- Hong Kong

- /

- Entertainment

- /

- SEHK:391

We Take A Look At Why Mei Ah Entertainment Group Limited's (HKG:391) CEO Has Earned Their Pay Packet

Key Insights

- Mei Ah Entertainment Group to hold its Annual General Meeting on 27th of September

- Total pay for CEO Tang Yuk Li includes HK$1.20m salary

- The overall pay is comparable to the industry average

- Mei Ah Entertainment Group's total shareholder return over the past three years was 39% while its EPS grew by 21% over the past three years

We have been pretty impressed with the performance at Mei Ah Entertainment Group Limited (HKG:391) recently and CEO Tang Yuk Li deserves a mention for their role in it. Shareholders will have this at the front of their minds in the upcoming AGM on 27th of September. This would also be a chance for them to hear the board review the financial results, discuss future company strategy and vote on any resolutions such as executive remuneration. Here is our take on why we think CEO compensation is not extravagant.

View our latest analysis for Mei Ah Entertainment Group

Comparing Mei Ah Entertainment Group Limited's CEO Compensation With The Industry

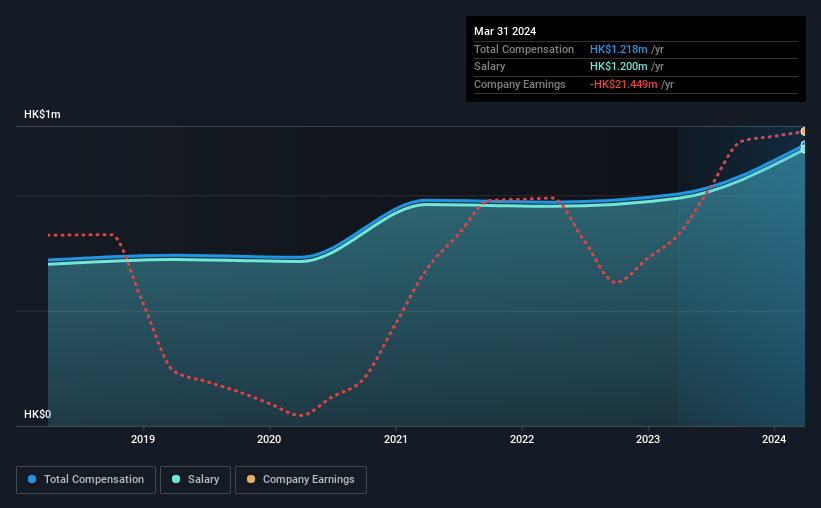

According to our data, Mei Ah Entertainment Group Limited has a market capitalization of HK$817m, and paid its CEO total annual compensation worth HK$1.2m over the year to March 2024. That's a notable increase of 21% on last year. In particular, the salary of HK$1.20m, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the Hong Kong Entertainment industry with market capitalizations under HK$1.6b, the reported median total CEO compensation was HK$1.4m. This suggests that Mei Ah Entertainment Group remunerates its CEO largely in line with the industry average.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | HK$1.2m | HK$987k | 99% |

| Other | HK$18k | HK$18k | 1% |

| Total Compensation | HK$1.2m | HK$1.0m | 100% |

Talking in terms of the industry, salary represented approximately 91% of total compensation out of all the companies we analyzed, while other remuneration made up 9% of the pie. Mei Ah Entertainment Group is focused on going down a more traditional approach and is paying a higher portion of compensation through salary, as compared to non-salary benefits. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Mei Ah Entertainment Group Limited's Growth

Mei Ah Entertainment Group Limited has seen its earnings per share (EPS) increase by 21% a year over the past three years. In the last year, its revenue is up 56%.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's great to see that revenue growth is strong, too. These metrics suggest the business is growing strongly. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Mei Ah Entertainment Group Limited Been A Good Investment?

We think that the total shareholder return of 39%, over three years, would leave most Mei Ah Entertainment Group Limited shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

Tang Yuk receives almost all of their compensation through a salary. Given the improved performance, shareholders may be more forgiving of CEO compensation in the upcoming AGM. In saying that, some shareholders may feel that the more important issues to be addressed may be how the management plans to steer the company towards sustainable profitability in the future.

Shareholders may want to check for free if Mei Ah Entertainment Group insiders are buying or selling shares.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:391

Mei Ah Entertainment Group

An investment holding company, engages in channel operation business primarily in Hong Kong, Mainland China, and Taiwan.

Mediocre balance sheet and overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.