Undervalued Opportunities: Penny Stocks To Watch In October 2024

Reviewed by Simply Wall St

As global markets grapple with rising U.S. Treasury yields, U.S. stocks have felt the pressure, with large-cap stocks faring better than their small-cap counterparts and growth stocks outperforming value ones. In such a climate, investors often seek out opportunities in less traditional areas of the market. Penny stocks, though an outdated term, still represent a segment where smaller or newer companies can offer surprising value when backed by strong financial health. This article explores three penny stocks that exhibit solid financial foundations and potential for long-term growth amidst current market conditions.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.57 | MYR2.83B | ★★★★★★ |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.78 | HK$495.14M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.71 | MYR122.98M | ★★★★★★ |

| Zhejiang Giuseppe Garment (SZSE:002687) | CN¥4.38 | CN¥2.15B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.765 | £473.73M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.905 | MYR300.41M | ★★★★★★ |

| Seafco (SET:SEAFCO) | THB2.36 | THB1.88B | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.12 | £426.67M | ★★★★☆☆ |

| Embark Early Education (ASX:EVO) | A$0.785 | A$144.03M | ★★★★☆☆ |

Click here to see the full list of 5,815 stocks from our Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Boyaa Interactive International (SEHK:434)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Boyaa Interactive International Limited is an investment holding company that develops and operates online card and board games in the People's Republic of China and internationally, with a market cap of HK$1.30 billion.

