- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:3393

Undervalued Small Caps With Insider Buying For August 2024

Reviewed by Simply Wall St

In the current climate of market volatility and economic uncertainty, small-cap stocks have faced significant challenges. The S&P 600 Index, which tracks small-cap companies, has experienced notable fluctuations as broader market sentiment and economic indicators continue to impact these smaller firms. Amidst this backdrop, identifying undervalued small caps with insider buying can present unique opportunities for investors.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Tokmanni Group Oyj | 14.3x | 0.4x | 33.65% | ★★★★★★ |

| Ramaco Resources | 13.0x | 1.0x | 29.04% | ★★★★★★ |

| Columbus McKinnon | 20.5x | 0.9x | 43.74% | ★★★★★★ |

| Bytes Technology Group | 24.0x | 5.4x | 14.54% | ★★★★★☆ |

| Nexus Industrial REIT | 2.6x | 3.2x | 25.13% | ★★★★★☆ |

| Chatham Lodging Trust | NA | 1.2x | 32.85% | ★★★★★☆ |

| Lindblad Expeditions Holdings | NA | 0.7x | 47.07% | ★★★★★☆ |

| Calfrac Well Services | 2.5x | 0.2x | -24.95% | ★★★★☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -95.69% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

Vimeo (NasdaqGS:VMEO)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Vimeo is a video hosting, sharing, and services platform that provides tools for creators and businesses to manage, distribute, and monetize their videos, with a market cap of approximately $1.05 billion.

Operations: Vimeo generates revenue primarily from its Internet Software & Services segment, amounting to $421.08 million. The company's gross profit margin has shown an upward trend, reaching 78.37% as of June 30, 2024. Operating expenses include significant allocations to sales & marketing and R&D, with recent figures at $128.38 million and $102.08 million respectively for the same period.

PE: 24.4x

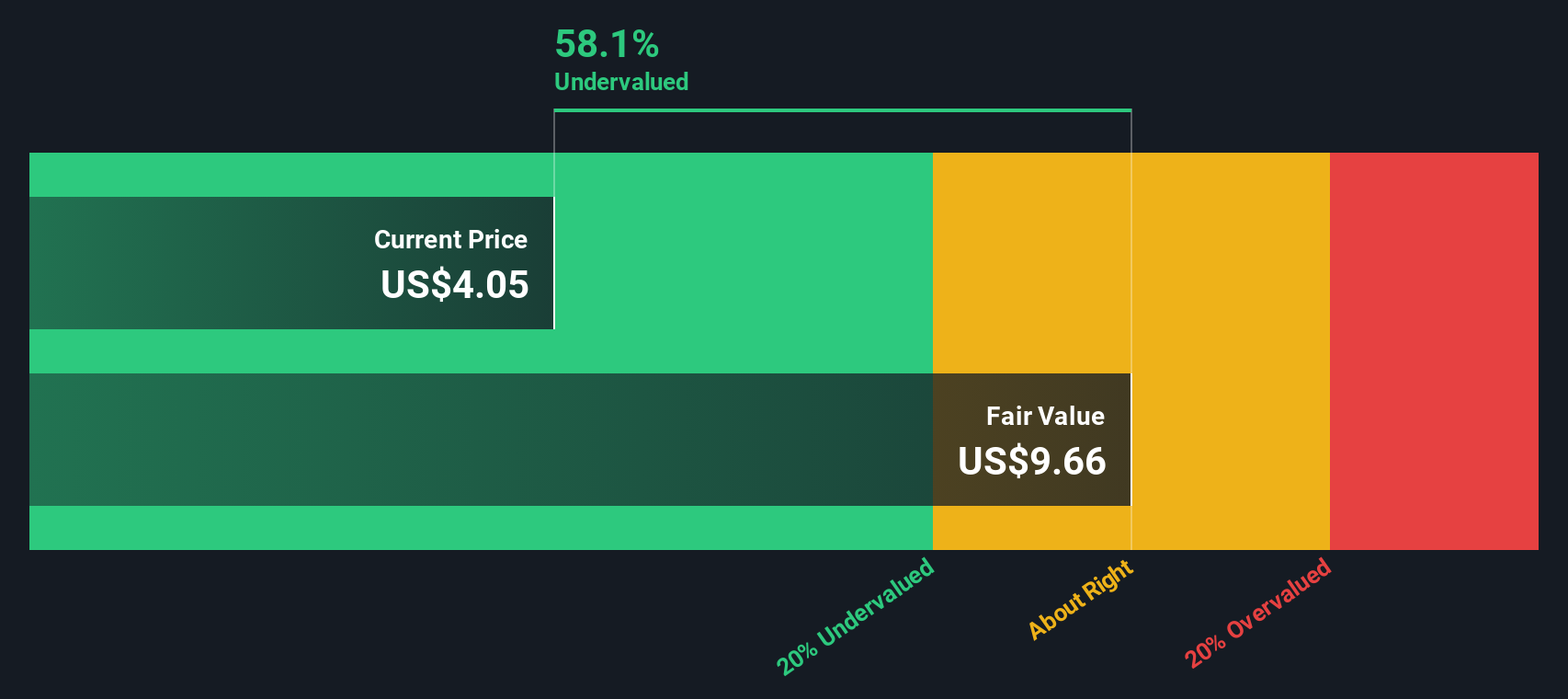

Vimeo, a small-cap company, recently reported Q2 2024 earnings with sales of US$104.38 million and net income of US$10.12 million, showing growth from the previous year. They launched an AI-powered video translation solution aimed at reducing costs and reaching global audiences efficiently. Despite being dropped from several growth indexes on July 1, 2024, they were added to the Russell 2000 Value-Defensive Index. Insider confidence is evident as executives have been purchasing shares over the past six months.

- Click here and access our complete valuation analysis report to understand the dynamics of Vimeo.

Examine Vimeo's past performance report to understand how it has performed in the past.

Kinetic Development Group (SEHK:1277)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Kinetic Development Group is involved in property development and investment, focusing on residential and commercial projects, with a market cap of CN¥2.45 billion.

Operations: Kinetic Development Group has seen its revenue grow from CN¥102.90 million in 2013 to CN¥4745.07 million by 2024, with a notable increase in gross profit margin reaching up to 69.80% during this period. The company’s primary costs are COGS and operating expenses, with significant non-operating expenses also impacting net income. Operating expenses include general & administrative and sales & marketing costs, which have varied over the years but remain key components of the financial structure.

PE: 4.4x

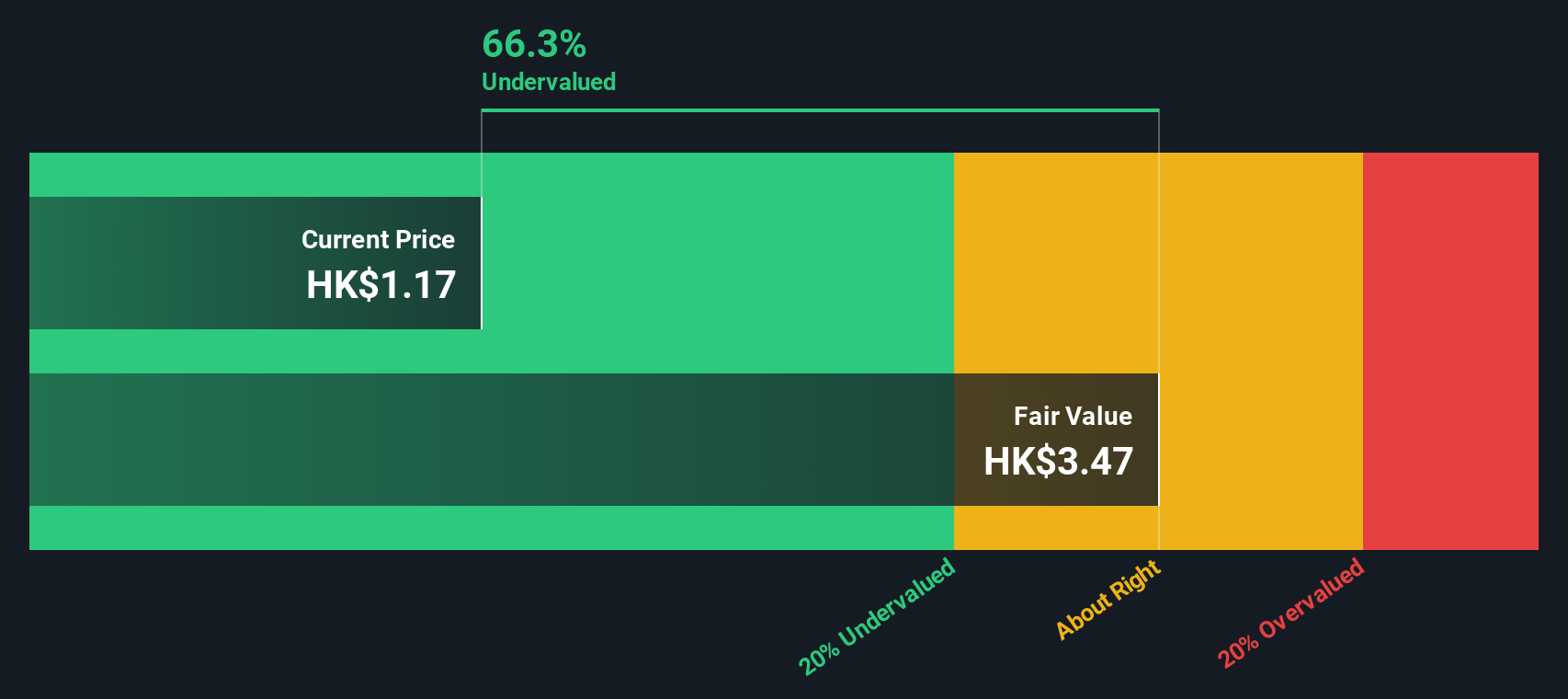

Kinetic Development Group, a small-cap stock, has recently attracted attention due to insider confidence. Between January and March 2024, several insiders purchased shares, indicating their belief in the company's potential. The firm relies entirely on external borrowing for its funding, which carries higher risk compared to customer deposits. A board meeting on Aug 12 will discuss a special dividend payment, potentially signaling strong financial health. Future prospects hinge on effective management of its funding risks and capitalizing on market opportunities.

- Navigate through the intricacies of Kinetic Development Group with our comprehensive valuation report here.

Gain insights into Kinetic Development Group's past trends and performance with our Past report.

Wasion Holdings (SEHK:3393)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Wasion Holdings specializes in the development and manufacturing of advanced metering infrastructure and distribution operations, with a market cap of approximately CN¥3.78 billion.

Operations: The company's revenue streams are primarily derived from Advanced Distribution Operations (CN¥2.48 billion), Power Advanced Metering Infrastructure (CN¥2.67 billion), and Communication and Fluid Advanced Metering Infrastructure (CN¥2.21 billion). Over recent periods, the gross profit margin has ranged from 29.12% to 35.59%.

PE: 11.6x

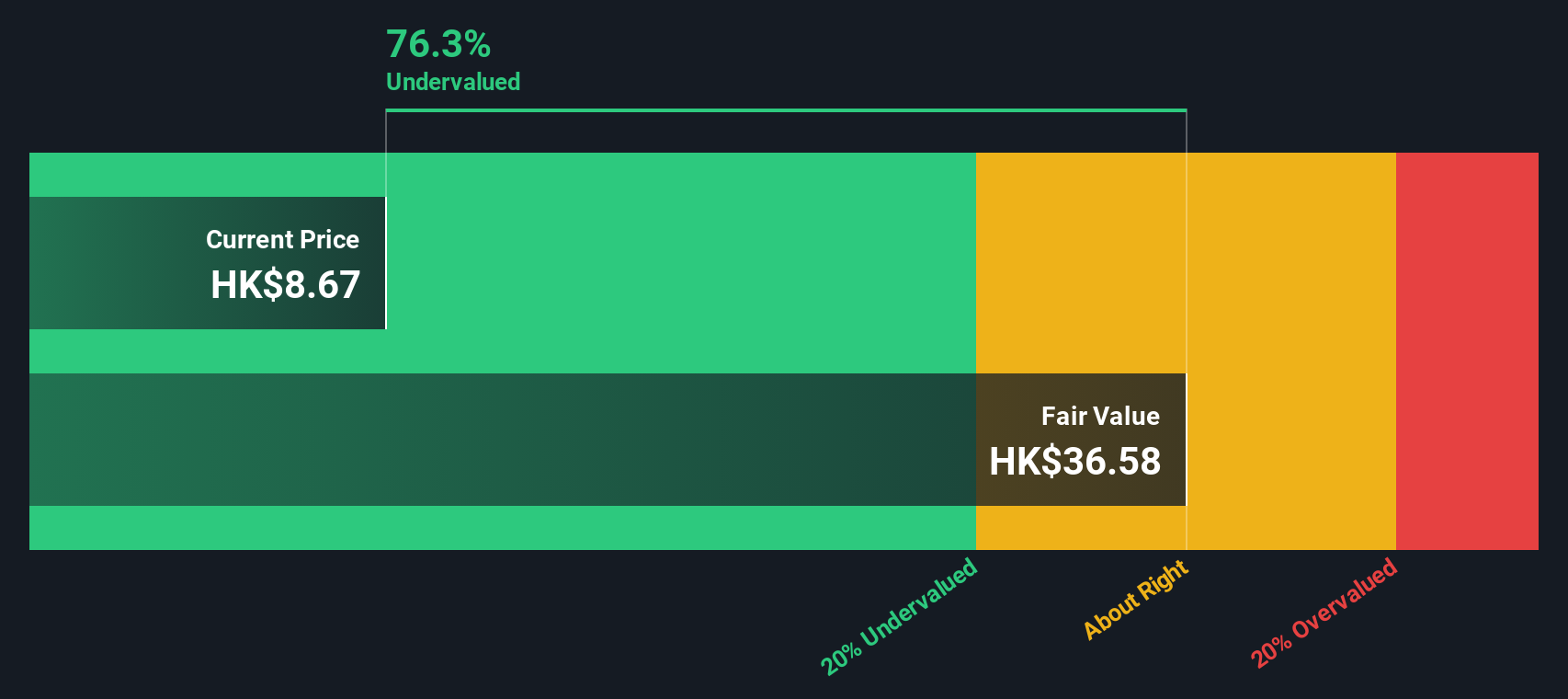

Wasion Holdings has demonstrated significant insider confidence, with Founder and Executive Chairman Wei Ji purchasing 500,000 shares for approximately HK$3.17 million between May and July 2024. This purchase represents a 0.05% increase in their holdings, signaling strong belief in the company's prospects. Recent smart meter contracts secured by Wasion's subsidiaries in Hungary (EUR31.62 million), Singapore (US$9.42 million), and Malaysia (US$5.74 million) underscore its expanding international footprint and potential for future growth despite higher-risk external borrowing as its sole funding source.

- Unlock comprehensive insights into our analysis of Wasion Holdings stock in this valuation report.

Assess Wasion Holdings' past performance with our detailed historical performance reports.

Summing It All Up

- Dive into all 208 of the Undervalued Small Caps With Insider Buying we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wasion Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3393

Wasion Holdings

An investment holding company, engages in the research and development, production, and sale of energy metering and energy efficiency management solutions for energy supply industries in the People’s Republic of China, Africa, the United States, Europe, and rest of Asia.

High growth potential with solid track record and pays a dividend.