- Hong Kong

- /

- Entertainment

- /

- SEHK:2100

Asian Penny Stocks Spotlight: 3 Picks With Market Caps Over US$50M

Reviewed by Simply Wall St

Amid escalating geopolitical tensions and shifting trade dynamics, Asian markets have been navigating a complex landscape. Despite these challenges, certain sectors continue to offer intriguing opportunities for investors willing to explore beyond the mainstream. Though 'penny stock' might sound like an outdated term, it still points to smaller or newer companies that can offer significant growth potential when backed by strong financials and fundamentals.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.77 | HK$2.25B | ✅ 3 ⚠️ 0 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.21 | HK$763.45M | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.19 | HK$1.82B | ✅ 3 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.45 | SGD182.38M | ✅ 3 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.21 | HK$2.02B | ✅ 4 ⚠️ 2 View Analysis > |

| Halcyon Technology (SET:HTECH) | THB2.54 | THB762M | ✅ 2 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.27 | SGD8.93B | ✅ 5 ⚠️ 0 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.182 | SGD36.26M | ✅ 4 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.13 | SGD858.72M | ✅ 4 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.66 | HK$53.38B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,154 stocks from our Asian Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Wanda Hotel Development (SEHK:169)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Wanda Hotel Development Company Limited is an investment holding company involved in property development, investment, leasing, and management across China, the United States, the British Virgin Islands, and internationally with a market cap of HK$3.05 billion.

