- South Korea

- /

- Electronic Equipment and Components

- /

- KOSE:A353200

High Growth Tech Stocks to Watch in December 2024

Reviewed by Simply Wall St

As global markets navigate a landscape marked by rate cuts from the ECB and SNB, alongside expectations for a Federal Reserve cut, the Nasdaq Composite has reached new heights, showcasing resilience in technology stocks despite broader index declines. With growth stocks continuing to outperform value counterparts, particularly in tech sectors like communication services and consumer discretionary, investors are keenly observing high-growth tech stocks that exhibit strong fundamentals and adaptability to current economic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1249 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

DAEDUCK ELECTRONICS (KOSE:A353200)

Simply Wall St Growth Rating: ★★★★☆☆

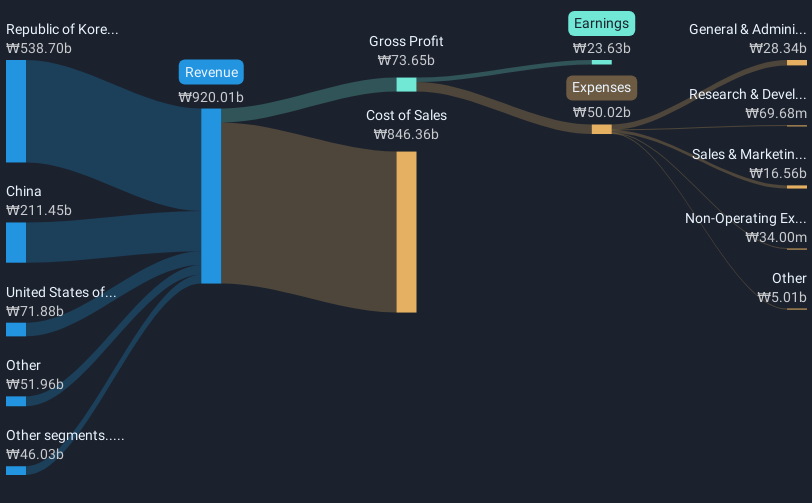

Overview: Daeduck Electronics Co., Ltd. specializes in the production and distribution of printed circuit boards (PCB) both domestically in South Korea and internationally, with a market capitalization of approximately ₩780.83 billion.

Operations: The company focuses on producing and selling printed circuit boards (PCBs), generating revenue of ₩920.01 billion.

DAEDUCK ELECTRONICS has demonstrated a robust trajectory in its financial performance, with an anticipated earnings growth of 58% per year, significantly outpacing the Korean market's average of 29.7%. This growth is supported by a revenue increase projected at 13.2% annually, which also exceeds the broader market expectation of 9%. Despite facing challenges like a profit margin reduction to 2.6% from last year’s 4.3%, the company's strong focus on R&D and strategic earnings calls suggest resilience and adaptability in navigating market dynamics. Recent quarterly reports show an increase in net income to KRW 5,176.58 million from KRW 3,765.62 million year-over-year, underscoring potential for continued upward momentum amidst competitive pressures.

XD (SEHK:2400)

Simply Wall St Growth Rating: ★★★★★☆

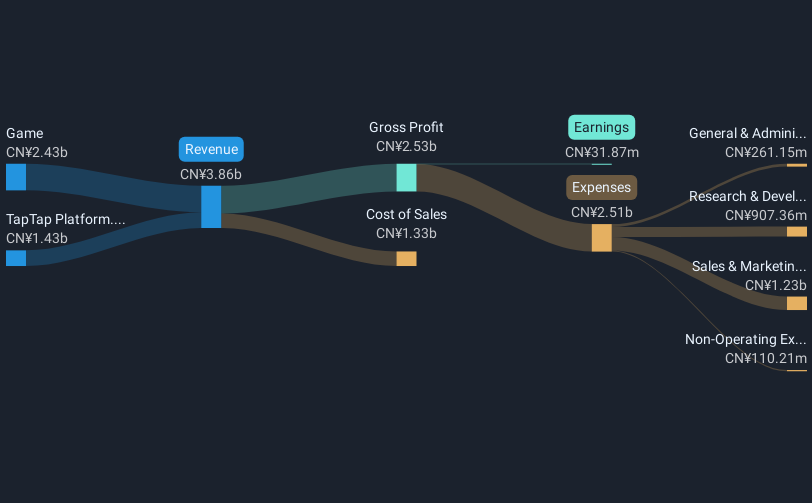

Overview: XD Inc. is an investment holding company that focuses on the development, publication, operation, and distribution of mobile and web games in Mainland China and internationally, with a market cap of approximately HK$12.92 billion.

Operations: XD Inc. generates revenue primarily through its Game segment, contributing CN¥2.43 billion, and the TapTap Platform, which adds CN¥1.43 billion to its income.

XD has carved a niche in the tech industry with its impressive annual earnings growth of 51.9%, significantly outstripping the Hong Kong market's average of 11.4%. This growth is bolstered by a robust revenue increase, projected at 14.6% annually, which also surpasses the broader market expectation of 7.8%. The company's commitment to innovation is evident from its R&D expenses, marking a strategic investment that aligns with its ambitious expansion plans in high-demand tech sectors. Furthermore, XD has recently transitioned to profitability, showcasing financial resilience and operational efficiency that could potentially shape its trajectory in an increasingly competitive landscape.

- Delve into the full analysis health report here for a deeper understanding of XD.

Examine XD's past performance report to understand how it has performed in the past.

Anhui XDLK Microsystem (SHSE:688582)

Simply Wall St Growth Rating: ★★★★★☆

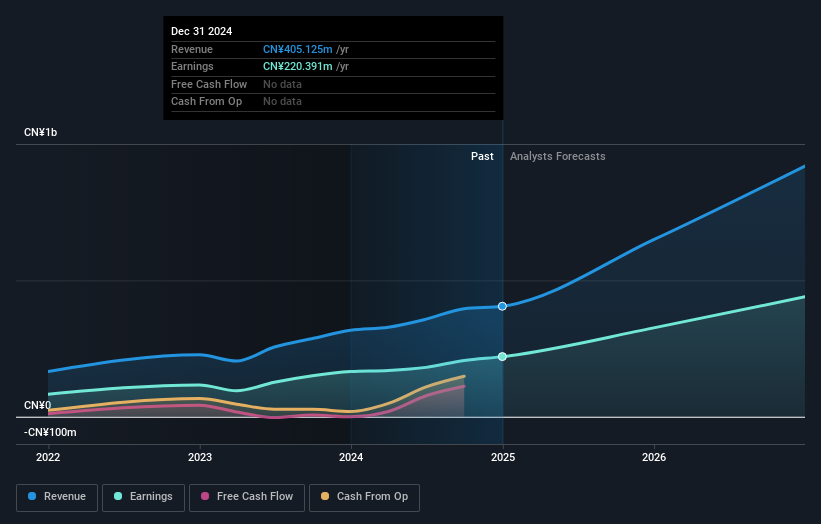

Overview: Anhui XDLK Microsystem Corporation Limited focuses on the research, development, production, and sale of sensors in China with a market capitalization of CN¥20.64 billion.

Operations: Anhui XDLK Microsystem generates revenue primarily from its electronic test and measurement instruments, amounting to CN¥396.31 million. The company is involved in the research, development, production, and sale of sensors within China.

Anhui XDLK Microsystem has demonstrated robust growth, with a notable 38.9% annual increase in revenue and an earnings surge of 35.5%, outpacing the broader Chinese market's averages significantly. This performance is underpinned by substantial R&D investments, which reflect the company’s strategic focus on innovation to maintain its competitive edge in the tech sector. Recent activities, including a significant acquisition and inclusion in the S&P Global BMI Index, suggest a proactive approach to expansion and market positioning that could influence its future trajectory positively.

- Dive into the specifics of Anhui XDLK Microsystem here with our thorough health report.

Explore historical data to track Anhui XDLK Microsystem's performance over time in our Past section.

Seize The Opportunity

- Access the full spectrum of 1249 High Growth Tech and AI Stocks by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A353200

DAEDUCK ELECTRONICS

Daeduck Electronics Co., Ltd. provides various printed circuit boards (PCB) in South Korea and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives