- China

- /

- Electrical

- /

- SZSE:301031

Top Growth Companies With Strong Insider Ownership October 2024

Reviewed by Simply Wall St

In October 2024, global markets have been marked by significant movements, with the S&P 500 and Nasdaq Composite showing robust gains driven by sectors like utilities and real estate, while European markets responded positively to the European Central Bank's rate cuts. Amidst these market dynamics, identifying growth companies with high insider ownership can be particularly appealing, as such stocks often indicate strong confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 41.9% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 30.1% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 29.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.2% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

Here's a peek at a few of the choices from the screener.

KBC Corporation (SHSE:688598)

Simply Wall St Growth Rating: ★★★★★☆

Overview: KBC Corporation, Ltd. is involved in the research, development, production, and sale of carbon-based composite materials and products both in China and internationally, with a market cap of CN¥4.90 billion.

Operations: KBC Corporation, Ltd. generates revenue through its activities in the research, development, production, and sale of carbon-based composite materials and products across domestic and international markets.

Insider Ownership: 15.3%

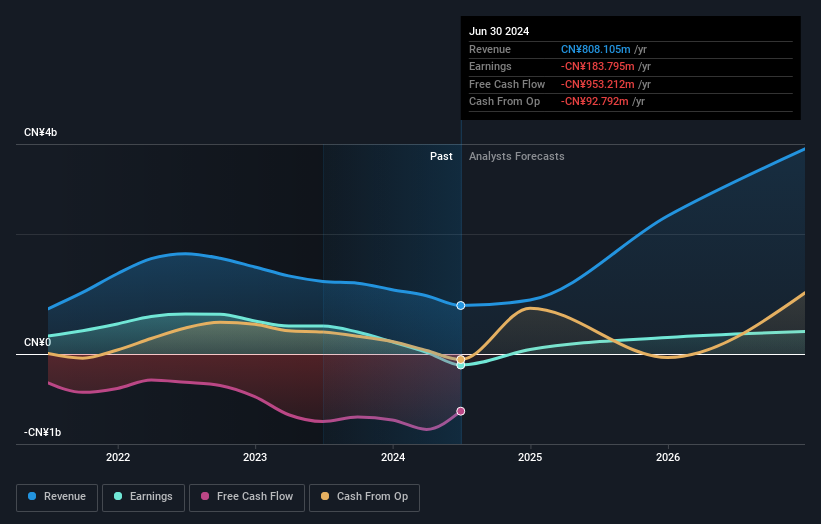

KBC Corporation demonstrates significant growth potential, with revenue forecasted to increase by 57% annually, outpacing the market. Despite recent financial setbacks—reporting a net loss of CNY 103.18 million for the half year ended June 30, 2024—the company is expected to become profitable over the next three years. The recent share buyback program reflects management's commitment to shareholder value despite a volatile share price and low forecasted return on equity at 4.9%.

- Get an in-depth perspective on KBC Corporation's performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that KBC Corporation is priced higher than what may be justified by its financials.

Shenzhen Sinexcel ElectricLtd (SZSE:300693)

Simply Wall St Growth Rating: ★★★★★★

Overview: Shenzhen Sinexcel Electric Co., Ltd. operates as a provider of energy interconnection ecosystems across various continents including Asia, Oceania, Europe, North America, South America, and Africa with a market capitalization of CN¥8.26 billion.

Operations: Unfortunately, the "Revenue Segments" section you provided is incomplete or missing specific data. Therefore, I can't summarize the company's revenue segments without further details. If you have additional information on their revenue breakdown, please share it so I can assist you accurately.

