Media Chinese International Limited (HKG:685) Stock Rockets 30% But Many Are Still Ignoring The Company

The Media Chinese International Limited (HKG:685) share price has done very well over the last month, posting an excellent gain of 30%. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

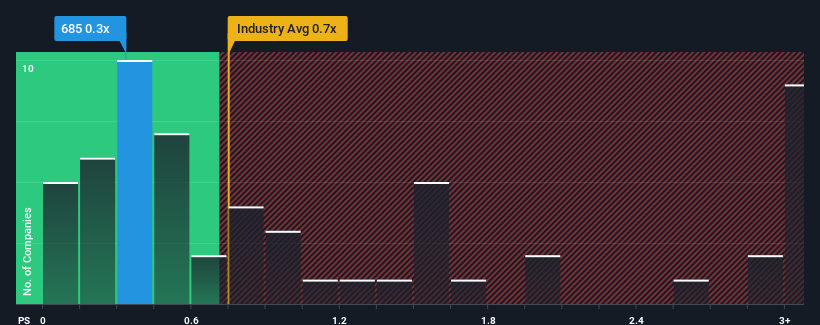

In spite of the firm bounce in price, it's still not a stretch to say that Media Chinese International's price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" compared to the Media industry in Hong Kong, where the median P/S ratio is around 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Media Chinese International

What Does Media Chinese International's P/S Mean For Shareholders?

Media Chinese International could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Media Chinese International.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Media Chinese International's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a worthy increase of 11%. The latest three year period has also seen a 27% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 30% as estimated by the lone analyst watching the company. That's shaping up to be materially higher than the 11% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Media Chinese International's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Media Chinese International appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Looking at Media Chinese International's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Media Chinese International (1 shouldn't be ignored!) that you should be aware of before investing here.

If you're unsure about the strength of Media Chinese International's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:685

Media Chinese International

An investment holding company, engages in the publishing, printing, and distributing of newspapers, magazines, books, and digital contents in Hong Kong, Taiwan, North America, Malaysia, and other Southeast Asian countries.

Fair value with mediocre balance sheet.

Market Insights

Community Narratives