With A 34% Price Drop For Easou Technology Holdings Limited (HKG:2550) You'll Still Get What You Pay For

Easou Technology Holdings Limited (HKG:2550) shareholders that were waiting for something to happen have been dealt a blow with a 34% share price drop in the last month. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

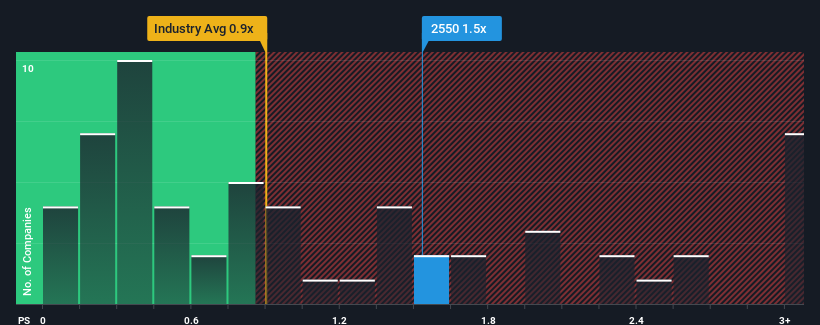

Even after such a large drop in price, you could still be forgiven for thinking Easou Technology Holdings is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.5x, considering almost half the companies in Hong Kong's Media industry have P/S ratios below 0.9x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Easou Technology Holdings

What Does Easou Technology Holdings' P/S Mean For Shareholders?

Easou Technology Holdings has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Easou Technology Holdings will help you shine a light on its historical performance.How Is Easou Technology Holdings' Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Easou Technology Holdings' to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 8.1% last year. This was backed up an excellent period prior to see revenue up by 39% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Comparing that to the industry, which is only predicted to deliver 7.6% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

In light of this, it's understandable that Easou Technology Holdings' P/S sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

What Does Easou Technology Holdings' P/S Mean For Investors?

There's still some elevation in Easou Technology Holdings' P/S, even if the same can't be said for its share price recently. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Easou Technology Holdings maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Easou Technology Holdings that you need to be mindful of.

If these risks are making you reconsider your opinion on Easou Technology Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Easou Technology Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2550

Easou Technology Holdings

Provides online reading platform, digital marketing, online games publishing, and other digital content services in Mainland China.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.