- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:1024

Exploring High Growth Tech Stocks In Hong Kong This October 2024

Reviewed by Simply Wall St

The Hong Kong market has been buoyed by recent stimulus measures from China, leading to a surge in the Hang Seng Index and renewed optimism among investors. In this favorable environment, identifying high-growth tech stocks becomes crucial, as these companies are often well-positioned to capitalize on economic upturns and technological advancements.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.37% | 25.47% | ★★★★★☆ |

| MedSci Healthcare Holdings | 48.74% | 48.78% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 25.31% | 39.04% | ★★★★★☆ |

| Cowell e Holdings | 31.82% | 35.43% | ★★★★★★ |

| RemeGen | 26.30% | 52.19% | ★★★★★☆ |

| Akeso | 32.58% | 54.53% | ★★★★★★ |

| Innovent Biologics | 22.24% | 59.39% | ★★★★★☆ |

| Biocytogen Pharmaceuticals (Beijing) | 21.53% | 109.17% | ★★★★★☆ |

| Beijing Airdoc Technology | 37.47% | 93.35% | ★★★★★☆ |

| Sichuan Kelun-Biotech Biopharmaceutical | 24.70% | 8.53% | ★★★★★☆ |

Click here to see the full list of 45 stocks from our SEHK High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Kuaishou Technology (SEHK:1024)

Simply Wall St Growth Rating: ★★★★☆☆

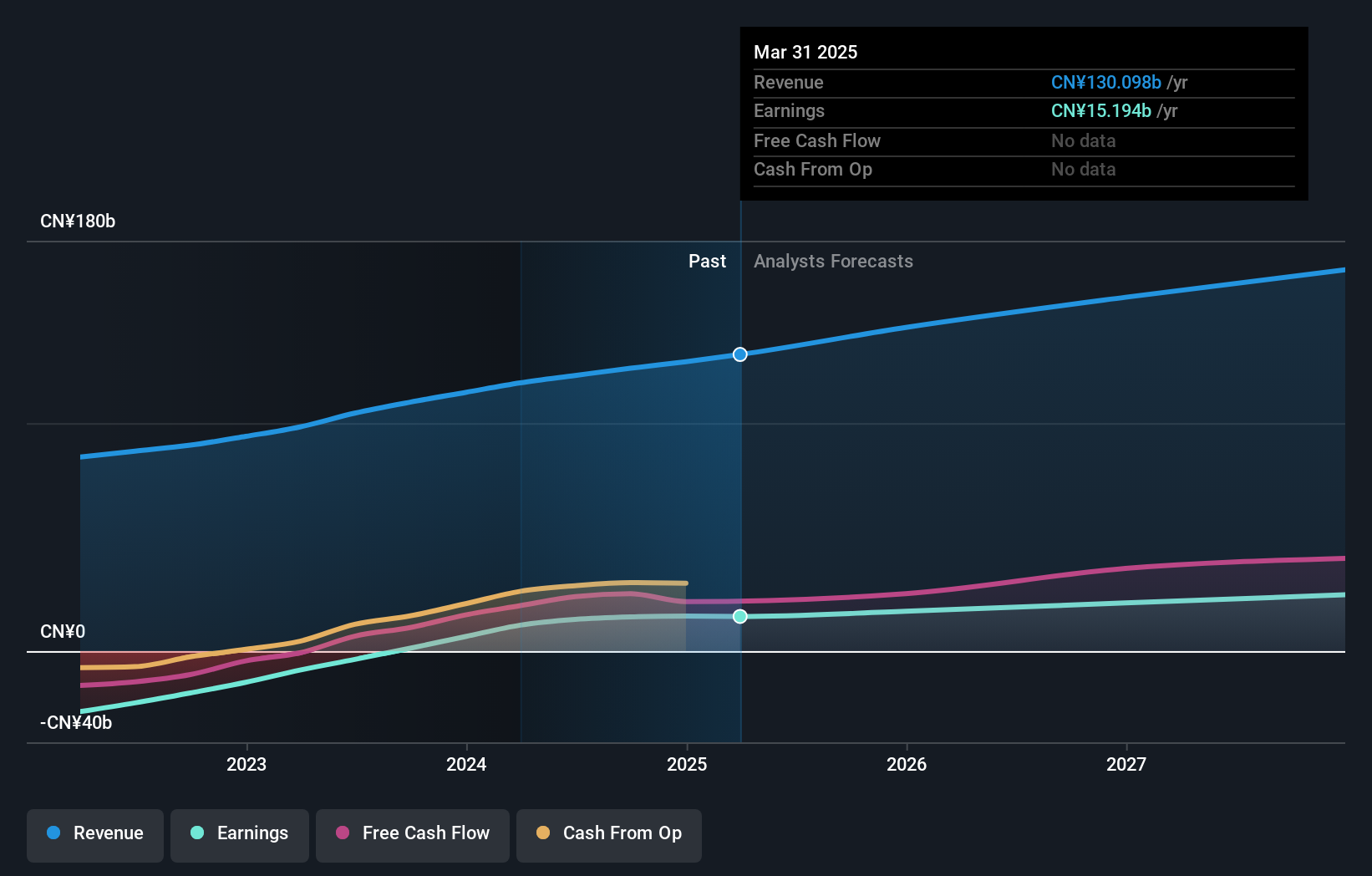

Overview: Kuaishou Technology, an investment holding company with a market cap of HK$236.57 billion, offers live streaming, online marketing, and other services in the People's Republic of China.

Operations: Kuaishou Technology generates revenue primarily from domestic operations (CN¥117.32 billion) and a smaller portion from overseas markets (CN¥3.57 billion). The company focuses on live streaming and online marketing services in the People's Republic of China.

Kuaishou Technology has demonstrated robust growth with a notable 9.0% increase in revenue year-over-year, reaching CNY 30.98 billion in Q2 2024, showcasing its resilience and adaptability in the competitive tech landscape of Hong Kong. The company's commitment to innovation is evident from its R&D investments, which have strategically fueled advancements such as the Kling AI video generation model. This focus on R&D not only enhances Kuaishou's product offerings but also solidifies its position in the market by aligning with evolving consumer demands and technological trends. Moreover, with an impressive surge in net income to CNY 3.98 billion from CNY 1.48 billion a year prior and an earnings forecast growth of 18.7% per annum, Kuaishou is setting a strong foothold for future expansion while outpacing average market growth rates.

- Get an in-depth perspective on Kuaishou Technology's performance by reading our health report here.

Explore historical data to track Kuaishou Technology's performance over time in our Past section.

Sunny Optical Technology (Group) (SEHK:2382)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sunny Optical Technology (Group) Company Limited is an investment holding company involved in the design, research, development, manufacturing, and sale of optical and optical-related products as well as scientific instruments, with a market cap of HK$62.94 billion.

Operations: Sunny Optical Technology (Group) generates revenue primarily from three segments: Optical Components (CN¥12.32 billion), Optoelectronic Products (CN¥25.10 billion), and Optical Instruments (CN¥0.59 billion). The company focuses on the design, research, development, manufacturing, and sale of these products.

Sunny Optical Technology has embraced significant growth, with a 32.0% increase in sales to CNY 18.86 billion for the first half of 2024, reflecting robust demand in the smartphone sector. This surge is underpinned by a strategic emphasis on R&D, where expenses are rigorously aligned with technological advancements and market needs, fostering innovation in optical solutions. The company's recent executive board enhancement aims to further strengthen its strategic direction and market penetration, promising continued upward trajectory in its financial and operational performance.

Tencent Holdings (SEHK:700)

Simply Wall St Growth Rating: ★★★★☆☆

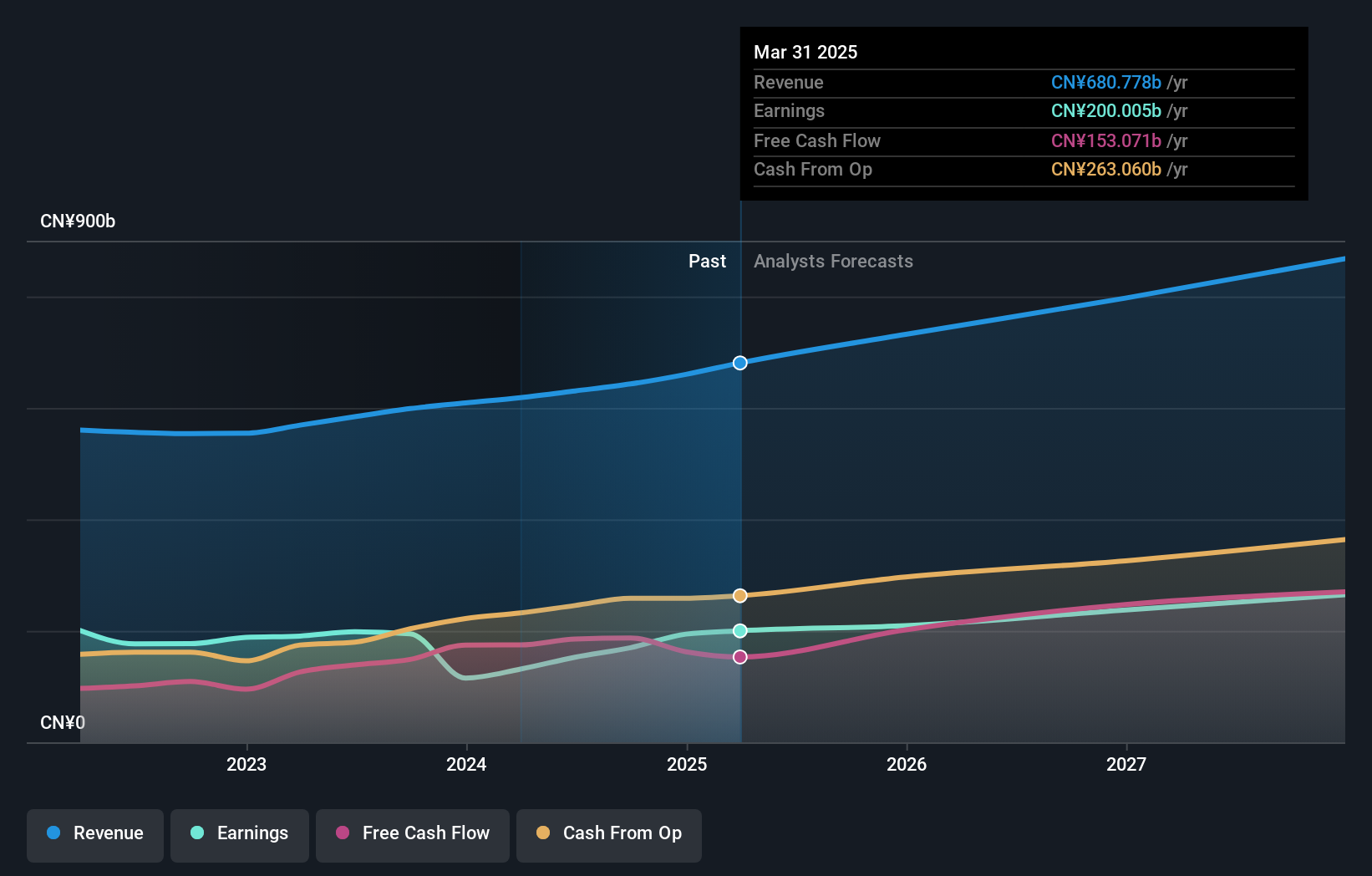

Overview: Tencent Holdings Limited, an investment holding company, provides value-added services (VAS), online advertising, fintech, and business services in China and internationally with a market cap of HK$4.09 trillion.

Operations: Tencent generates revenue primarily from value-added services (CN¥302.28 billion), fintech and business services (CN¥209.17 billion), and online advertising (CN¥111.89 billion). The company operates both in China and internationally, leveraging its diverse portfolio to drive growth across multiple sectors.

Tencent Holdings has demonstrated a robust financial performance in the first half of 2024, with revenues soaring to CNY 320.62 billion, an increase from the previous year's CNY 299.19 billion. This growth is complemented by a significant rise in net income, which more than doubled to CNY 89.52 billion due to strategic expansions and optimizations in its core operations. The company's commitment to innovation is evident from its R&D spending trends, aligning with an industry-wide push towards enhancing technological capabilities and services delivery. At the recent CITIC CLSA Investor’s Forum, Tencent highlighted these advancements and their positive impact on earnings per share, which have nearly doubled year-over-year, underscoring their effective strategy execution amid dynamic market conditions.

Where To Now?

- Click through to start exploring the rest of the 42 SEHK High Growth Tech and AI Stocks now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kuaishou Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1024

Kuaishou Technology

An investment holding company, provides live streaming, online marketing, and other services in the People’s Republic of China.

Outstanding track record with flawless balance sheet.