Media Chinese International's (HKG:685) Stock Price Has Reduced 77% In The Past Five Years

We think intelligent long term investing is the way to go. But that doesn't mean long term investors can avoid big losses. To wit, the Media Chinese International Limited (HKG:685) share price managed to fall 77% over five long years. We certainly feel for shareholders who bought near the top. And some of the more recent buyers are probably worried, too, with the stock falling 32% in the last year. Furthermore, it's down 12% in about a quarter. That's not much fun for holders.

View our latest analysis for Media Chinese International

Media Chinese International wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last five years Media Chinese International saw its revenue shrink by 11% per year. That's definitely a weaker result than most pre-profit companies report. So it's not altogether surprising to see the share price down 12% per year in the same time period. This kind of price performance makes us very wary, especially when combined with falling revenue. Of course, the poor performance could mean the market has been too severe selling down. That can happen.

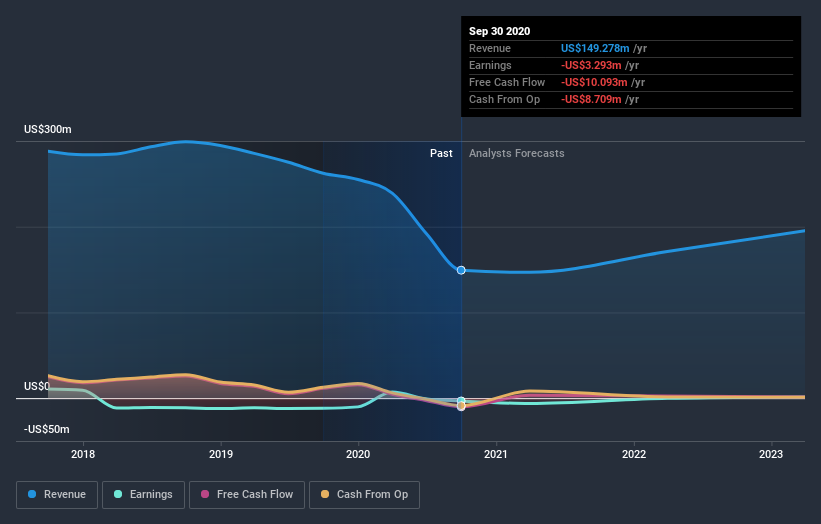

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So we recommend checking out this free report showing consensus forecasts

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Media Chinese International's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Its history of dividend payouts mean that Media Chinese International's TSR, which was a 70% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

Media Chinese International shareholders are down 30% for the year, but the market itself is up 22%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 11% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Media Chinese International better, we need to consider many other factors. Case in point: We've spotted 1 warning sign for Media Chinese International you should be aware of.

Media Chinese International is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you’re looking to trade Media Chinese International, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:685

Media Chinese International

An investment holding company, engages in the publishing, printing, and distributing of newspapers, magazines, books, and digital contents in Hong Kong, Taiwan, North America, Malaysia, and other Southeast Asian countries.

Fair value with mediocre balance sheet.

Market Insights

Community Narratives