As global markets show mixed signals, with small-cap indices like the Russell 2000 and S&P MidCap 400 outperforming larger benchmarks, investors are increasingly exploring diverse opportunities. Penny stocks, though often seen as a throwback to earlier market days, remain relevant for those seeking affordable entry points into potentially high-growth sectors. By focusing on companies with strong financials and clear growth potential, investors can uncover promising opportunities among these smaller or newer firms.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Tristel (AIM:TSTL) | £3.875 | £184.64M | ★★★★★★ |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.19 | MYR334.96M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.595 | MYR2.96B | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.77 | MYR133.38M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.78 | HK$495.14M | ★★★★★★ |

| Zhejiang Giuseppe Garment (SZSE:002687) | CN¥4.28 | CN¥2.1B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.93 | MYR308.7M | ★★★★★★ |

| Hume Cement Industries Berhad (KLSE:HUMEIND) | MYR3.58 | MYR2.59B | ★★★★★☆ |

| Embark Early Education (ASX:EVO) | A$0.795 | A$126.84M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £4.095 | £407.27M | ★★★★☆☆ |

Click here to see the full list of 5,773 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

IGG (SEHK:799)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: IGG Inc is an investment holding company that develops and operates mobile and online games across Asia, North America, Europe, and internationally with a market cap of HK$4.83 billion.

Operations: The company's revenue primarily comes from the development and operation of online games, generating HK$5.50 billion.

Market Cap: HK$4.83B

IGG Inc, with a market cap of HK$4.83 billion, has shown notable financial improvements recently. The company reported a net income of HK$330.95 million for the first half of 2024, reversing from a net loss the previous year. Trading at 78.9% below its estimated fair value and being debt-free enhances its appeal among penny stocks. Share repurchases are underway, potentially boosting earnings per share and shareholder value further. Despite past earnings declines averaging 45.8% annually over five years, IGG's recent profitability marks a significant turnaround in performance within the gaming industry landscape.

- Dive into the specifics of IGG here with our thorough balance sheet health report.

- Assess IGG's future earnings estimates with our detailed growth reports.

CNNC Hua Yuan Titanium Dioxide (SZSE:002145)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: CNNC Hua Yuan Titanium Dioxide Co., Ltd is involved in the production and sale of rutile titanium dioxide in China, with a market cap of CN¥14.99 billion.

Operations: There are no specific revenue segments reported for this company.

