- China

- /

- Infrastructure

- /

- SZSE:002023

3 Growth Companies Insiders Are Betting On

Reviewed by Simply Wall St

As global markets navigate a landscape of fluctuating oil prices and economic shifts, the U.S. indices have shown resilience, with the S&P 500 and Nasdaq Composite reflecting strong performances driven by sectors like utilities and real estate. Amidst this backdrop, insider ownership in growth companies can serve as a compelling indicator of confidence in their potential; such stocks may offer unique opportunities for investors seeking alignment between company leadership and shareholder interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 41.9% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 30.1% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 29.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.2% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

Let's review some notable picks from our screened stocks.

Jinhong GasLtd (SHSE:688106)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Jinhong Gas Co., Ltd. is a Chinese company that produces and sells bulk, special, and natural gas products, with a market cap of CN¥9.38 billion.

Operations: Jinhong Gas Co., Ltd.'s revenue is derived from its production and sale of bulk, special, and natural gas products within China.

Insider Ownership: 35.4%

Jinhong Gas Ltd. demonstrates strong growth potential with earnings forecasted to grow 23.52% annually, outpacing the Chinese market's revenue growth projection of 13.5%. Despite trading significantly below its estimated fair value, return on equity is predicted to remain modest at 13.6% over three years. Recent buyback plans totaling CNY 80 million reflect strategic insider confidence, though dividends are not well-covered by free cash flows, indicating a focus on reinvestment and expansion over immediate shareholder returns.

- Delve into the full analysis future growth report here for a deeper understanding of Jinhong GasLtd.

- Our valuation report unveils the possibility Jinhong GasLtd's shares may be trading at a discount.

Shenzhen United Winners Laser (SHSE:688518)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen United Winners Laser Co., Ltd. manufactures and sells laser welding equipment in China and internationally, with a market cap of CN¥5.46 billion.

Operations: Revenue Segments (in millions of CN¥):

Insider Ownership: 14.3%

Shenzhen United Winners Laser is expected to see earnings grow significantly at 44.1% annually, surpassing the Chinese market's forecasted growth of 23.8%. However, recent financial results show a decline in revenue and net income compared to the previous year, with sales at CNY 1.42 billion and net income at CNY 51.18 million. Despite this, high insider ownership may indicate confidence in long-term growth prospects amid challenges like low profit margins and return on equity forecasts.

- Click here and access our complete growth analysis report to understand the dynamics of Shenzhen United Winners Laser.

- According our valuation report, there's an indication that Shenzhen United Winners Laser's share price might be on the expensive side.

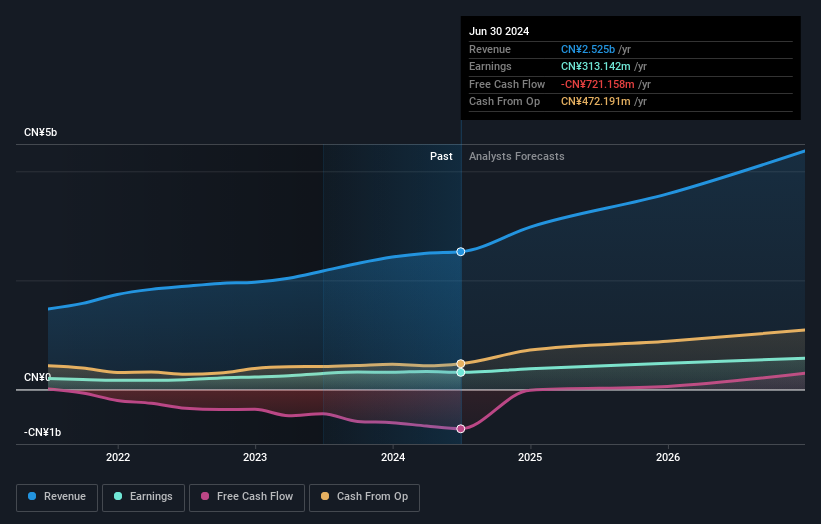

Sichuan Haite High-techLtd (SZSE:002023)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sichuan Haite High-tech Co., Ltd specializes in providing aircraft airborne equipment maintenance services in China, with a market capitalization of CN¥8.18 billion.

Operations: The company's revenue is primarily derived from Aeronautical Engineering Technology and Services, which generated CN¥853.97 million, and High-End Core Equipment Research and Development and Support, contributing CN¥255.73 million.

Insider Ownership: 15.3%

Sichuan Haite High-tech Ltd. is poised for growth with earnings forecasted to increase by 29.03% annually, outpacing the CN market's 23.8% projection. Recent financials show robust performance, with half-year revenue rising to CNY 618.02 million from CNY 502.44 million and net income reaching CNY 47.08 million from CNY 28.58 million year-on-year, reflecting strong operational momentum despite a low future return on equity forecast of 2.6%.

- Get an in-depth perspective on Sichuan Haite High-techLtd's performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Sichuan Haite High-techLtd is priced higher than what may be justified by its financials.

Turning Ideas Into Actions

- Delve into our full catalog of 1480 Fast Growing Companies With High Insider Ownership here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002023

Sichuan Haite High-techLtd

Provides aircraft airborne equipment maintenance services in China.

Reasonable growth potential with proven track record.