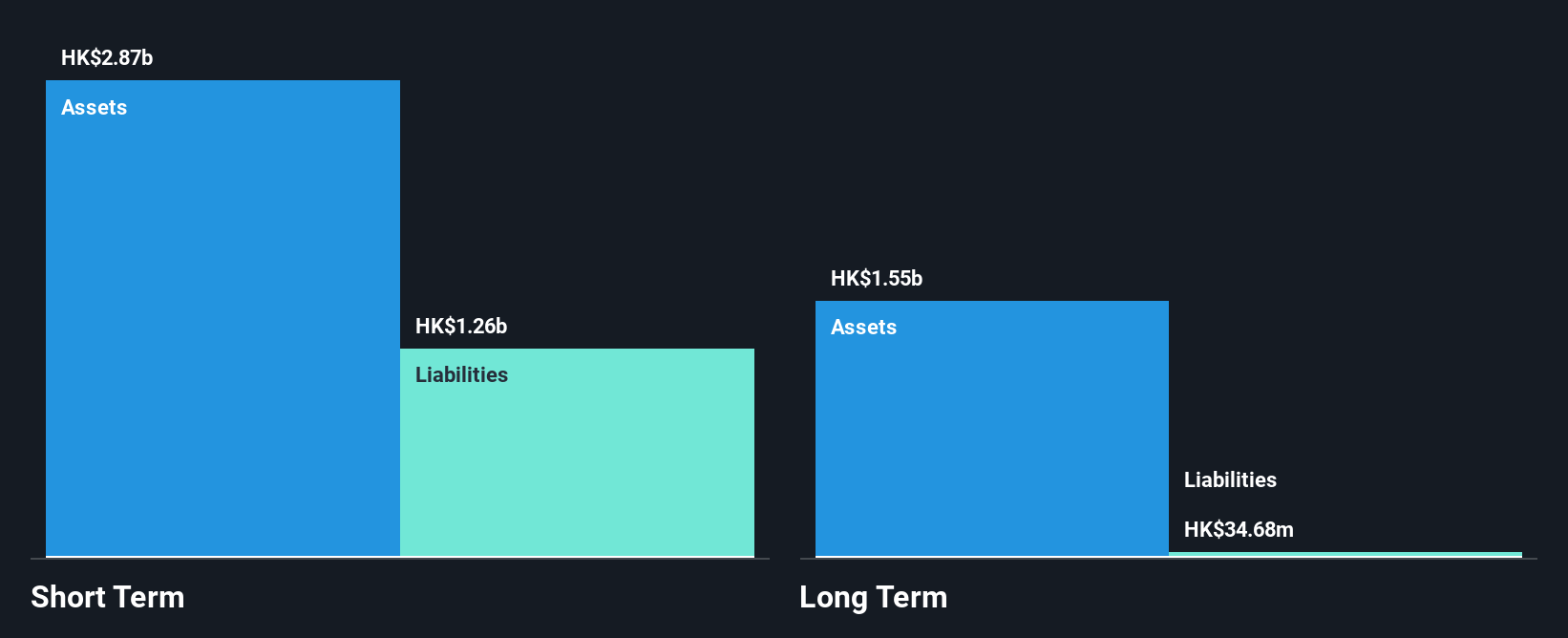

Super Strong Holdings Limited, with a market cap of HK$53.33 million, remains unprofitable and has seen increased losses over the past five years. Despite this, it maintains a strong liquidity position with short-term assets of HK$98.6 million exceeding both short- and long-term liabilities. The company is debt-free, having reduced its debt from a 3% debt-to-equity ratio five years ago. Recent capital raised through a follow-on equity offering for HK$2.42 million aims to extend its cash runway beyond the current 11 months forecasted based on free cash flow estimates amidst ongoing high share price volatility and an inexperienced management team.

- Click here and access our complete financial health analysis report to understand the dynamics of Super Strong Holdings.

- Gain insights into Super Strong Holdings' past trends and performance with our report on the company's historical track record.

Tgi Infrastructures (TASE:TGI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tgi Infrastructures Ltd, along with its subsidiary, engages in the production, processing, assembly, and marketing of magnesium-based mechanical assemblies for the automotive industry in Israel with a market cap of ₪147.32 million.

Operations: The company generates revenue primarily from its Infrastructure and Energy segment, which accounts for ₪85.56 million, and The Metal and Electrical Industries segment, contributing ₪76.24 million.

Market Cap: ₪147.32M

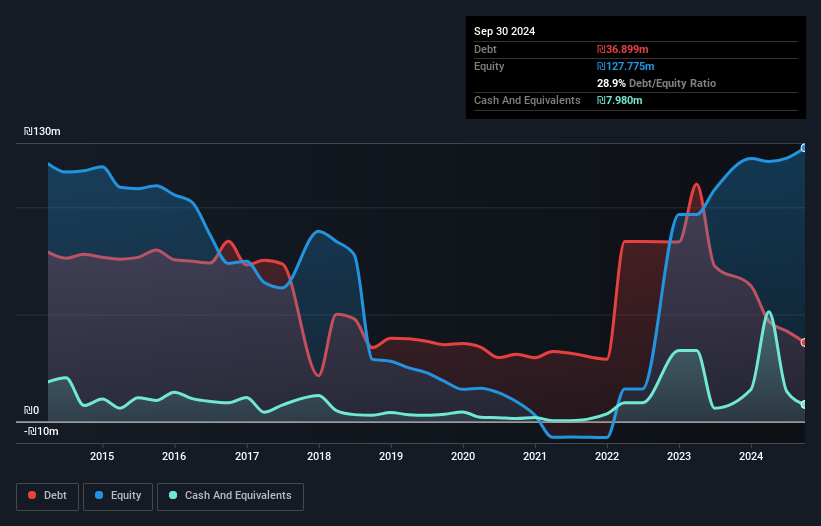

Tgi Infrastructures Ltd, with a market cap of ₪147.32 million, has shown improved profitability despite declining sales, reporting a net income increase to ₪5.54 million for Q3 2024 from ₪1.91 million the previous year. The company's financial stability is supported by reduced debt levels and strong asset coverage over liabilities, though its return on equity remains low at 16.1%. While Tgi's dividend yield of 13.58% is not well covered by earnings or cash flows, its experienced management and board provide strategic oversight amidst stable weekly volatility and satisfactory net debt to equity ratio of 22.6%.

- Dive into the specifics of Tgi Infrastructures here with our thorough balance sheet health report.

- Gain insights into Tgi Infrastructures' historical outcomes by reviewing our past performance report.

Taking Advantage

- Access the full spectrum of 5,815 Penny Stocks by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:8262

Super Strong Holdings

An investment holding company, provides property construction services in Hong Kong.

Moderate with adequate balance sheet.

Market Insights

Community Narratives