Market Cap: CN¥14.99B

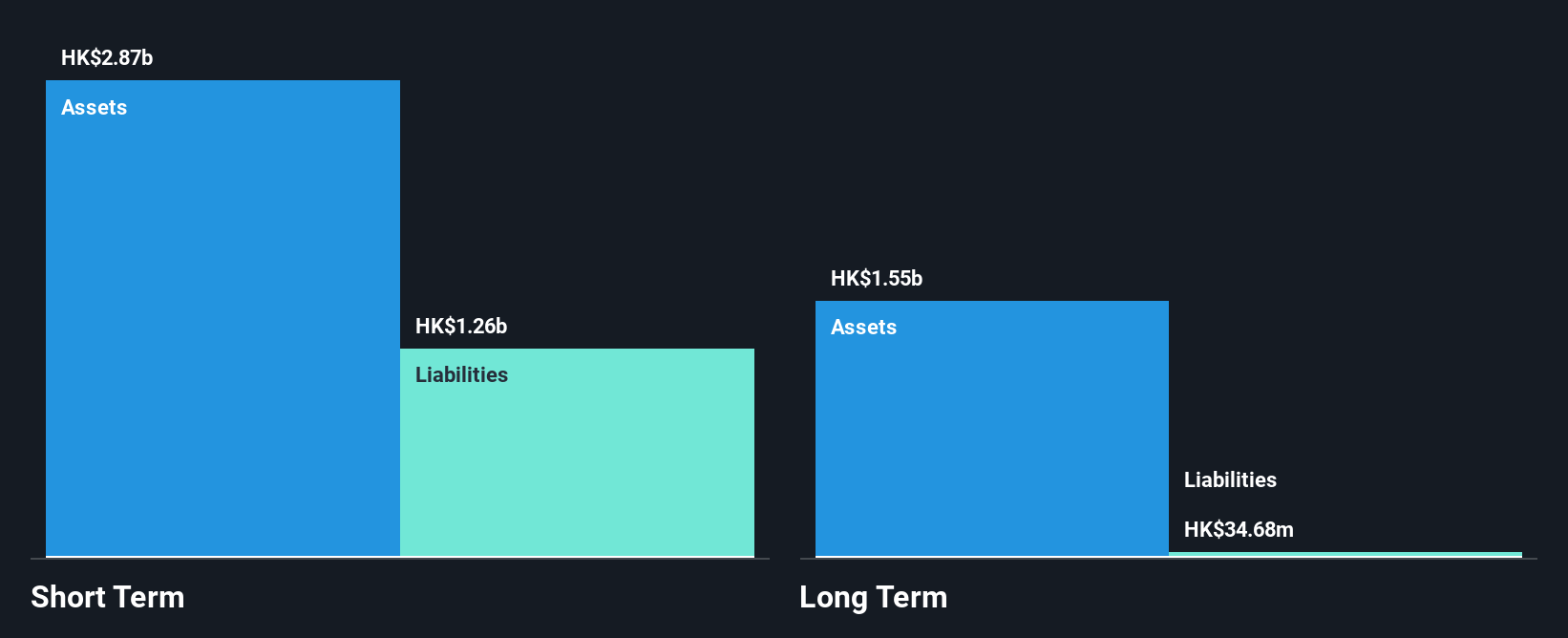

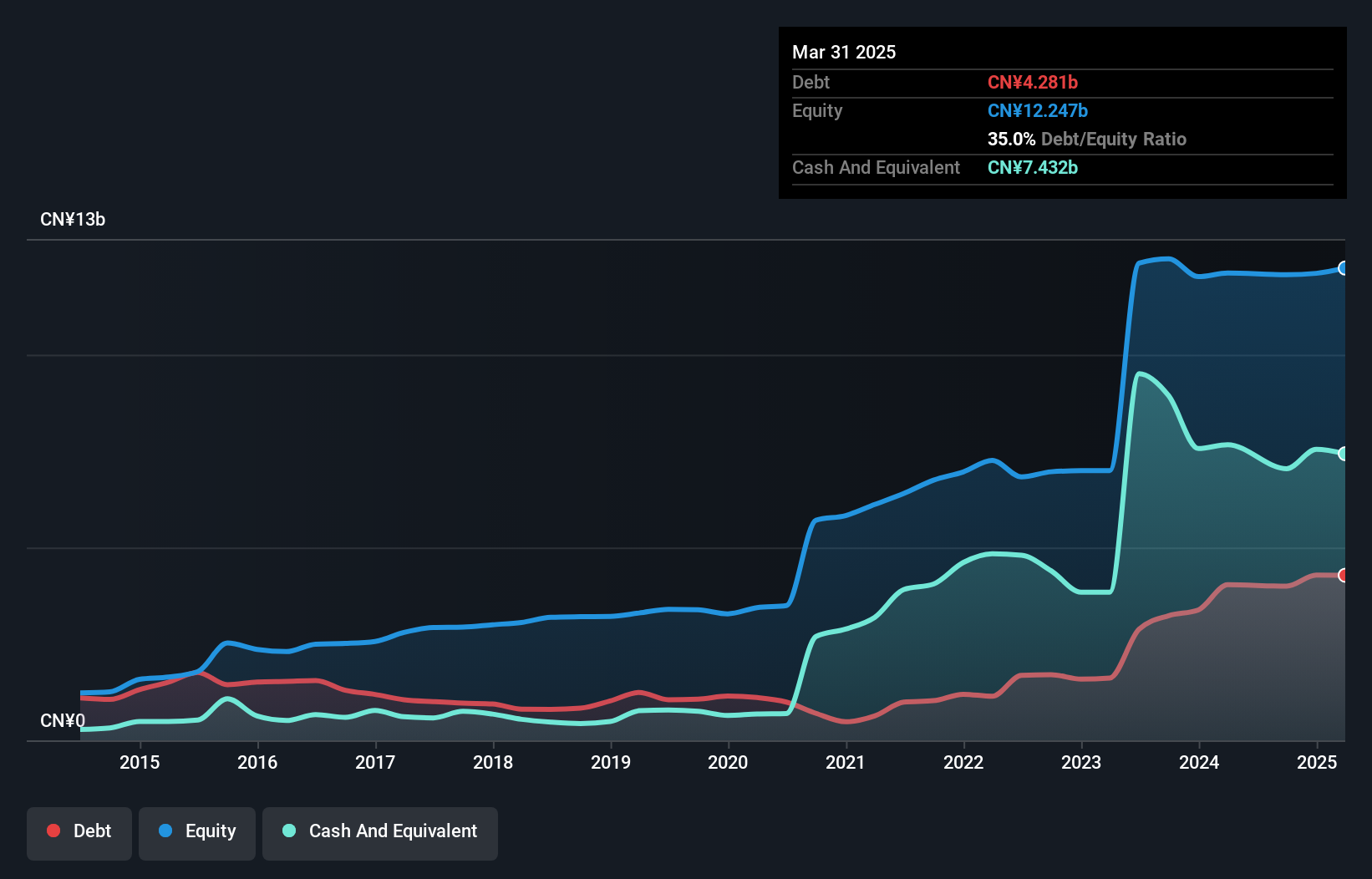

CNNC Hua Yuan Titanium Dioxide Co., Ltd, with a market cap of CN¥14.99 billion, has demonstrated robust financial performance in recent periods. The company reported sales of CN¥3.15 billion for the first half of 2024, showing growth from the previous year. Earnings have increased by 59% over the past year, surpassing both its five-year average and industry benchmarks. The company's short-term assets significantly cover both short- and long-term liabilities, reflecting sound liquidity management. Despite having low return on equity at 4.3%, its debt level is manageable with more cash than total debt and interest payments are well-covered by profits.

- Take a closer look at CNNC Hua Yuan Titanium Dioxide's potential here in our financial health report.

- Gain insights into CNNC Hua Yuan Titanium Dioxide's past trends and performance with our report on the company's historical track record.

HARBIN GLORIA PHARMACEUTICALS (SZSE:002437)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Harbin Gloria Pharmaceuticals Co., Ltd focuses on the research, development, production, and sale of pharmaceutical products in China with a market cap of CN¥5.18 billion.

Operations: The company's revenue is primarily derived from Chemical Medicine, which accounts for CN¥2.28 billion, followed by Traditional Chinese Medicine contributing CN¥133.24 million.

