- Hong Kong

- /

- Water Utilities

- /

- SEHK:1129

Exploring Promising Penny Stocks In December 2024

Reviewed by Simply Wall St

Amid a backdrop of mixed performances in major global indices, with growth stocks outpacing value shares significantly, investors are keenly observing the Federal Reserve's upcoming decisions on interest rates. The recent economic data highlights a rebound in job growth and mixed sector performance, contributing to both opportunities and challenges for market participants. In this context, penny stocks—typically representing smaller or newer companies—remain an intriguing investment area due to their potential for growth when supported by strong financial health. As we explore several promising penny stocks this December 2024, we'll focus on those that combine affordability with robust balance sheets and potential long-term upside.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.54B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$143.12M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.435 | MYR1.18B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.885 | MYR298.75M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.16 | £806.27M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.05 | HK$44.27B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.56 | A$67.4M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.53 | £67.32M | ★★★★☆☆ |

| Tristel (AIM:TSTL) | £3.65 | £183.61M | ★★★★★★ |

Click here to see the full list of 5,699 stocks from our Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

China Water Industry Group (SEHK:1129)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: China Water Industry Group Limited is an investment holding company that offers water supply and sewage treatment services in the People’s Republic of China, with a market cap of approximately HK$137.93 million.

Operations: The company's revenue is derived from two main segments: HK$249.11 million from the exploitation and sale of renewable energy, and HK$391.10 million from providing water supply, sewage treatment, and construction services.

Market Cap: HK$137.93M

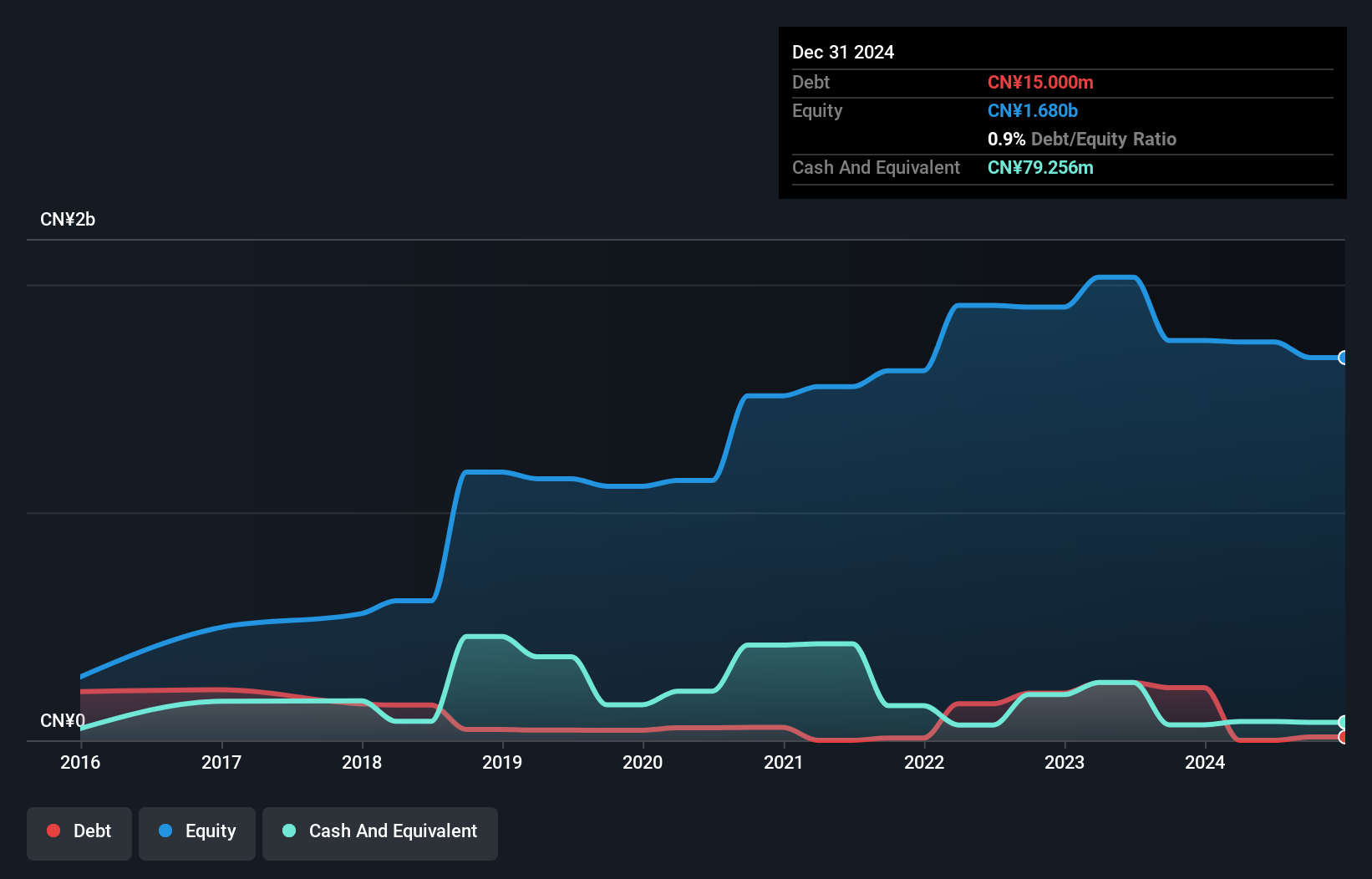

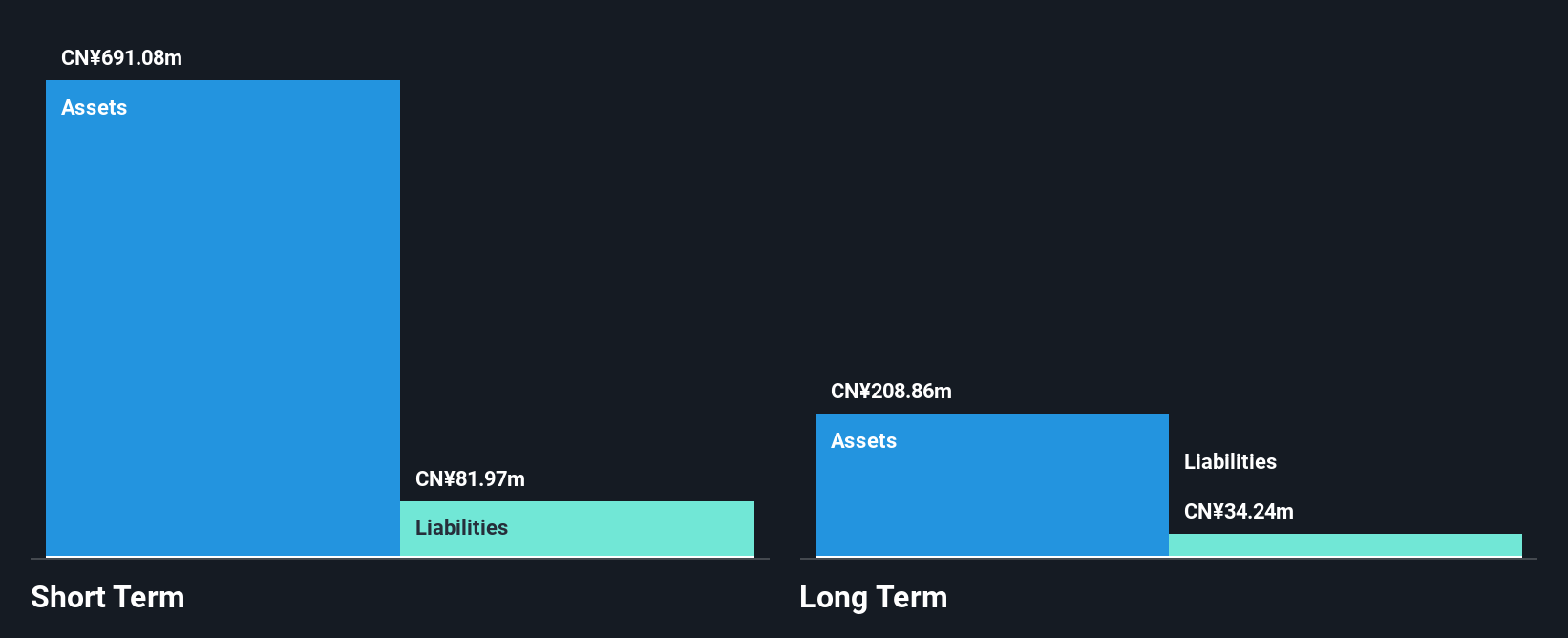

China Water Industry Group, with a market cap of HK$137.93 million, faces challenges typical of smaller stocks, including unprofitability and declining earnings over the past five years. The company’s net debt to equity ratio is satisfactory at 28.3%, and it has sufficient cash runway for over a year based on current free cash flow. Recent board changes and a rights issue indicate efforts to stabilize finances and governance. Shareholders have not been significantly diluted recently, but volatility remains high at 10%. The seasoned management team may provide stability amid ongoing financial restructuring efforts.

- Click here to discover the nuances of China Water Industry Group with our detailed analytical financial health report.

- Understand China Water Industry Group's track record by examining our performance history report.

7Road Holdings (SEHK:797)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: 7Road Holdings Limited is an investment holding company that develops and distributes web and mobile games in the People's Republic of China and internationally, with a market cap of HK$3 billion.

Operations: The company generates revenue from its Computer Graphics segment, amounting to CN¥400.16 million.

Market Cap: HK$3B

7Road Holdings, with a market cap of HK$3 billion, operates in the gaming sector and generates CN¥400.16 million from its Computer Graphics segment. Despite being unprofitable with a negative return on equity of -17.34%, it has managed to reduce losses over the past five years by 1.4% annually. The company benefits from having no debt, ensuring no interest coverage concerns, while its short-term assets significantly exceed both short and long-term liabilities. Recent changes include appointing ZHONGHUI ANDA CPA Limited as the new auditor after Elite Partners' resignation due to regulatory issues in China.

- Unlock comprehensive insights into our analysis of 7Road Holdings stock in this financial health report.

- Gain insights into 7Road Holdings' past trends and performance with our report on the company's historical track record.

Harbin VITI Electronics (SHSE:603023)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Harbin VITI Electronics Co., Ltd. engages in the research, development, manufacturing, and sale of automobile electronic products for cars and buses in China, with a market cap of approximately CN¥1.67 billion.

Operations: The company's revenue is derived entirely from its Computer Communications and Other Electronic Equipment Manufacturing segment, amounting to CN¥54.23 million.

Market Cap: CN¥1.67B

Harbin VITI Electronics, with a market cap of CN¥1.67 billion, operates in the automobile electronics sector in China. Despite being unprofitable and experiencing increased losses over the past five years, it maintains a strong balance sheet with no debt and significant short-term assets (CN¥674.3 million) exceeding liabilities. Recent earnings for the first nine months of 2024 showed modest revenue growth to CN¥46.21 million from CN¥44.98 million year-on-year, alongside a net income increase to CN¥3.55 million from CN¥1.84 million, reflecting slight operational improvements amidst ongoing challenges in profitability and return on equity (-1.81%).

- Click here and access our complete financial health analysis report to understand the dynamics of Harbin VITI Electronics.

- Explore historical data to track Harbin VITI Electronics' performance over time in our past results report.

Make It Happen

- Navigate through the entire inventory of 5,699 Penny Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1129

China Water Industry Group

An investment holding company, provides water supply and sewage treatment services in the People’s Republic of China.

Moderate risk with adequate balance sheet.

Market Insights

Community Narratives