- Hong Kong

- /

- Entertainment

- /

- SEHK:799

Discovering Promising Penny Stocks In Global For June 2025

Reviewed by Simply Wall St

As global markets continue to navigate a mix of cooling labor trends and manufacturing contractions, U.S. stocks have shown resilience with major indices climbing for the second consecutive week. In this context, identifying promising investment opportunities requires a keen eye on financial health and growth potential. Though the term 'penny stock' might sound like a relic of past trading days, it still highlights smaller or less-established companies that can offer great value. By focusing on those with robust financials and clear growth trajectories, investors can uncover hidden gems in today's market landscape.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.64 | A$70.76M | ✅ 4 ⚠️ 2 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.16 | HK$725.59M | ✅ 4 ⚠️ 2 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.12 | £463.53M | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.67 | SEK275.19M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.425 | SGD172.25M | ✅ 3 ⚠️ 3 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.645 | A$441.56M | ✅ 5 ⚠️ 1 View Analysis > |

| Tasmea (ASX:TEA) | A$2.99 | A$725.72M | ✅ 4 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.28 | SGD8.97B | ✅ 5 ⚠️ 0 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ✅ 5 ⚠️ 0 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.86 | £11.84M | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 5,579 stocks from our Global Penny Stocks screener.

Let's dive into some prime choices out of the screener.

LifeTech Scientific (SEHK:1302)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: LifeTech Scientific Corporation is an investment holding company that develops, manufactures, and trades interventional medical devices for cardiovascular and peripheral vascular diseases across various global markets, with a market cap of HK$7.50 billion.

Operations: The company's revenue is derived from three main segments: Structural Heart Diseases Business generating CN¥527.58 million, Peripheral Vascular Diseases Business contributing CN¥751.11 million, and Cardiac Pacing and Electrophysiology Business with CN¥25.01 million.

Market Cap: HK$7.5B

LifeTech Scientific Corporation, with a market cap of HK$7.50 billion, is advancing in the medical device sector through recent regulatory approval of its Aortic Arch Stent Graft System in China. This innovation enhances their portfolio and aligns with international guidelines for treating aortic arch dissection. Despite facing negative earnings growth last year, LifeTech maintains strong financial health with short-term assets exceeding liabilities and no debt burden. The company’s net profit margin has decreased to 17.1% from 20.8%, yet it continues to deliver high-quality earnings without shareholder dilution, supported by an experienced board averaging 11.2 years of tenure.

- Dive into the specifics of LifeTech Scientific here with our thorough balance sheet health report.

- Assess LifeTech Scientific's previous results with our detailed historical performance reports.

IGG (SEHK:799)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: IGG Inc is an investment holding company that develops and operates mobile and online games across Asia, North America, Europe, and other international markets, with a market cap of HK$4.21 billion.

Operations: The company generates revenue of HK$5.74 billion from its development and operation of online games.