Market Cap: CN¥5.18B

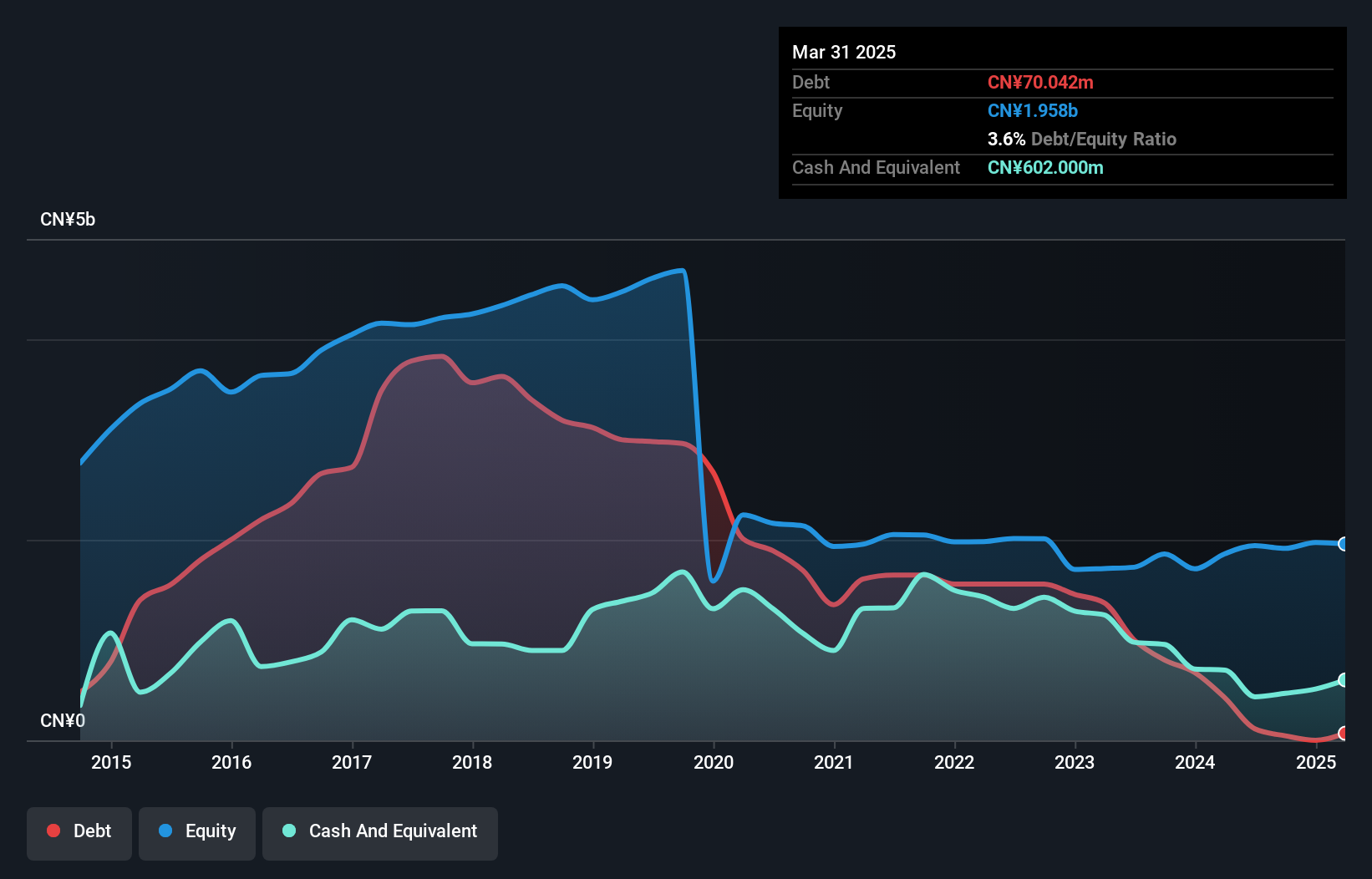

Harbin Gloria Pharmaceuticals, with a market cap of CN¥5.18 billion, has shown financial resilience despite recent shareholder dilution. The company reported net income of CN¥124.97 million for the first half of 2024, a significant increase from the previous year. Its debt is well-managed, with more cash than total debt and strong interest coverage by EBIT at 55.7 times. Although there was a large one-off gain impacting earnings, its short-term assets exceed liabilities, ensuring liquidity stability. However, the board's average tenure suggests inexperience and return on equity remains low at 11.7%.

- Click here and access our complete financial health analysis report to understand the dynamics of HARBIN GLORIA PHARMACEUTICALS.

- Explore historical data to track HARBIN GLORIA PHARMACEUTICALS' performance over time in our past results report.

Taking Advantage

- Investigate our full lineup of 5,773 Penny Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002145

CNNC Hua Yuan Titanium Dioxide

Engages in the production and sale of rutile titanium dioxide in China.

Proven track record with adequate balance sheet.