These Return Metrics Don't Make Media Chinese International (HKG:685) Look Too Strong

If we're looking to avoid a business that is in decline, what are the trends that can warn us ahead of time? Typically, we'll see the trend of both return on capital employed (ROCE) declining and this usually coincides with a decreasing amount of capital employed. This reveals that the company isn't compounding shareholder wealth because returns are falling and its net asset base is shrinking. And from a first read, things don't look too good at Media Chinese International (HKG:685), so let's see why.

Understanding Return On Capital Employed (ROCE)

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. Analysts use this formula to calculate it for Media Chinese International:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.022 = US$3.4m ÷ (US$208m - US$55m) (Based on the trailing twelve months to September 2022).

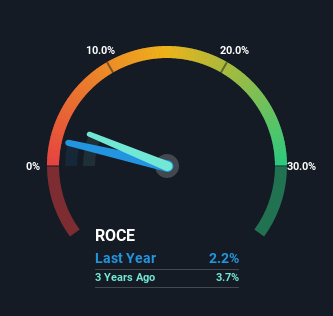

Therefore, Media Chinese International has an ROCE of 2.2%. Ultimately, that's a low return and it under-performs the Media industry average of 5.0%.

See our latest analysis for Media Chinese International

Above you can see how the current ROCE for Media Chinese International compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting going forward, you should check out our free report for Media Chinese International.

So How Is Media Chinese International's ROCE Trending?

In terms of Media Chinese International's historical ROCE trend, it isn't fantastic. The company used to generate 7.6% on its capital five years ago but it has since fallen noticeably. On top of that, the business is utilizing 43% less capital within its operations. The combination of lower ROCE and less capital employed can indicate that a business is likely to be facing some competitive headwinds or seeing an erosion to its moat. Typically businesses that exhibit these characteristics aren't the ones that tend to multiply over the long term, because statistically speaking, they've already gone through the growth phase of their life cycle.

The Bottom Line

In short, lower returns and decreasing amounts capital employed in the business doesn't fill us with confidence. It should come as no surprise then that the stock has fallen 63% over the last five years, so it looks like investors are recognizing these changes. Unless there is a shift to a more positive trajectory in these metrics, we would look elsewhere.

If you'd like to know about the risks facing Media Chinese International, we've discovered 3 warning signs that you should be aware of.

While Media Chinese International may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:685

Media Chinese International

An investment holding company, engages in the publishing, printing, and distributing of newspapers, magazines, books, and digital contents in Hong Kong, Taiwan, North America, Malaysia, and other Southeast Asian countries.

Fair value with mediocre balance sheet.

Market Insights

Community Narratives