- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:2018

High Growth Tech Stocks In Hong Kong Showcasing Promising Potential

Reviewed by Simply Wall St

As global markets face pressures from rising U.S. Treasury yields and mixed economic signals, Hong Kong's tech sector remains a focal point of interest for investors seeking high growth potential amidst broader market fluctuations. In this environment, identifying strong stocks often involves looking for companies with robust innovation capabilities, solid financial health, and the ability to adapt to changing economic landscapes.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| MedSci Healthcare Holdings | 48.74% | 48.78% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 23.28% | 38.76% | ★★★★★☆ |

| Innovent Biologics | 21.96% | 59.01% | ★★★★★☆ |

| RemeGen | 26.23% | 52.03% | ★★★★★☆ |

| Cowell e Holdings | 31.68% | 35.44% | ★★★★★★ |

| Akeso | 33.50% | 53.28% | ★★★★★★ |

| Qingci Games | 54.54% | 168.74% | ★★★★★☆ |

| Biocytogen Pharmaceuticals (Beijing) | 21.53% | 109.17% | ★★★★★☆ |

| Beijing Airdoc Technology | 37.47% | 93.35% | ★★★★★☆ |

| Sichuan Kelun-Biotech Biopharmaceutical | 24.61% | 7.62% | ★★★★★☆ |

Click here to see the full list of 43 stocks from our SEHK High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

AAC Technologies Holdings (SEHK:2018)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AAC Technologies Holdings Inc. is an investment holding company that offers solutions for smart devices across various regions including Mainland China, Hong Kong, Taiwan, other Asian countries, the United States, and Europe, with a market capitalization of HK$36.91 billion.

Operations: AAC Technologies Holdings generates revenue primarily from its acoustics and electromagnetic drives and precision mechanics segments, contributing CN¥7.64 billion and CN¥8.28 billion, respectively. The company also earns from optics products and sensor and semiconductor products.

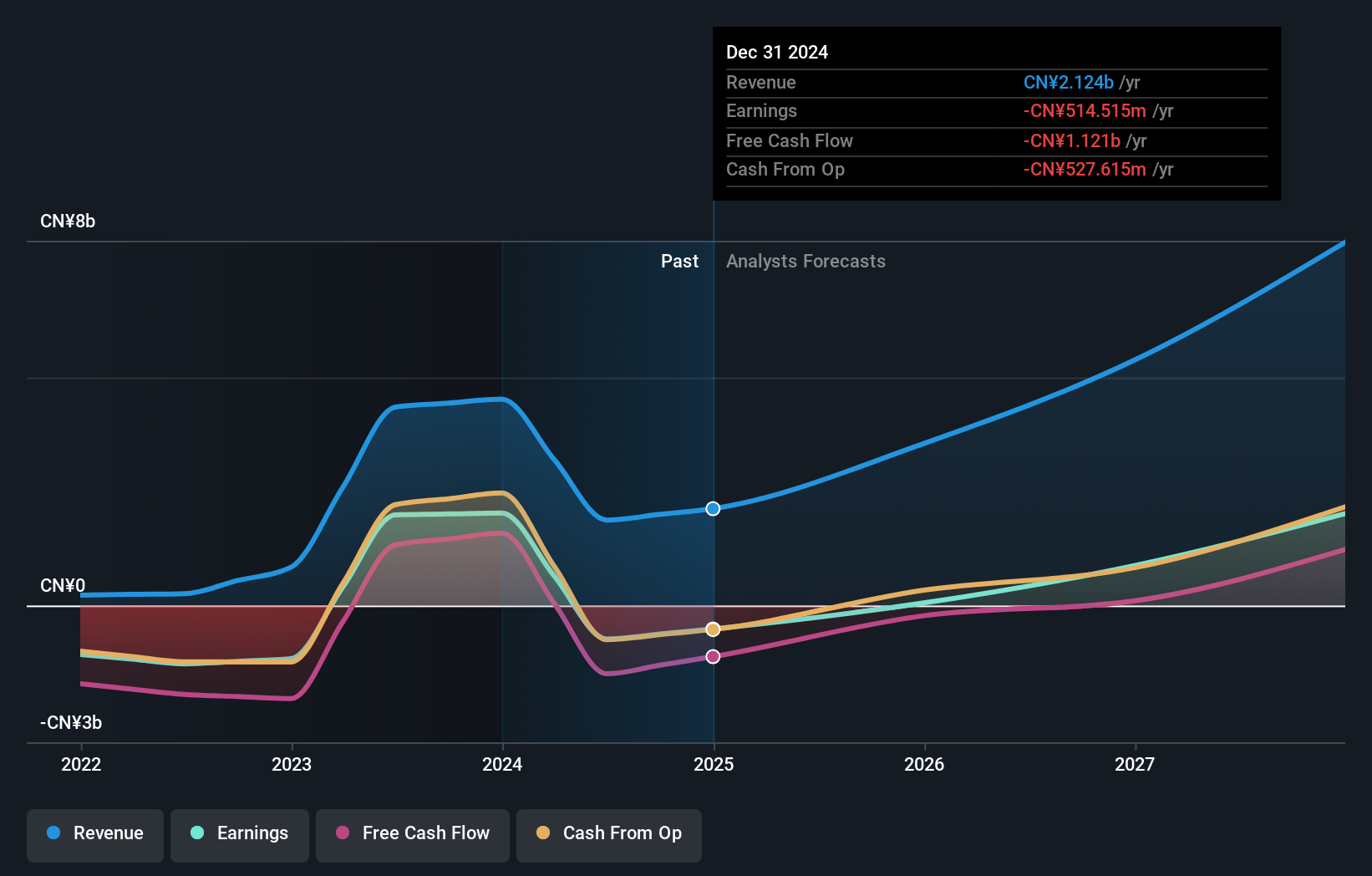

AAC Technologies Holdings has demonstrated robust financial performance, with sales soaring to CNY 11.25 billion in the first half of 2024, a significant rise from CNY 9.22 billion the previous year. This growth is supported by an impressive net income increase to CNY 537 million from CNY 150 million, reflecting strong operational efficiency and market demand. The company's commitment to innovation is evident in its R&D spending trends, consistently aligning with revenue growth and underpinning future technological advancements. With recent strategic moves like relocating their principal business office and participating in major industry conferences, AAC Technologies is actively enhancing its business footprint and staying relevant in the competitive tech landscape of Hong Kong.

Kingsoft (SEHK:3888)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kingsoft Corporation Limited operates in the entertainment and office software and services sectors across Mainland China, Hong Kong, and internationally, with a market capitalization of approximately HK$36.42 billion.

Operations: Kingsoft Corporation Limited generates revenue primarily from two segments: office software and services, which accounted for CN¥4.80 billion, and entertainment software, contributing CN¥4.18 billion. The company operates in Mainland China, Hong Kong, and internationally.

Kingsoft's recent performance underscores its potential in the Hong Kong tech sector, with a notable revenue increase to CNY 4.61 billion in the first half of 2024, up from CNY 4.16 billion year-over-year. This growth is complemented by a significant surge in net income to CNY 677.92 million, driven by effective strategies and market adaptation. The company's investment in innovation is highlighted by its R&D expenses which align closely with these financial metrics, ensuring sustained development and competitiveness in evolving tech landscapes. Additionally, Kingsoft has actively managed its capital through share repurchases totaling HKD 592.96 million since early 2024, reflecting confidence in its operational stability and future prospects.

- Click to explore a detailed breakdown of our findings in Kingsoft's health report.

Evaluate Kingsoft's historical performance by accessing our past performance report.

Akeso (SEHK:9926)

Simply Wall St Growth Rating: ★★★★★★

Overview: Akeso, Inc. is a biopharmaceutical company engaged in the research, development, manufacturing, and commercialization of antibody drugs with a market cap of HK$62.38 billion.

Operations: The company focuses on the research, development, production, and sale of biopharmaceutical products, generating CN¥1.87 billion in revenue from these activities.

Akeso's recent follow-on equity offering, raising HKD 1.94 billion, underscores its strategic financial bolstering amidst significant clinical advancements. The firm's R&D dedication is evident with a robust 33.5% revenue growth forecast, attributed to innovations like cadonilimab for cervical cancer—showing a promising 53.3% increase in earnings potential per year. This aligns with their aggressive development and commercialization strategy across oncology and non-oncology sectors, marking Akeso as a dynamic contender in Hong Kong's high-tech biopharma landscape despite the broader market challenges.

- Unlock comprehensive insights into our analysis of Akeso stock in this health report.

Gain insights into Akeso's past trends and performance with our Past report.

Taking Advantage

- Embark on your investment journey to our 43 SEHK High Growth Tech and AI Stocks selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2018

AAC Technologies Holdings

An investment holding company, provides solutions for smart devices in Mainland China, Hong Kong Special Administrative Region of the People’s Republic of China, Taiwan, other Asian countries, the United States, and Europe.

Excellent balance sheet with reasonable growth potential.