- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:3601

Reflecting on 360 Ludashi Holdings' (HKG:3601) Share Price Returns Over The Last Year

The simplest way to benefit from a rising market is to buy an index fund. But if you buy individual stocks, you can do both better or worse than that. That downside risk was realized by 360 Ludashi Holdings Limited (HKG:3601) shareholders over the last year, as the share price declined 34%. That's disappointing when you consider the market returned 11%. 360 Ludashi Holdings hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. Unhappily, the share price slid 4.9% in the last week.

See our latest analysis for 360 Ludashi Holdings

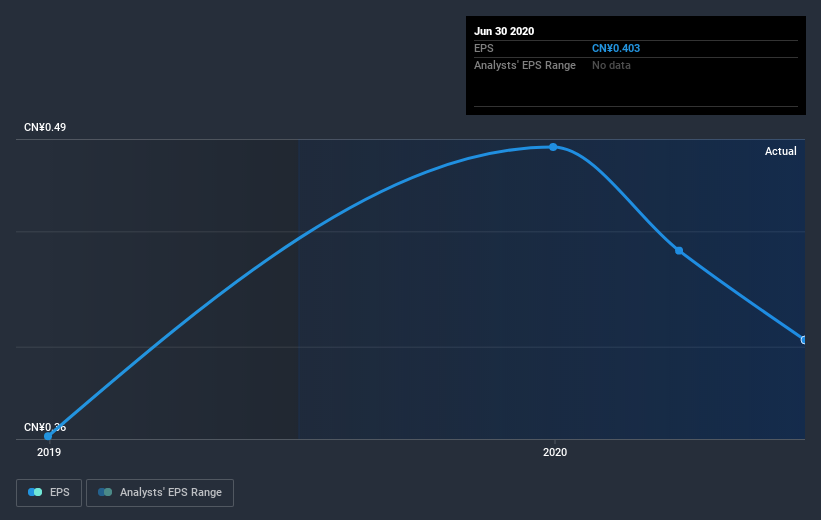

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Unfortunately 360 Ludashi Holdings reported an EPS drop of 4.9% for the last year. This reduction in EPS is not as bad as the 34% share price fall. Unsurprisingly, given the lack of EPS growth, the market seems to be more cautious about the stock. The P/E ratio of 5.26 also points to the negative market sentiment.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into 360 Ludashi Holdings' key metrics by checking this interactive graph of 360 Ludashi Holdings's earnings, revenue and cash flow.

A Different Perspective

Given that the market gained 11% in the last year, 360 Ludashi Holdings shareholders might be miffed that they lost 32% (even including dividends). While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. The share price decline has continued throughout the most recent three months, down 15%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 4 warning signs for 360 Ludashi Holdings you should be aware of, and 1 of them can't be ignored.

Of course 360 Ludashi Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade 360 Ludashi Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if 360 Ludashi Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:3601

360 Ludashi Holdings

An investment holding company, engages in online advertising and online game platform businesses in the People's Republic of China and internationally.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success