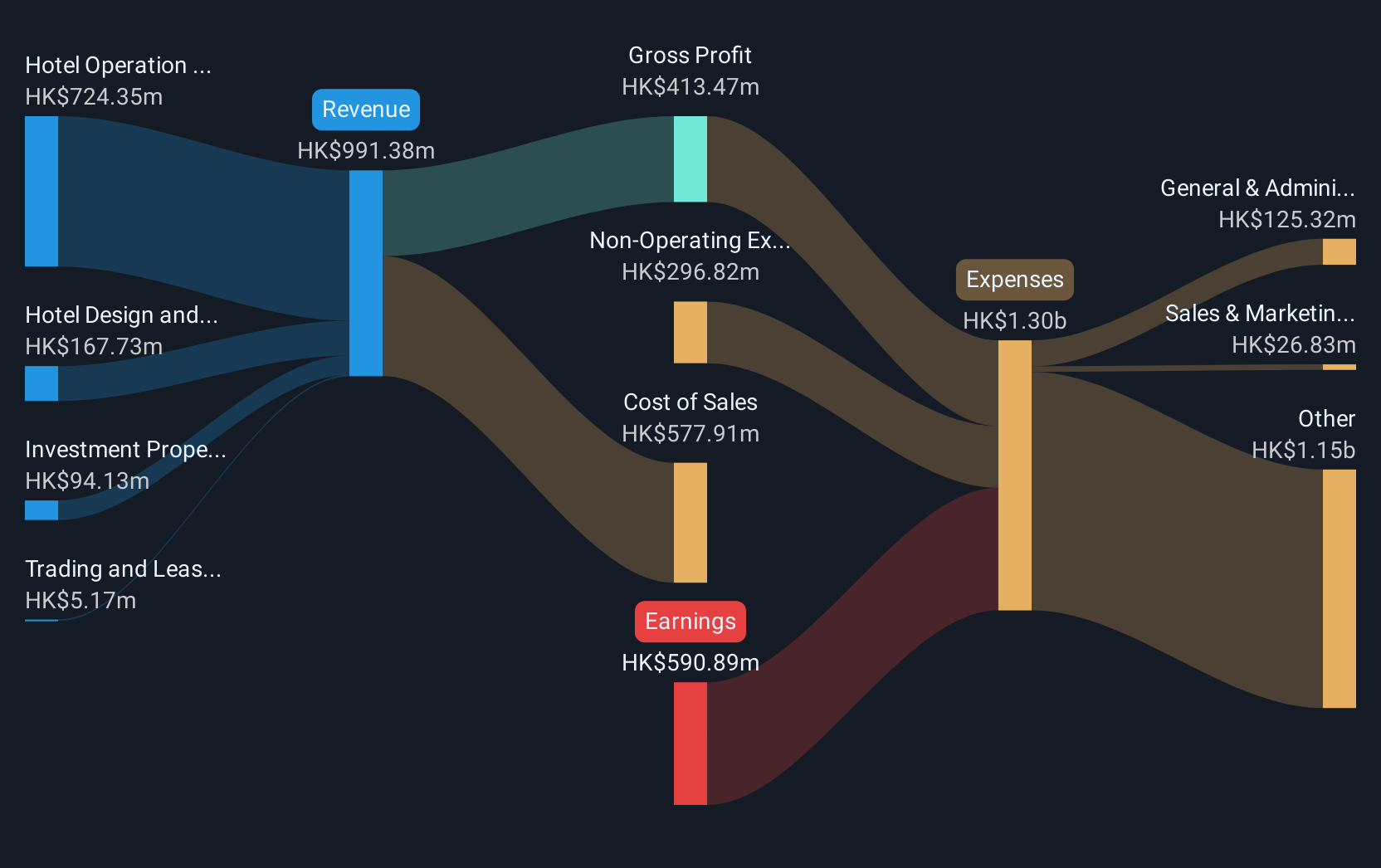

Operations: The company's revenue is primarily derived from hotel operation and management services (HK$724.35 million), supplemented by hotel design and construction management services (HK$167.73 million), investment property leasing (HK$94.13 million), and trading and leasing of overseas properties (HK$5.17 million).

Market Cap: HK$3.05B

Wanda Hotel Development's recent financials highlight its challenges as a penny stock, with a reported net loss of HK$590.89 million for 2024, contrasting sharply with the previous year's profit. The company remains debt-free and has ample short-term assets (HK$1.8 billion) covering both short and long-term liabilities, providing some financial stability despite unprofitability. Its experienced management team and board offer strategic guidance, while the company's substantial cash runway supports operations for over three years without needing additional funding. However, volatility in share price and declining earnings growth present ongoing concerns for potential investors.

- Get an in-depth perspective on Wanda Hotel Development's performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into Wanda Hotel Development's track record.

BAIOO Family Interactive (SEHK:2100)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: BAIOO Family Interactive Limited is an investment holding company that offers internet content and services in China and internationally, with a market cap of HK$1.49 billion.

Operations: The company generates revenue primarily from its Online Entertainment Business, which accounted for CN¥545.13 million.

Market Cap: HK$1.49B

BAIOO Family Interactive Limited, with a market cap of HK$1.49 billion, primarily generates revenue from its Online Entertainment Business, reporting CN¥545.13 million in sales for 2024 despite a net loss of CN¥28.03 million. The company is debt-free and maintains healthy short-term assets (CN¥1.1 billion) that exceed both short and long-term liabilities, offering financial stability amid unprofitability. Recent announcements include a special dividend proposal and increased quarterly active accounts to 6.5 million as of March 2025, reflecting growth in user engagement despite challenges in profit generation over the past five years due to declining earnings trends.

- Navigate through the intricacies of BAIOO Family Interactive with our comprehensive balance sheet health report here.

- Learn about BAIOO Family Interactive's historical performance here.

TeleChoice International (SGX:T41)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: TeleChoice International Limited is an investment holding company offering info-communications services and solutions to consumer and enterprise markets across Singapore, Indonesia, Malaysia, the Philippines, Hong Kong, and internationally with a market cap of SGD74.52 million.

Operations: The company's revenue is derived from three main segments: Network Engineering Services generating SGD53.25 million, Info-Communications Technology Services with SGD86.13 million, and Personal Communications Solutions Services contributing SGD241.41 million.

