- Hong Kong

- /

- Medical Equipment

- /

- SEHK:2185

Navigating Penny Stocks: Shanghai Bio-heart Biological Technology Among 3 Noteworthy Picks

Reviewed by Simply Wall St

As global markets react to political shifts and economic indicators, major indexes like the S&P 500 have reached new highs, buoyed by optimism around trade policies and AI investments. In such a climate, investors often look for opportunities that balance risk with potential reward. Penny stocks, though an older term, continue to intrigue due to their potential for growth when backed by solid financials. This article will highlight several penny stocks that stand out for their financial strength and promise in today's market landscape.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.525 | MYR2.61B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.885 | £491.62M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.75 | £182.42M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.75 | HK$43.11B | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.93 | £148.85M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR292.11M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.72 | MYR425.99M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.06 | £780M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.11 | HK$704.62M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.78 | A$139.45M | ★★★★☆☆ |

Click here to see the full list of 5,723 stocks from our Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Shanghai Bio-heart Biological Technology (SEHK:2185)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Shanghai Bio-heart Biological Technology Co., Ltd. (SEHK:2185) is a company focused on developing and commercializing innovative cardiovascular medical devices, with a market cap of HK$438.15 million.

Operations: Shanghai Bio-heart Biological Technology Co., Ltd. has not reported any specific revenue segments.

Market Cap: HK$438.15M

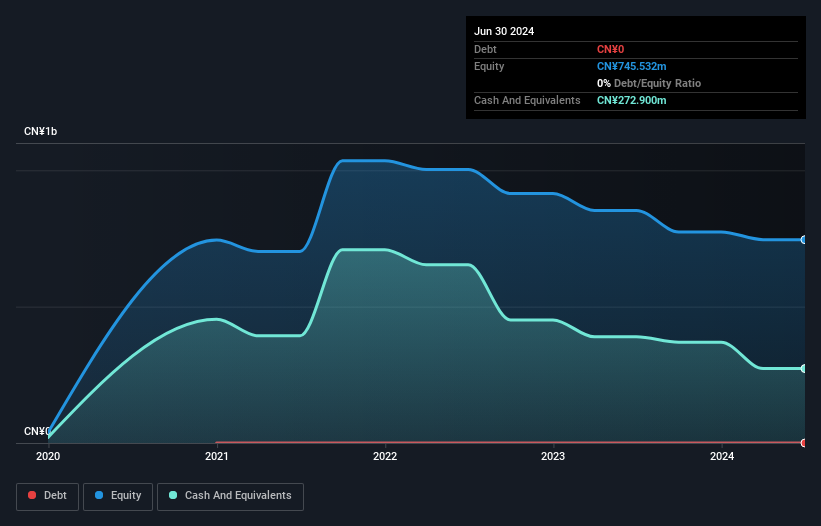

Shanghai Bio-heart Biological Technology Co., Ltd., with a market cap of HK$438.15 million, is currently pre-revenue and unprofitable but has managed to reduce its losses by 16.1% annually over the past five years. The company's short-term assets significantly exceed both its short and long-term liabilities, indicating strong liquidity. It remains debt-free and has a cash runway extending beyond two years if current spending trends continue. Recent strategic moves include amendments to company bylaws and increased capital contributions in a partnership agreement, while promising results from the Iberis-HTN trial highlight potential advancements in their cardiovascular device offerings.

- Click here and access our complete financial health analysis report to understand the dynamics of Shanghai Bio-heart Biological Technology.

- Examine Shanghai Bio-heart Biological Technology's past performance report to understand how it has performed in prior years.

Digital Domain Holdings (SEHK:547)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Digital Domain Holdings Limited is an investment holding company involved in the media entertainment and trading business across various countries including China, Hong Kong, the United States, Canada, the United Kingdom, and India with a market cap of HK$3.99 billion.

Operations: The company generates revenue of HK$503.44 million from its media entertainment segment.

Market Cap: HK$3.99B

Digital Domain Holdings Limited, with a market cap of HK$3.99 billion, generates HK$503.44 million in revenue from its media entertainment segment but remains unprofitable. The company has experienced management and board teams, with average tenures of 9.9 and 3.6 years respectively, providing stability amid recent executive changes including the appointment of Mr. Wong Cheung Lok as CEO. Despite an increased debt-to-equity ratio over five years, its net debt to equity stands at a satisfactory 17.2%. Short-term assets exceed liabilities by a significant margin, yet the cash runway is limited to less than a year if growth continues at historical rates.

- Take a closer look at Digital Domain Holdings' potential here in our financial health report.

- Assess Digital Domain Holdings' previous results with our detailed historical performance reports.

Kindstar Globalgene Technology (SEHK:9960)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Kindstar Globalgene Technology, Inc. is an investment holding company offering clinical testing services in the People's Republic of China, with a market cap of approximately HK$1.15 billion.

Operations: The company's revenue segments include Hematology Testing (CN¥591.37 million), Neurology Testing (CN¥96.80 million), Maternity-Related Testing (CN¥54.42 million), Routine Testing (CN¥49.78 million), Genetic Disease and Rare Diseases (CN¥47.27 million), Infectious Diseases (CN¥43.73 million), Oncology Testing (CN¥17.89 million), and Scientific research services and CRO (CN¥28.06 million).

Market Cap: HK$1.15B

Kindstar Globalgene Technology, Inc., with a market cap of HK$1.15 billion, shows financial resilience as short-term assets (CN¥2.3 billion) surpass both short-term (CN¥813.3 million) and long-term liabilities (CN¥99.3 million). Despite experiencing negative earnings growth last year (-83.8%), the company has become profitable over five years, growing earnings by 64.8% annually on average. However, current profit margins have declined to 1% from 4.7% the previous year, and operating cash flow remains negative, indicating challenges in covering debt through cash generation despite having more cash than total debt. The management team averages 3.9 years of experience, providing some stability amidst these financial dynamics.

- Jump into the full analysis health report here for a deeper understanding of Kindstar Globalgene Technology.

- Learn about Kindstar Globalgene Technology's future growth trajectory here.

Summing It All Up

- Get an in-depth perspective on all 5,723 Penny Stocks by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2185

Shanghai Bio-heart Biological Technology

Shanghai Bio-heart Biological Technology Co., Ltd.

Excellent balance sheet low.

Market Insights

Community Narratives