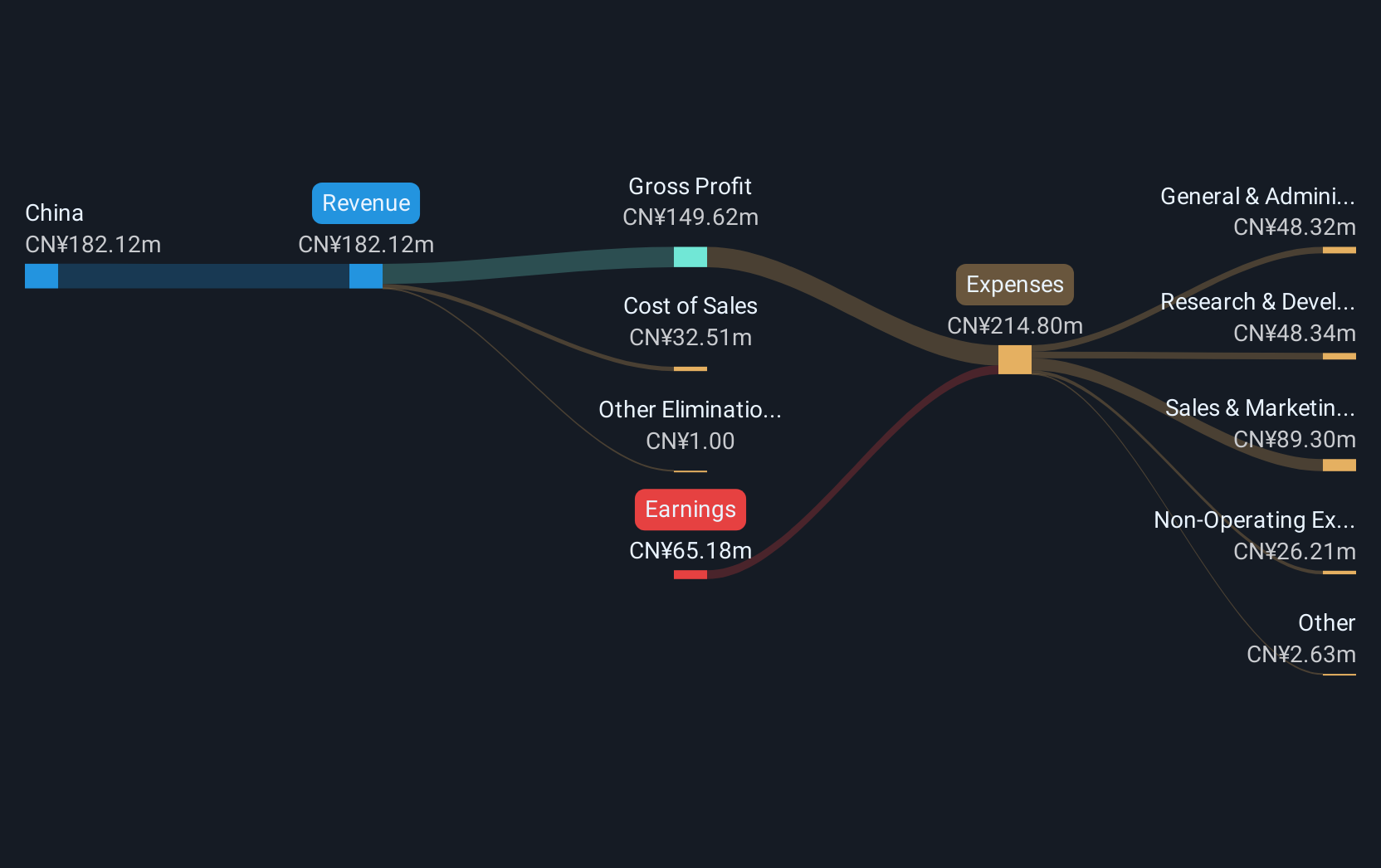

Operations: The company generates revenue primarily from the PRC, including Hong Kong, amounting to CN¥413.66 million.

