- Hong Kong

- /

- Entertainment

- /

- SEHK:2400

Can You Imagine How Jubilant XD's (HKG:2400) Shareholders Feel About Its 115% Share Price Gain?

XD Inc. (HKG:2400) shareholders might be rather concerned because the share price has dropped 42% in the last month. But that doesn't detract from the splendid returns of the last year. During that period, the share price soared a full 115%. So some might not be surprised to see the price retrace some. Investors should be wondering whether the business itself has the fundamental value required to continue to drive gains.

See our latest analysis for XD

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Over the last twelve months, XD actually shrank its EPS by 8.9%.

Given the share price gain, we doubt the market is measuring progress with EPS. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

However the year on year revenue growth of 26% would help. We do see some companies suppress earnings in order to accelerate revenue growth.

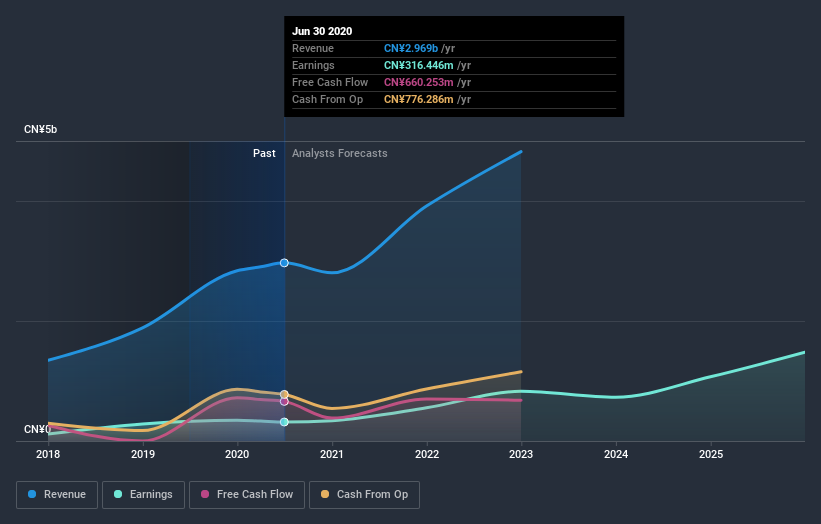

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free report showing analyst forecasts should help you form a view on XD

A Different Perspective

It's nice to see that XD shareholders have gained 115% over the last year. A substantial portion of that gain has come in the last three months, with the stock up 48% in that time. This suggests the company is continuing to win over new investors. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for XD that you should be aware of before investing here.

We will like XD better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade XD, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:2400

XD

An investment holding company, develops, publishes, operates, and distributes mobile and web games in Mainland China and internationally.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives