- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:3700

Inkeverse Group (HKG:3700) stock falls 14% in past week as five-year earnings and shareholder returns continue downward trend

We're definitely into long term investing, but some companies are simply bad investments over any time frame. It hits us in the gut when we see fellow investors suffer a loss. Spare a thought for those who held Inkeverse Group Limited (HKG:3700) for five whole years - as the share price tanked 72%. The falls have accelerated recently, with the share price down 16% in the last three months. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

If the past week is anything to go by, investor sentiment for Inkeverse Group isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Check out our latest analysis for Inkeverse Group

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

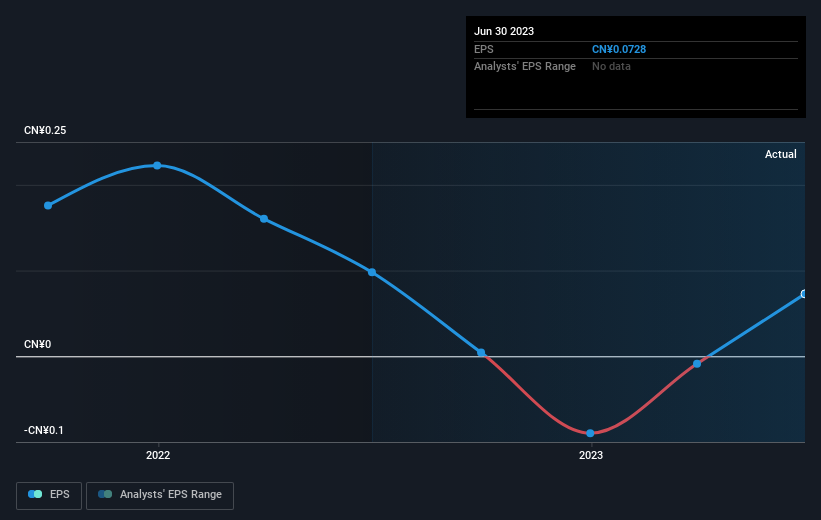

During the five years over which the share price declined, Inkeverse Group's earnings per share (EPS) dropped by 42% each year. The share price decline of 23% per year isn't as bad as the EPS decline. So the market may previously have expected a drop, or else it expects the situation will improve.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into Inkeverse Group's key metrics by checking this interactive graph of Inkeverse Group's earnings, revenue and cash flow.

A Different Perspective

While the broader market gained around 11% in the last year, Inkeverse Group shareholders lost 13%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 11% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Inkeverse Group has 2 warning signs (and 1 which shouldn't be ignored) we think you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3700

Inkeverse Group

An investment holding company, operates mobile live streaming platforms in the People’s Republic of China.

Flawless balance sheet and good value.