Insider Ownership: 28.9%

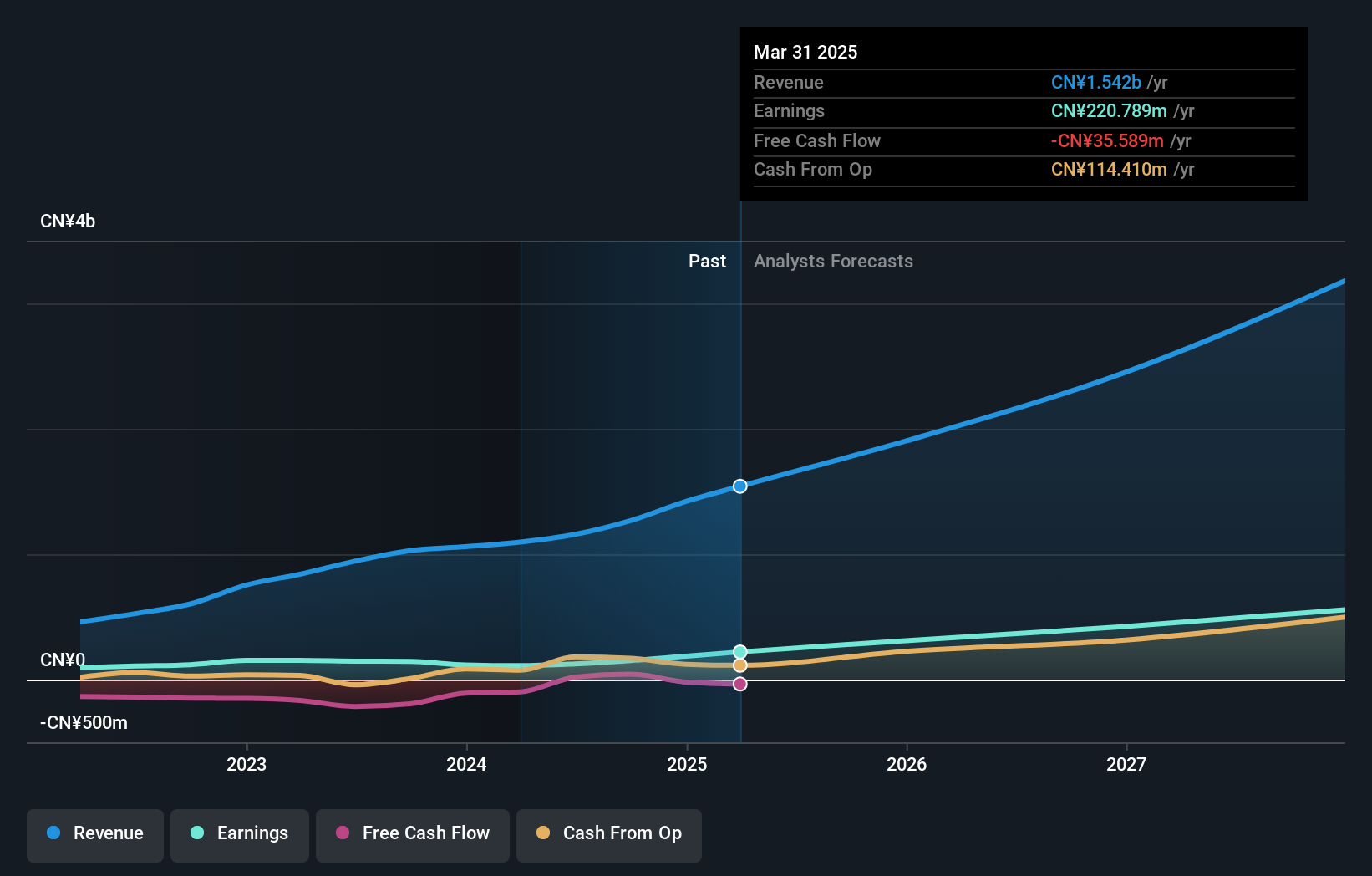

Shenzhen Sinexcel Electric Ltd. shows strong growth prospects, with revenue expected to grow 28.1% annually, surpassing the Chinese market average. Despite a volatile share price and earnings per share remaining flat year-over-year, the company trades significantly below its estimated fair value. Recent earnings reported sales of CNY 1.40 billion for the half year ended June 2024, up from CNY 1.08 billion previously. The company's buyback program has been modestly active, enhancing shareholder value without substantial insider trading activity recently noted.

- Click to explore a detailed breakdown of our findings in Shenzhen Sinexcel ElectricLtd's earnings growth report.

- The analysis detailed in our Shenzhen Sinexcel ElectricLtd valuation report hints at an deflated share price compared to its estimated value.

Xi'an Sinofuse Electric (SZSE:301031)

Simply Wall St Growth Rating: ★★★★★★

Overview: Xi'an Sinofuse Electric Co., Ltd. focuses on the research, development, production, and sale of circuit protection devices and fuses, with a market cap of CN¥6.63 billion.

Operations: The company's revenue primarily comes from its circuit protection devices, fuses, and related accessories.

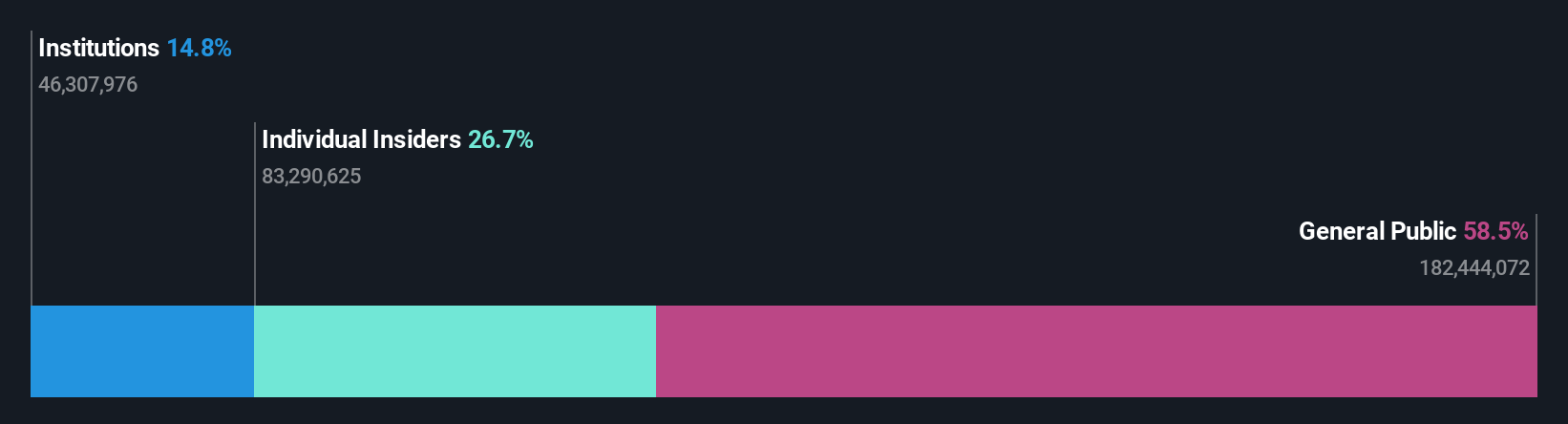

Insider Ownership: 36.8%

Xi'an Sinofuse Electric is poised for robust growth, with earnings projected to rise significantly at 45.3% annually, outpacing the Chinese market. Revenue growth is also strong, forecasted at 29.7% per year. Despite a dip in profit margins from 15.6% to 10.8%, recent financials show increased sales and net income compared to last year. The company completed a modest share buyback worth CNY 20.14 million, reflecting strategic capital allocation without significant insider trading activity recently observed.

- Click here and access our complete growth analysis report to understand the dynamics of Xi'an Sinofuse Electric.

- Upon reviewing our latest valuation report, Xi'an Sinofuse Electric's share price might be too optimistic.

Make It Happen

- Get an in-depth perspective on all 1480 Fast Growing Companies With High Insider Ownership by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301031

Xi'an Sinofuse Electric

Engages in the research, development, production, and sale of circuit protection devices, fuses, and related accessories.

Exceptional growth potential with excellent balance sheet.