Market Cap: HK$4.21B

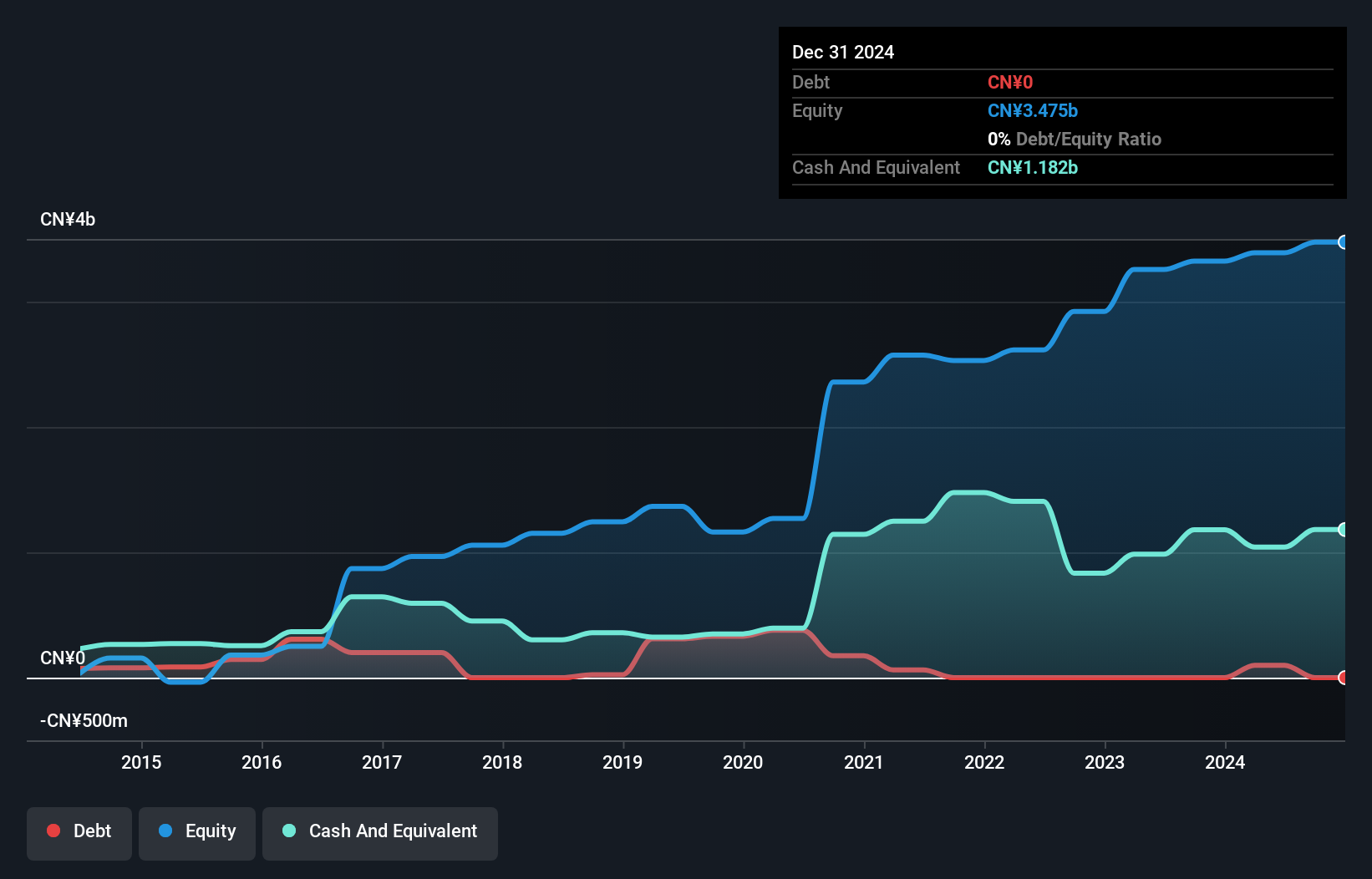

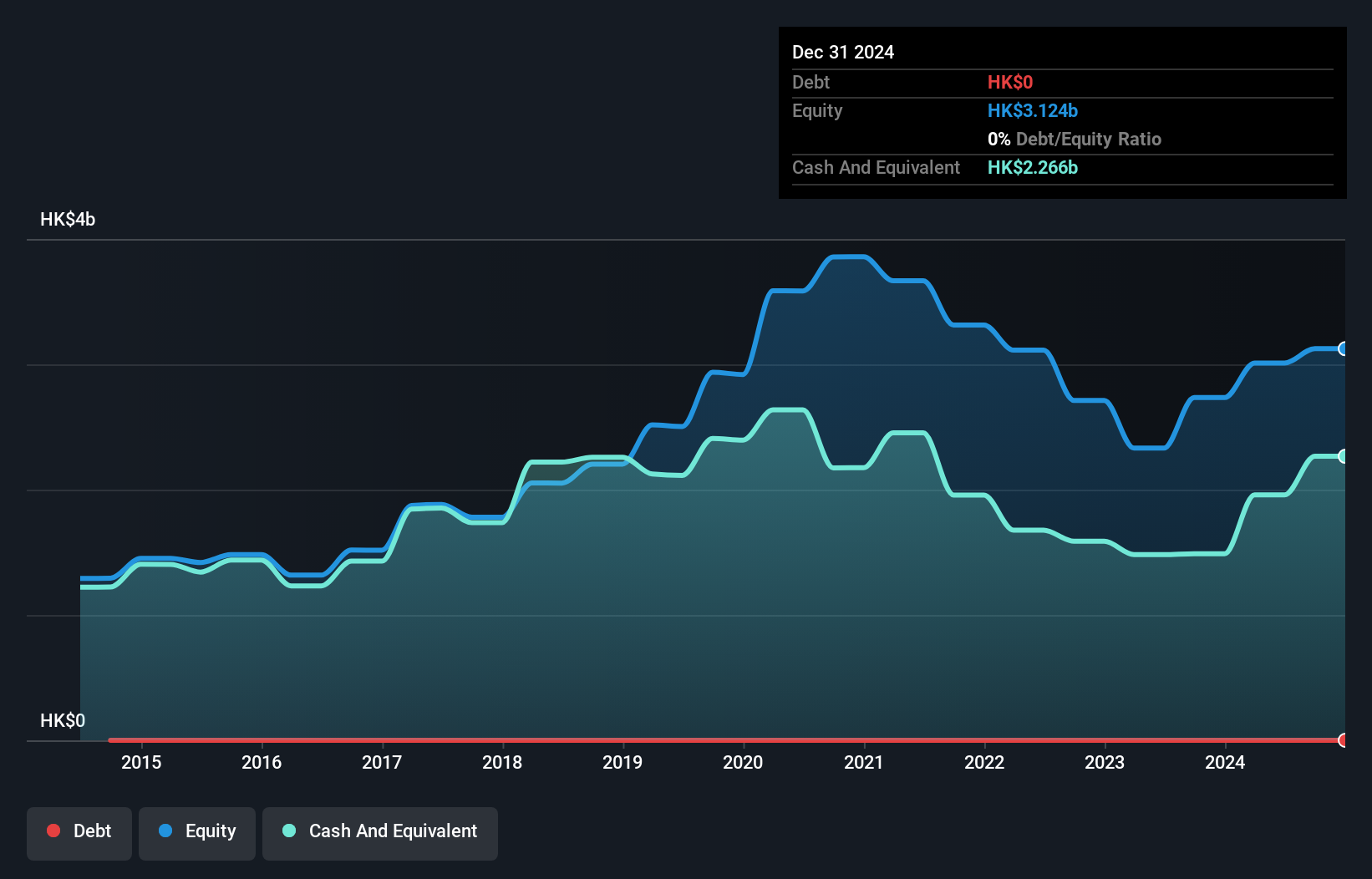

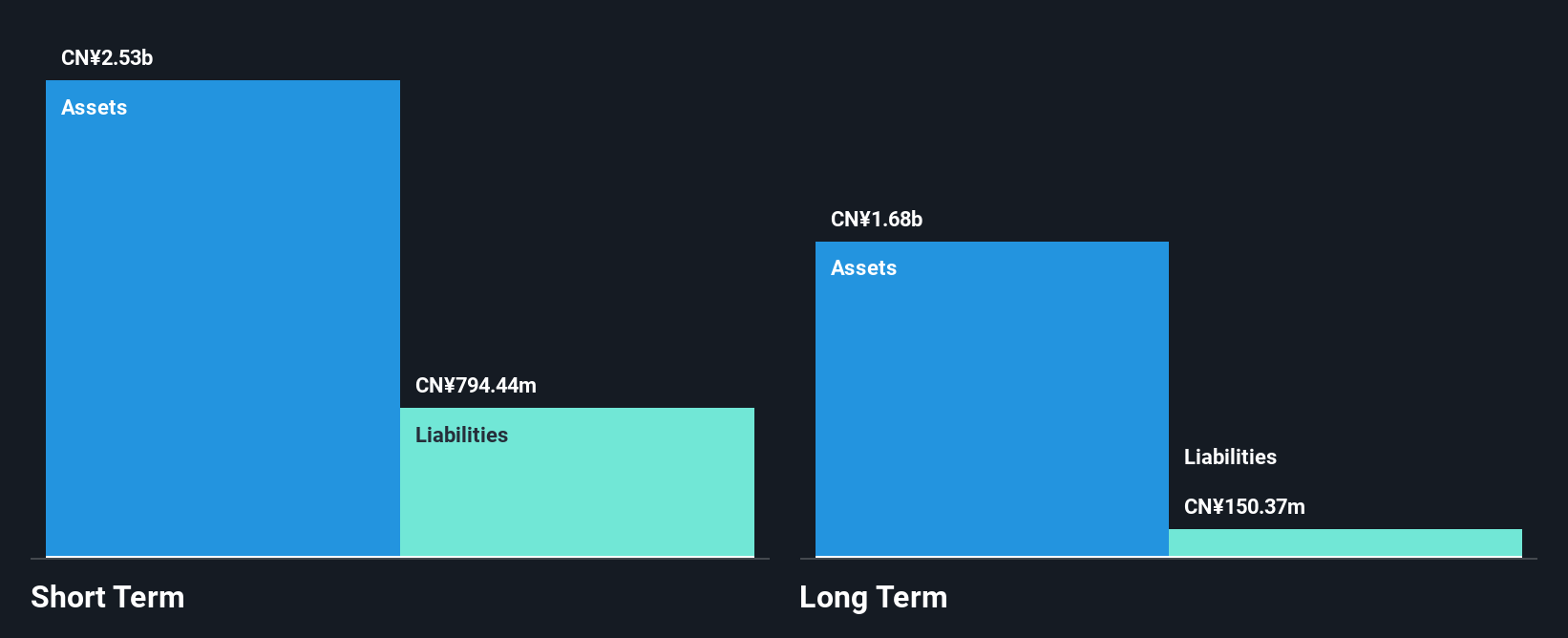

IGG Inc, with a market cap of HK$4.21 billion, is experiencing significant earnings growth, reporting a 694.9% increase over the past year, which contrasts sharply with its five-year average decline of 41.8% per year. The company has no debt and maintains strong financial health with short-term assets exceeding both long-term and short-term liabilities. Trading at a price-to-earnings ratio of 7.2x, it offers good relative value compared to the Hong Kong market average of 11.2x. Recent share buybacks are expected to enhance net asset value per share and earnings per share further supporting investor interest in IGG Inc's stock performance amidst an unstable dividend track record.

- Navigate through the intricacies of IGG with our comprehensive balance sheet health report here.