Market Cap: SGD74.52M

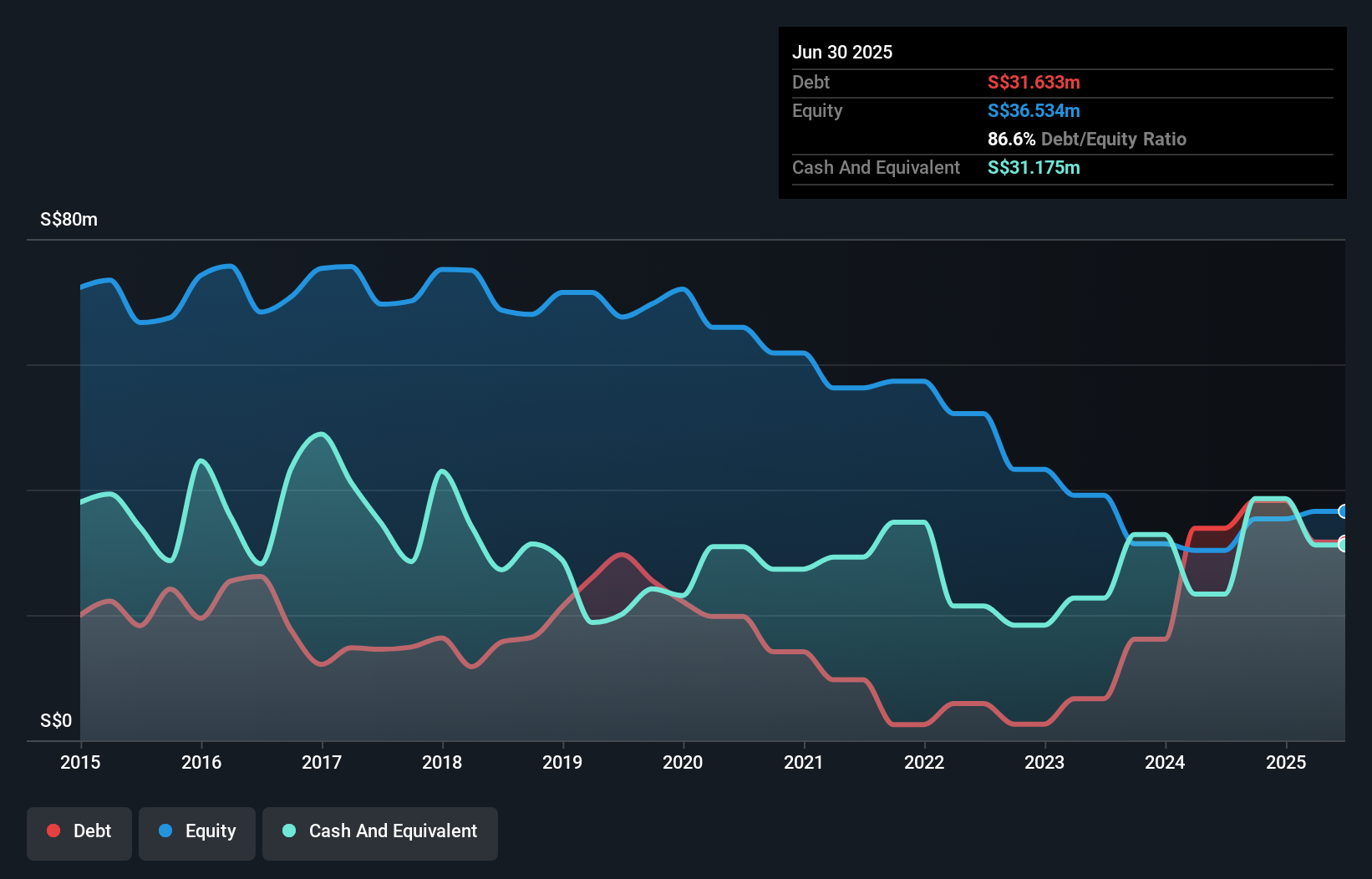

TeleChoice International Limited, with a market cap of SGD74.52 million, has become profitable in the past year despite a 26.2% annual decline in earnings over five years. The company operates across three segments: Network Engineering Services (SGD53.25M), Info-Communications Technology Services (SGD86.13M), and Personal Communications Solutions Services (SGD241.41M). While short-term assets exceed liabilities, the debt-to-equity ratio has increased significantly to 108.3%. Recent developments include a final dividend declaration and an upcoming earnings report for Q1 2025, indicating ongoing shareholder engagement amidst operational challenges and high share price volatility.

- Click here to discover the nuances of TeleChoice International with our detailed analytical financial health report.

- Gain insights into TeleChoice International's historical outcomes by reviewing our past performance report.

Next Steps

- Navigate through the entire inventory of 1,154 Asian Penny Stocks here.

- Curious About Other Options? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BAIOO Family Interactive might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2100

BAIOO Family Interactive

An investment holding company, provides internet content and services in the People’s Republic of China and internationally.

Flawless balance sheet with minimal risk.

Similar Companies

Market Insights

Community Narratives