Market Cap: HK$1.3B

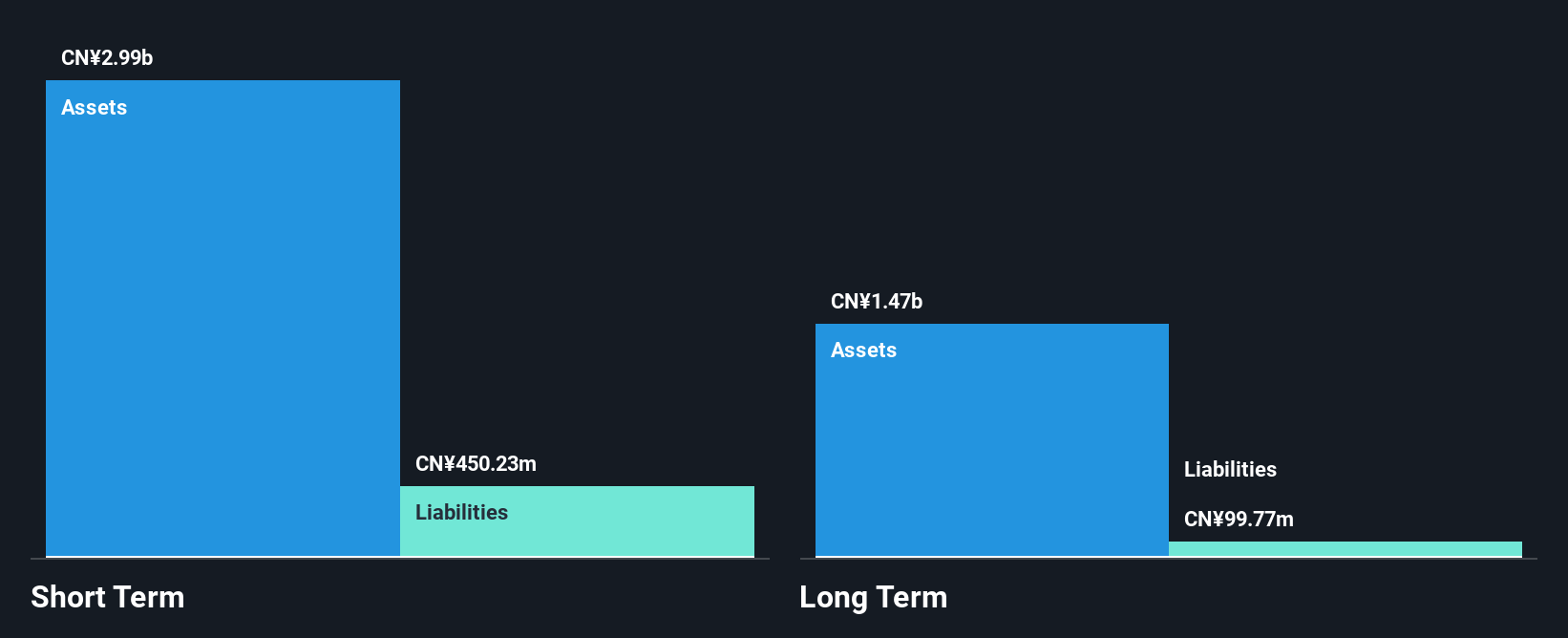

Boyaa Interactive International has demonstrated significant earnings growth, with a 258.6% increase over the past year, far outpacing the entertainment industry average. Despite this impressive growth, its return on equity remains low at 18.6%. The company is debt-free and benefits from strong short-term asset coverage of both its long-term and short-term liabilities, which enhances financial stability. Recent earnings reports indicate a shift from net income to a net loss in the second quarter of 2024; however, for the first half of 2024, net income increased significantly due to gains in digital assets and reduced financial asset devaluation impacts.

- Click here to discover the nuances of Boyaa Interactive International with our detailed analytical financial health report.

- Explore historical data to track Boyaa Interactive International's performance over time in our past results report.

Dasheng Times Cultural Investment (SHSE:600892)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Dasheng Times Cultural Investment Co., Ltd. operates in the cultural investment sector and has a market cap of CN¥2.72 billion.

Operations: The company generates its revenue primarily from the Chinese market, amounting to CN¥197.62 million.

Market Cap: CN¥2.72B

Dasheng Times Cultural Investment faces challenges as it reported a net loss of CN¥15.48 million for the nine months ending September 30, 2024, reversing from a net income of CN¥10.06 million the previous year. Sales dropped to CN¥115.04 million from CN¥164.51 million, indicating revenue pressures in its primary Chinese market. Despite reducing its debt-to-equity ratio significantly over five years and having more cash than total debt, the company remains unprofitable with negative return on equity at -28.25%. Short-term liabilities exceed short-term assets slightly, though long-term liabilities are well-covered by current assets.

- Unlock comprehensive insights into our analysis of Dasheng Times Cultural Investment stock in this financial health report.

- Learn about Dasheng Times Cultural Investment's historical performance here.

Zhejiang Jihua Group (SHSE:603980)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Zhejiang Jihua Group Co., Ltd. operates in the dyestuff industry with a market capitalization of approximately CN¥2.92 billion.

Operations: Zhejiang Jihua Group Co., Ltd. does not report specific revenue segments.

Market Cap: CN¥2.92B

Zhejiang Jihua Group Co., Ltd. reported a net income of CN¥128.2 million for the nine months ending September 30, 2024, recovering from a net loss of CN¥61.91 million the previous year, with sales declining to CN¥1,158.86 million from CN¥1,279.02 million. The company's debt is well-covered by operating cash flow and it holds more cash than its total debt, indicating financial stability despite increased debt levels over five years. Shareholder dilution has not been significant recently and short-term assets exceed both short- and long-term liabilities comfortably, suggesting solid liquidity management amidst ongoing profitability challenges in the dyestuff industry.

- Click here and access our complete financial health analysis report to understand the dynamics of Zhejiang Jihua Group.

- Gain insights into Zhejiang Jihua Group's past trends and performance with our report on the company's historical track record.

Make It Happen

- Gain an insight into the universe of 5,815 Penny Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Jihua Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603980

Adequate balance sheet low.

Market Insights

Community Narratives