- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:1980

Is Tian Ge Interactive Holdings (HKG:1980) Weighed On By Its Debt Load?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Tian Ge Interactive Holdings Limited (HKG:1980) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Tian Ge Interactive Holdings

How Much Debt Does Tian Ge Interactive Holdings Carry?

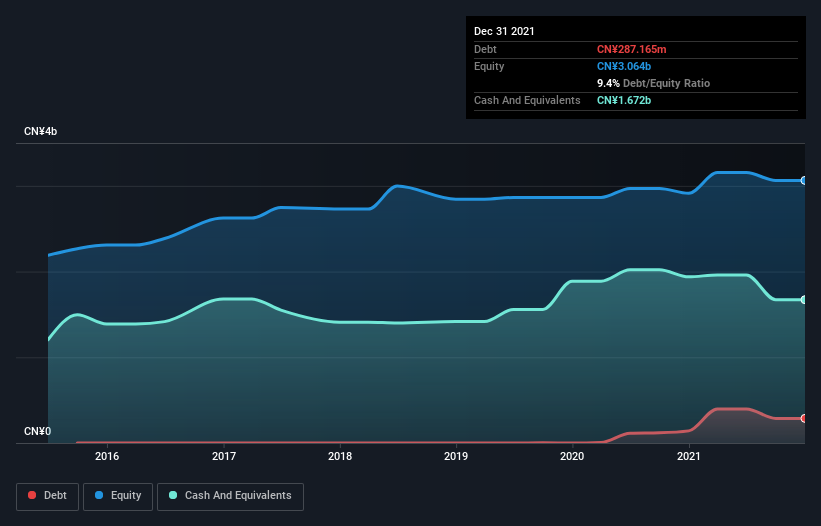

The image below, which you can click on for greater detail, shows that at December 2021 Tian Ge Interactive Holdings had debt of CN¥287.2m, up from CN¥141.4m in one year. However, it does have CN¥1.67b in cash offsetting this, leading to net cash of CN¥1.38b.

How Strong Is Tian Ge Interactive Holdings' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Tian Ge Interactive Holdings had liabilities of CN¥434.3m due within 12 months and liabilities of CN¥28.9m due beyond that. On the other hand, it had cash of CN¥1.67b and CN¥5.31m worth of receivables due within a year. So it can boast CN¥1.21b more liquid assets than total liabilities.

This surplus liquidity suggests that Tian Ge Interactive Holdings' balance sheet could take a hit just as well as Homer Simpson's head can take a punch. On this view, lenders should feel as safe as the beloved of a black-belt karate master. Simply put, the fact that Tian Ge Interactive Holdings has more cash than debt is arguably a good indication that it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But it is Tian Ge Interactive Holdings's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Tian Ge Interactive Holdings had a loss before interest and tax, and actually shrunk its revenue by 36%, to CN¥211m. That makes us nervous, to say the least.

So How Risky Is Tian Ge Interactive Holdings?

While Tian Ge Interactive Holdings lost money on an earnings before interest and tax (EBIT) level, it actually booked a paper profit of CN¥77m. So taking that on face value, and considering the cash, we don't think its very risky in the near term. The next few years will be important as the business matures. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 3 warning signs for Tian Ge Interactive Holdings you should be aware of, and 1 of them is potentially serious.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Tian Ge Interactive Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1980

Tian Ge Interactive Holdings

An investment holding company, engages in the operation of live social video platforms and other services in the People’s Republic of China and internationally.

Mediocre balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026