As global markets navigate a landscape marked by cautious monetary policies and mixed economic signals, investors are increasingly turning their attention to Asia, where diverse economic conditions present both challenges and opportunities. Amidst these dynamics, dividend stocks in the region stand out as attractive options for those seeking income generation in uncertain times.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.27% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.76% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.94% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 4.06% | ★★★★★★ |

| NCD (TSE:4783) | 4.77% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.89% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.48% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.83% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.87% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.38% | ★★★★★★ |

Click here to see the full list of 1042 stocks from our Top Asian Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

SinoMedia Holding (SEHK:623)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SinoMedia Holding Limited is an investment holding company that offers TV advertisement, creative content production, and digital marketing services to advertisers and advertising agents in China and internationally, with a market cap of HK$965.64 million.

Operations: SinoMedia Holding Limited generates revenue primarily from its advertising segment, which amounts to CN¥462.77 million.

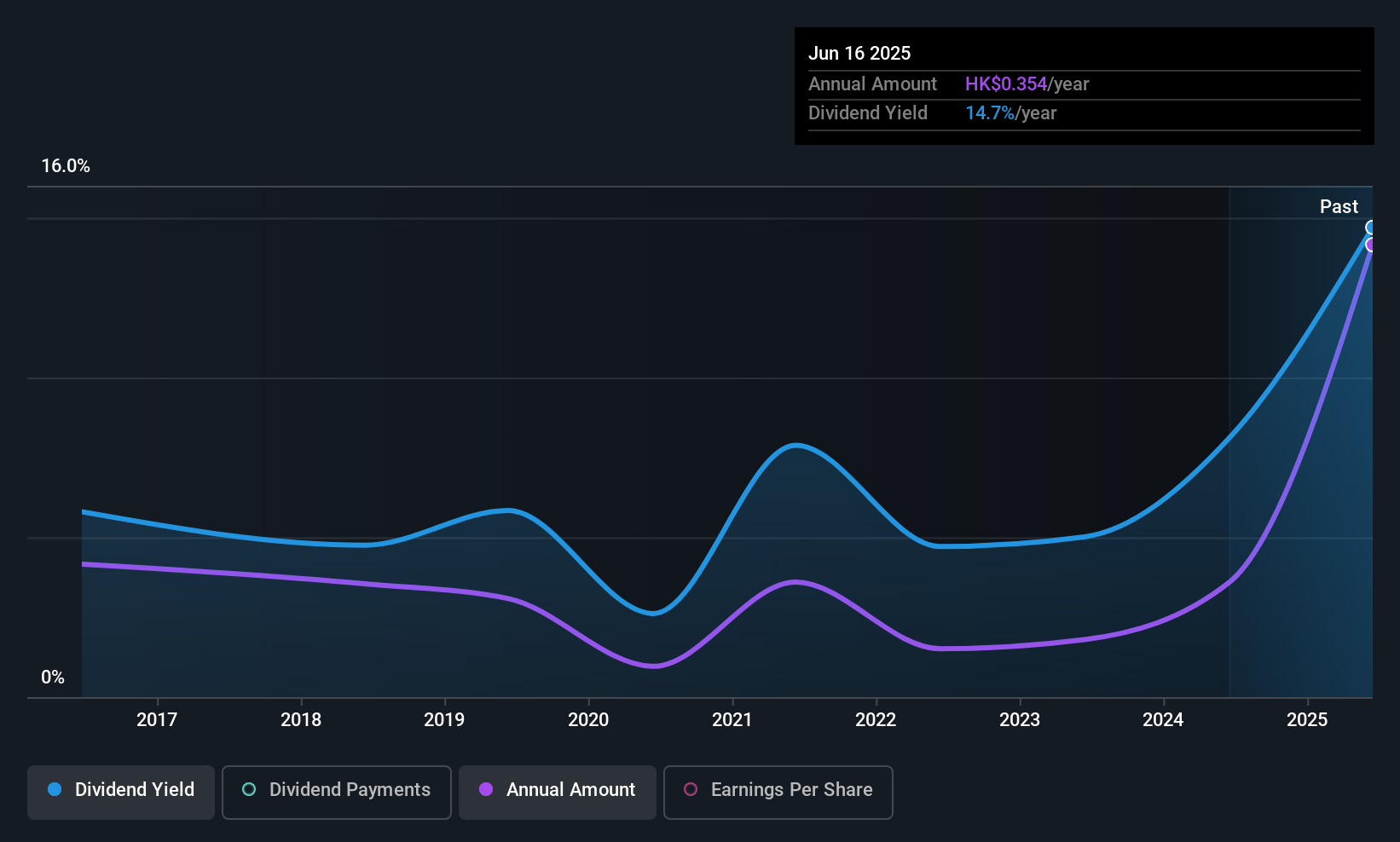

Dividend Yield: 17.3%

SinoMedia Holding's dividend yield of 17.26% ranks among the top 25% in Hong Kong, yet its sustainability is questionable due to a high cash payout ratio of 516%. Despite earnings growth of 30.7% over the past year and a low price-to-earnings ratio of 8x, dividends have been volatile and unreliable over the last decade. Recent earnings showed improved net income but declining sales, highlighting potential challenges for consistent dividend payouts.

- Delve into the full analysis dividend report here for a deeper understanding of SinoMedia Holding.

- The analysis detailed in our SinoMedia Holding valuation report hints at an inflated share price compared to its estimated value.

ITFOR (TSE:4743)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ITFOR Inc. offers IT solutions across various industries in Japan and has a market cap of ¥43.86 billion.

Operations: ITFOR Inc.'s revenue is derived from two main segments: Recurring, which contributes ¥9.10 billion, and System Development and Sales, accounting for ¥10.82 billion.

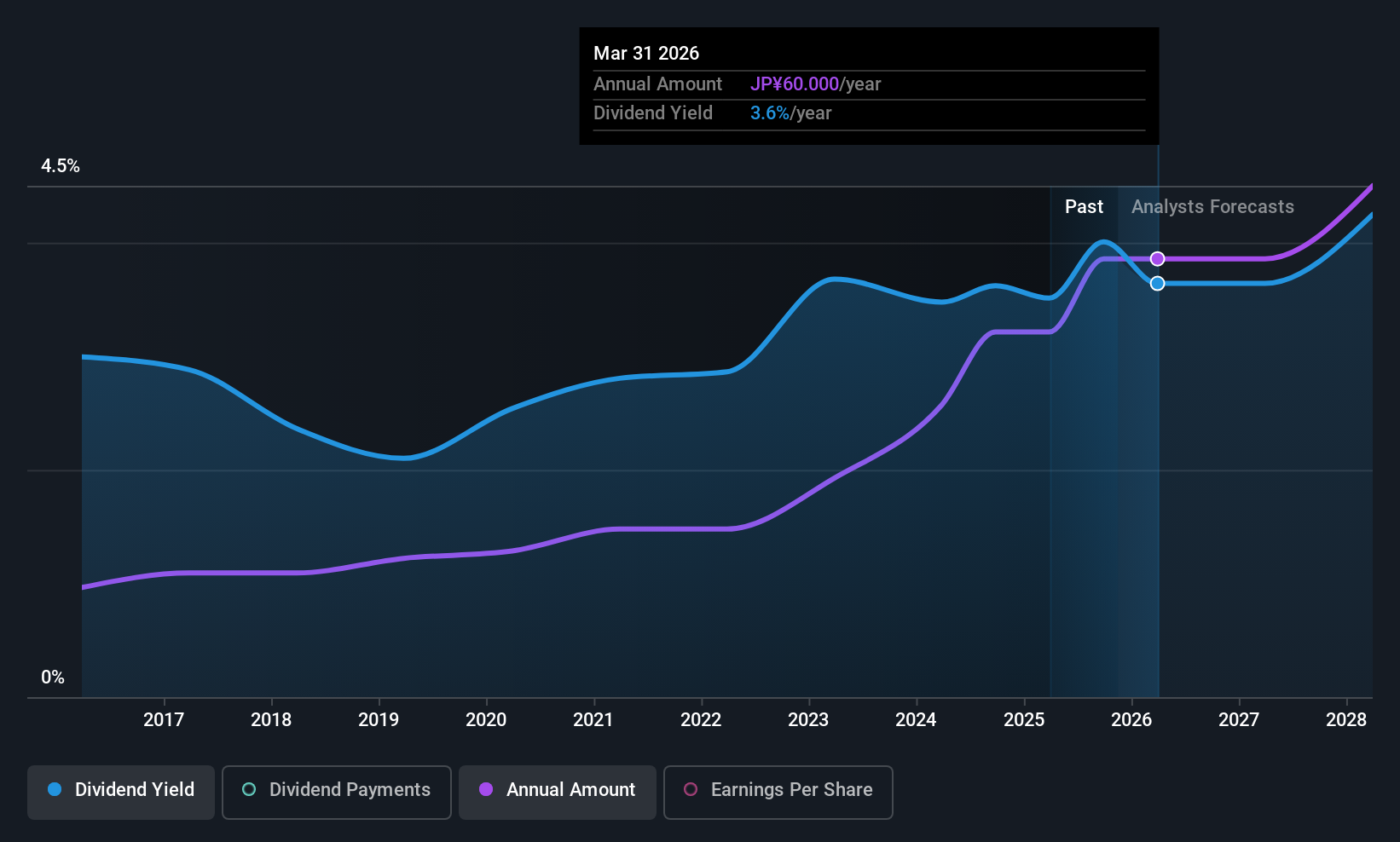

Dividend Yield: 3.6%

ITFOR offers a stable dividend yield of 3.61%, supported by a sustainable payout ratio of 49.3% from earnings and 73.6% from cash flows, ensuring reliability over the past decade. Although slightly below Japan's top dividend payers, its dividends have consistently grown without volatility. With a price-to-earnings ratio of 16.1x, ITFOR is valued attractively compared to industry peers, and its earnings are projected to grow annually by 8.38%, further bolstering future dividend prospects.

- Click here and access our complete dividend analysis report to understand the dynamics of ITFOR.

- Our valuation report here indicates ITFOR may be overvalued.

Okinawa Financial Group (TSE:7350)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Okinawa Financial Group, Inc. offers a range of financial services in Japan and has a market cap of ¥92.32 billion.

Operations: Okinawa Financial Group, Inc. generates revenue through its diverse financial services offerings in Japan.

Dividend Yield: 3.2%

Okinawa Financial Group provides a stable dividend yield of 3.24%, supported by a low payout ratio of 29.7%, indicating strong coverage by earnings. Over the past decade, dividends have been reliable and consistently growing, though they remain below Japan's top quartile for dividend payers. The stock trades at 13.4% below its estimated fair value, offering potential upside. Recent board discussions hint at possible revisions to earnings forecasts and an increase in year-end dividends, enhancing its appeal to income-focused investors.

- Take a closer look at Okinawa Financial Group's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Okinawa Financial Group shares in the market.

Summing It All Up

- Unlock more gems! Our Top Asian Dividend Stocks screener has unearthed 1039 more companies for you to explore.Click here to unveil our expertly curated list of 1042 Top Asian Dividend Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7350

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives