- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:700

Exploring 3 High Growth Tech Stocks In Hong Kong

Reviewed by Simply Wall St

As global markets react to China's robust stimulus measures, the Hong Kong market has seen a notable uptick, with the Hang Seng Index gaining 13% recently. This positive sentiment provides an opportune backdrop for exploring high-growth tech stocks in Hong Kong, where innovation and economic support can create promising investment opportunities.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.37% | 25.47% | ★★★★★☆ |

| MedSci Healthcare Holdings | 48.74% | 48.78% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 25.31% | 39.04% | ★★★★★☆ |

| Cowell e Holdings | 31.82% | 35.43% | ★★★★★★ |

| RemeGen | 26.30% | 52.19% | ★★★★★☆ |

| Akeso | 32.58% | 54.53% | ★★★★★★ |

| Biocytogen Pharmaceuticals (Beijing) | 21.53% | 109.17% | ★★★★★☆ |

| Innovent Biologics | 22.24% | 59.39% | ★★★★★☆ |

| Sichuan Kelun-Biotech Biopharmaceutical | 24.70% | 8.53% | ★★★★★☆ |

| Beijing Airdoc Technology | 37.47% | 93.35% | ★★★★★☆ |

Click here to see the full list of 46 stocks from our SEHK High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Kuaishou Technology (SEHK:1024)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kuaishou Technology, an investment holding company, offers live streaming, online marketing, and other services in the People’s Republic of China with a market cap of HK$236.48 billion.

Operations: Kuaishou Technology generates revenue primarily from domestic operations (CN¥117.32 billion) and a smaller portion from overseas markets (CN¥3.57 billion). The company's business model includes live streaming and online marketing services in China.

Kuaishou Technology, amid a robust earnings surge, reported a significant jump in Q2 2024 with sales hitting CNY 30.98 billion, up from CNY 27.74 billion year-over-year. This growth is underpinned by an impressive increase in net income to CNY 3.98 billion from CNY 1.48 billion, reflecting strong operational efficiency and market acceptance of their offerings like the Kling AI platform upgrades and new subscription models tailored for diverse user needs. These strategic moves not only enhance user engagement but also solidify Kuaishou's position in content creation and digital interaction landscapes, leveraging advanced AI capabilities to meet evolving consumer demands effectively.

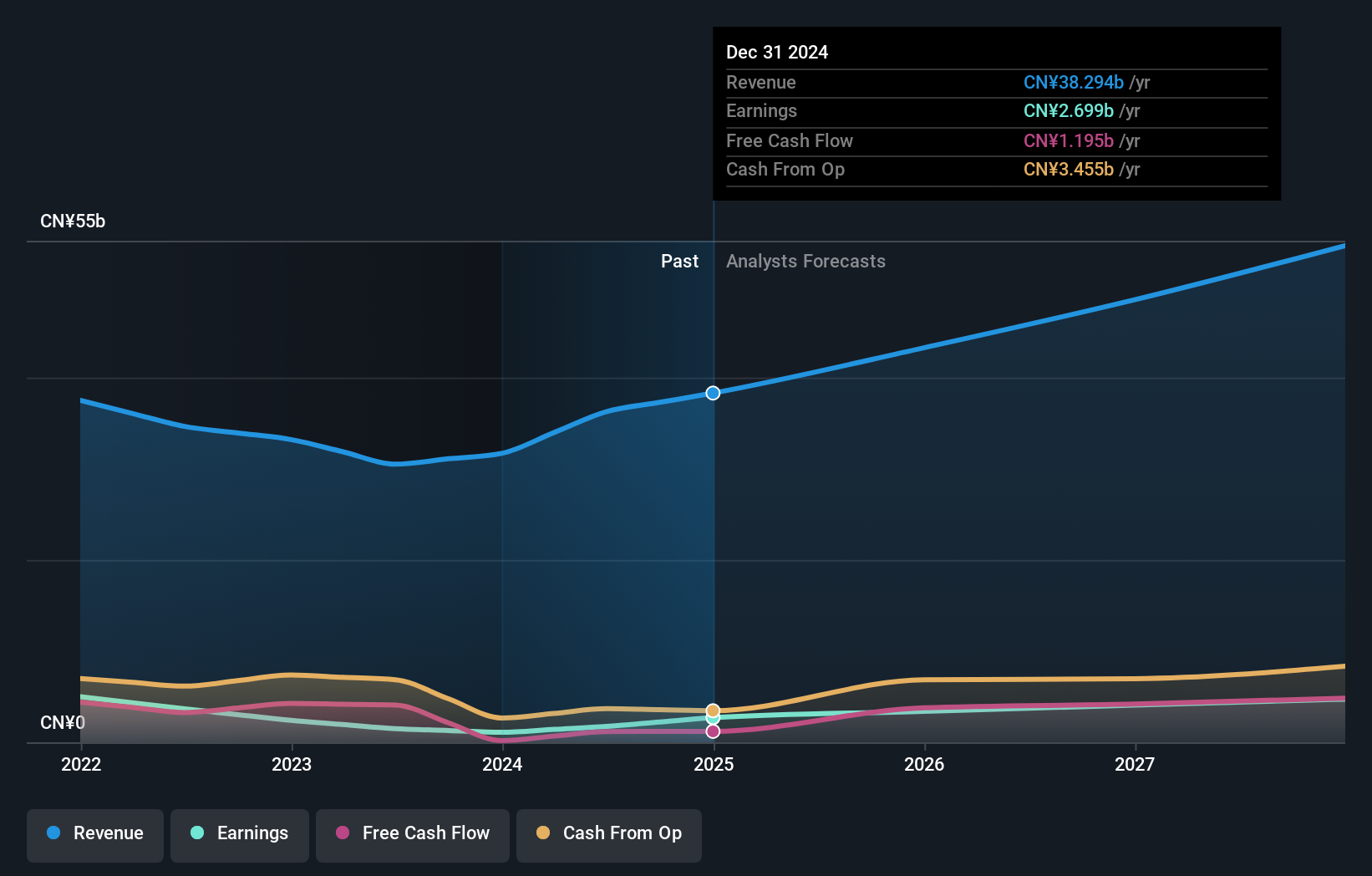

Sunny Optical Technology (Group) (SEHK:2382)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sunny Optical Technology (Group) Company Limited, with a market cap of HK$62.94 billion, specializes in the design, research, development, manufacturing, and sale of optical and optical-related products as well as scientific instruments.

Operations: Sunny Optical Technology (Group) Company Limited generates revenue primarily from three segments: Optical Components (CN¥12.32 billion), Optoelectronic Products (CN¥25.10 billion), and Optical Instruments (CN¥0.59 billion).

Sunny Optical Technology, a key figure in Hong Kong's tech scene, recently showcased robust growth with H1 2024 sales soaring to CNY 18.86 billion from CNY 14.28 billion the previous year, alongside net income more than doubling to CNY 1.08 billion. This surge is linked to strategic enhancements in their product mix and expansion in the smartphone market segment, reflecting a keen adaptation to market demands and technological trends. Notably, their commitment to innovation is underscored by R&D expenses which are crucial for sustaining their competitive edge and supporting projected annual earnings growth of 20.8%. Their recent executive board changes hint at a strengthened focus on strategic development, promising intriguing future prospects for the company within the high-tech industry landscape of Hong Kong.

- Dive into the specifics of Sunny Optical Technology (Group) here with our thorough health report.

Understand Sunny Optical Technology (Group)'s track record by examining our Past report.

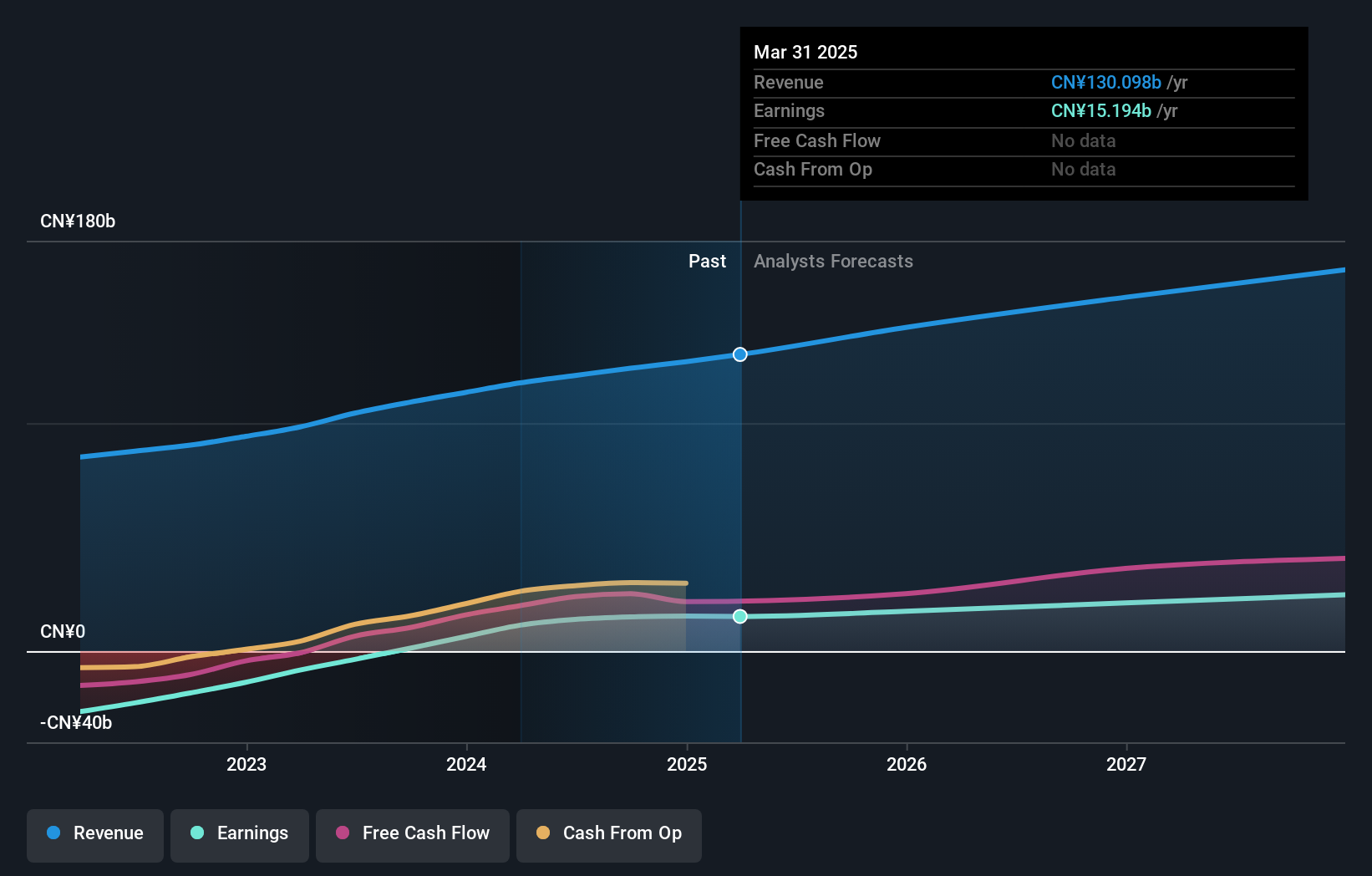

Tencent Holdings (SEHK:700)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tencent Holdings Limited, an investment holding company, provides a wide range of services including value-added services (VAS), online advertising, fintech, and business solutions both in China and globally, with a market cap of approximately HK$4.09 trillion.

Operations: Tencent Holdings Limited generates revenue primarily from value-added services (CN¥302.28 billion), fintech and business services (CN¥209.17 billion), and online advertising (CN¥111.89 billion). The company's diverse portfolio spans across multiple sectors, contributing to its substantial market presence both domestically and internationally.

Tencent Holdings has demonstrated a notable uptick in its financial performance, with second-quarter revenue climbing to CNY 161.12 billion, up from CNY 149.21 billion in the previous year. This growth is complemented by a substantial increase in net income, which nearly doubled to CNY 47.63 billion. The firm's commitment to innovation is evident from its R&D expenses, crucial for maintaining its competitive edge within the tech industry. Despite a challenging environment marked by a -23% earnings growth over the past year compared to the industry average of -22.8%, Tencent's projected annual profit growth of 12.8% outpaces the Hong Kong market forecast of 12.2%. These figures highlight Tencent’s resilience and potential for sustained growth amidst evolving market dynamics.

- Get an in-depth perspective on Tencent Holdings' performance by reading our health report here.

Examine Tencent Holdings' past performance report to understand how it has performed in the past.

Where To Now?

- Click this link to deep-dive into the 46 companies within our SEHK High Growth Tech and AI Stocks screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tencent Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:700

Tencent Holdings

An investment holding company, provides value-added services, marketing services, fintech, and business services in Mainland China and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives