- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:1415

High Growth Tech Stocks in Asia for June 2025

Reviewed by Simply Wall St

As global markets experience a mix of economic signals, with the U.S. labor market showing resilience and China's manufacturing sector facing challenges, Asian tech stocks are drawing attention for their potential in an evolving landscape. In this dynamic environment, identifying high-growth tech stocks involves looking for companies that demonstrate strong innovation capabilities and adaptability to shifting market trends, particularly in sectors like artificial intelligence and digital services.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 29.68% | 30.37% | ★★★★★★ |

| Eoptolink Technology | 31.19% | 30.90% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Fositek | 26.71% | 33.90% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.44% | 23.48% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.31% | 28.63% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| PharmaResearch | 24.40% | 25.85% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| JNTC | 54.24% | 87.93% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

Cowell e Holdings (SEHK:1415)

Simply Wall St Growth Rating: ★★★★★★

Overview: Cowell e Holdings Inc. is an investment holding company involved in designing, developing, manufacturing, and selling modules and system integration products for smartphones, multimedia tablets, and other mobile devices with a market cap of HK$21.05 billion.

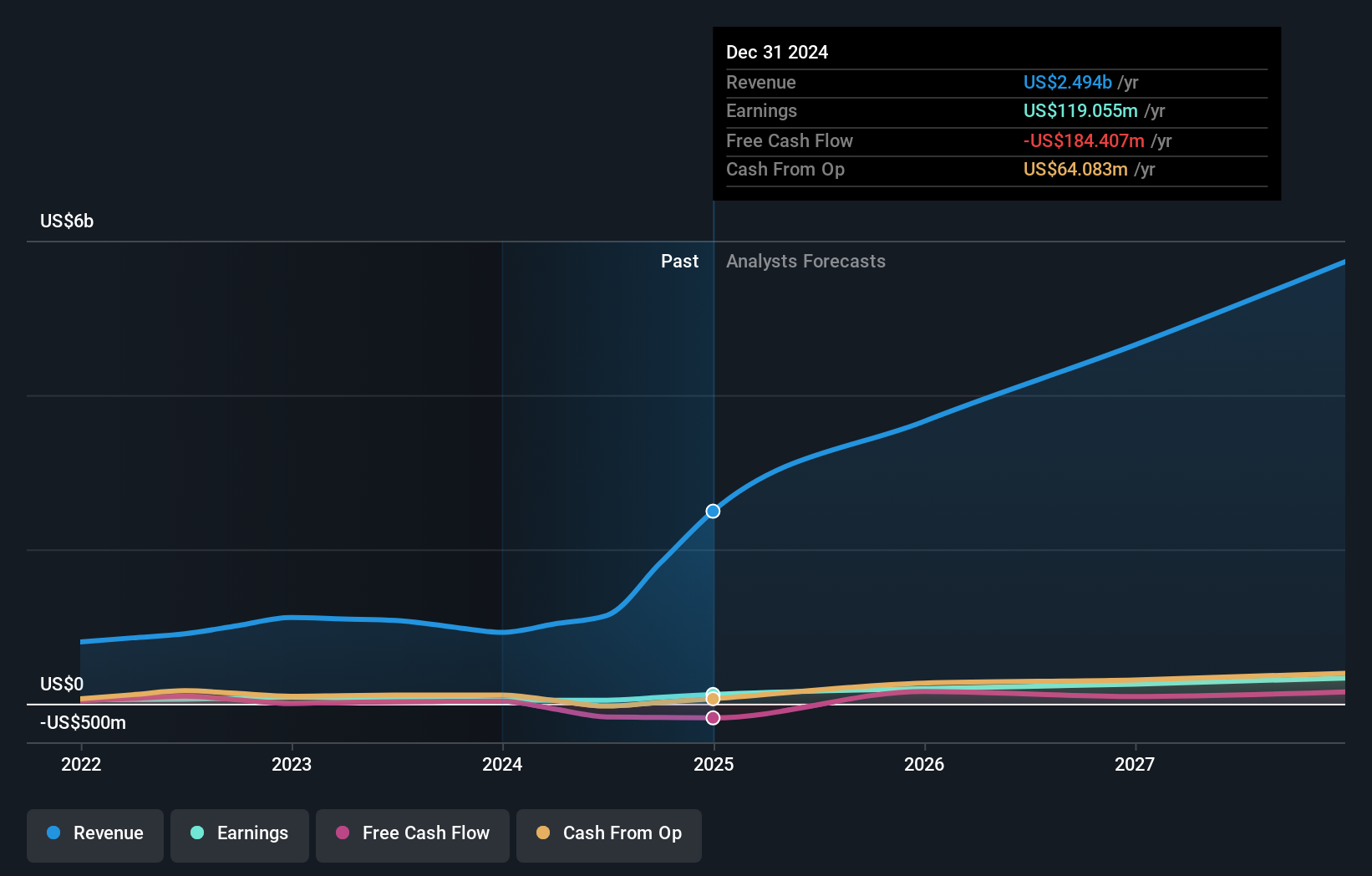

Operations: Cowell e Holdings generates revenue primarily from its photographic equipment and supplies segment, amounting to $2.49 billion. The company focuses on modules and system integration products for mobile devices.

Cowell e Holdings has demonstrated robust growth, with a notable 155.5% increase in earnings over the past year, significantly outpacing the electronic industry's average of 17.1%. This surge is supported by an aggressive R&D investment strategy, aligning with a broader industry trend where tech firms intensify innovation to stay competitive. The company's recent annual general meeting highlighted strategic initiatives like share repurchases and executive re-elections, positioning it well for sustained growth amidst volatile market conditions. With revenues and earnings both expected to grow at annual rates of 20.2% and 24.6% respectively, Cowell e Holdings is navigating its future with a clear focus on expanding its technological edge and market share.

- Click here to discover the nuances of Cowell e Holdings with our detailed analytical health report.

Understand Cowell e Holdings' track record by examining our Past report.

Everest Medicines (SEHK:1952)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Everest Medicines Limited is a biopharmaceutical company focused on discovering, licensing, developing, and commercializing therapies and vaccines for critical unmet medical needs in Greater China and other Asia Pacific markets, with a market cap of approximately HK$17.70 billion.

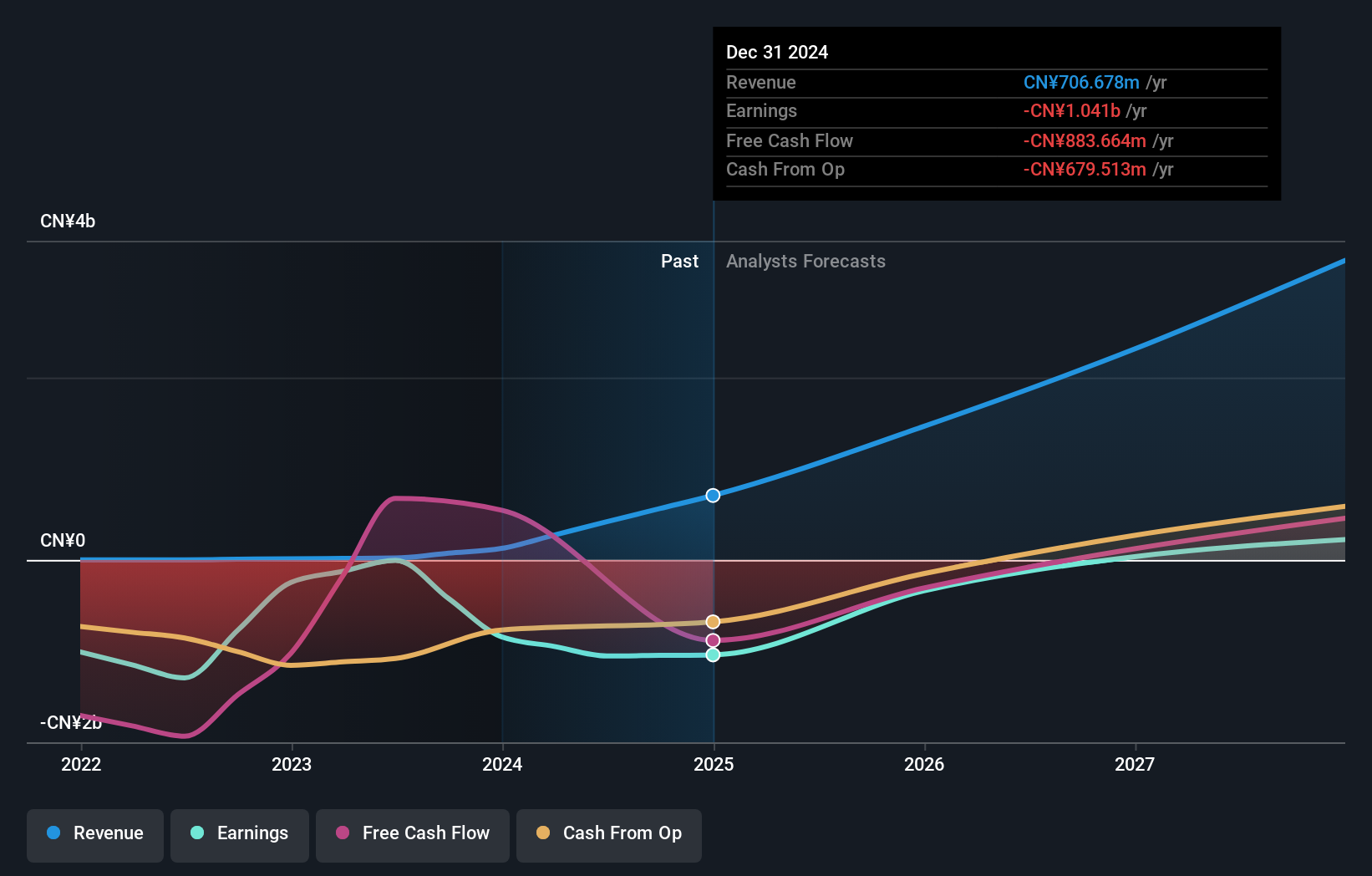

Operations: The company's primary revenue stream is from its pharmaceuticals segment, generating CN¥706.68 million. Everest Medicines Limited focuses on addressing unmet medical needs in Greater China and Asia Pacific regions through its biopharmaceutical offerings.

Everest Medicines is navigating a transformative phase with significant strides in biotechnology, particularly in the treatment of renal diseases. Recent approval of NEFECON by China's NMPA, marking it as the first etiological treatment for IgAN, underscores its pioneering role in addressing unmet medical needs. The company reported a robust revenue growth to CNY 706.68 million from CNY 125.93 million year-over-year, despite an increased net loss to CNY 1,041.38 million from CNY 844.46 million, reflecting substantial investments in R&D and clinical trials essential for future innovations and market expansion. These developments suggest Everest Medicines is poised to influence significant advancements in nephrology therapeutics across Asia.

- Get an in-depth perspective on Everest Medicines' performance by reading our health report here.

Assess Everest Medicines' past performance with our detailed historical performance reports.

Kingsoft (SEHK:3888)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kingsoft Corporation Limited operates in the entertainment and office software and services sectors across Mainland China, Hong Kong, and internationally, with a market capitalization of approximately HK$47.88 billion.

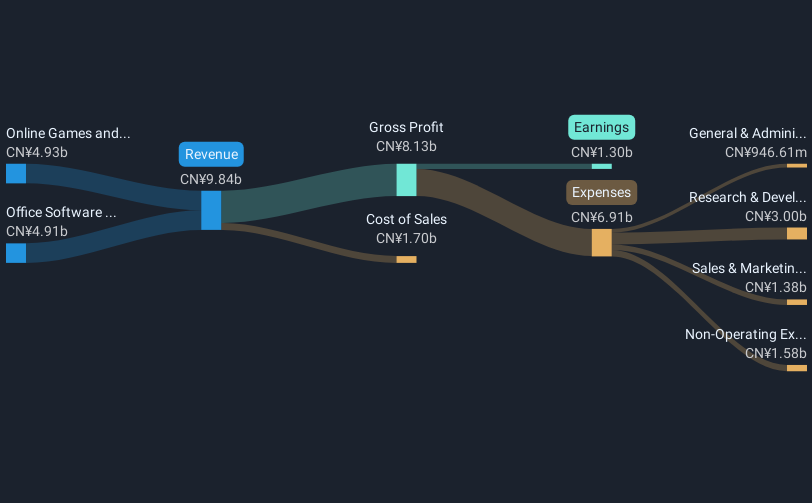

Operations: Kingsoft Corporation Limited generates revenue primarily from its online games and office software and services, with the former contributing CN¥5.32 billion and the latter CN¥5.20 billion.

Amidst a landscape where software firms are increasingly moving to SaaS models, Kingsoft stands out with its strategic focus on cloud services and office software solutions. The company recently reported a steady revenue increase to CNY 2.34 billion in Q1 2025 from CNY 2.14 billion in the previous year, reflecting a growth trajectory despite a slight dip in net income by CNY 0.7 million year-over-year. This performance is underpinned by robust R&D investments, crucial for maintaining competitive edge and innovation in the fast-evolving tech sector of Asia. With earnings expected to grow by an impressive 22.4% annually, Kingsoft is poised to capitalize on expanding digital needs across diverse markets while enhancing shareholder value through strategic dividends, evidenced by the recent declaration of HKD 0.15 per share for FY2024.

Summing It All Up

- Click here to access our complete index of 489 Asian High Growth Tech and AI Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1415

Cowell e Holdings

An investment holding company, engages in the design, development, manufacture and sale of modules and system integration products for smartphones, multimedia tablets and other mobile devices.

Exceptional growth potential with proven track record.

Market Insights

Community Narratives