- Examine IGG's earnings growth report to understand how analysts expect it to perform.

Shanghai YongLi Belting (SZSE:300230)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Shanghai YongLi Belting Co., Ltd is engaged in the development, production, and sale of conveyor belts with a market cap of CN¥4.26 billion.

Operations: Shanghai YongLi Belting Co., Ltd has not reported any specific revenue segments.

Market Cap: CN¥4.26B

Shanghai YongLi Belting Co., Ltd, with a market cap of CN¥4.26 billion, has demonstrated financial resilience despite recent challenges. The company reported first-quarter 2025 revenue of CN¥508.05 million and net income of CN¥33.63 million, though profit margins declined from the previous year. Its short-term assets significantly exceed both short-term and long-term liabilities, indicating strong liquidity management. While earnings growth was negative last year, the company's debt is well-covered by operating cash flow at 77.4%, and it holds more cash than its total debt. However, volatility remains high with an unstable dividend track record following recent decreases in dividend payouts.

- Get an in-depth perspective on Shanghai YongLi Belting's performance by reading our balance sheet health report here.

- Evaluate Shanghai YongLi Belting's historical performance by accessing our past performance report.

Where To Now?

- Click through to start exploring the rest of the 5,576 Global Penny Stocks now.

- Ready For A Different Approach? AI is about to change healthcare. These 22 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:799

IGG

An investment holding company, develops and operates mobile and online games in Asia, North America, Europe, and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives