Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Mobvista Inc. (HKG:1860) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Mobvista

How Much Debt Does Mobvista Carry?

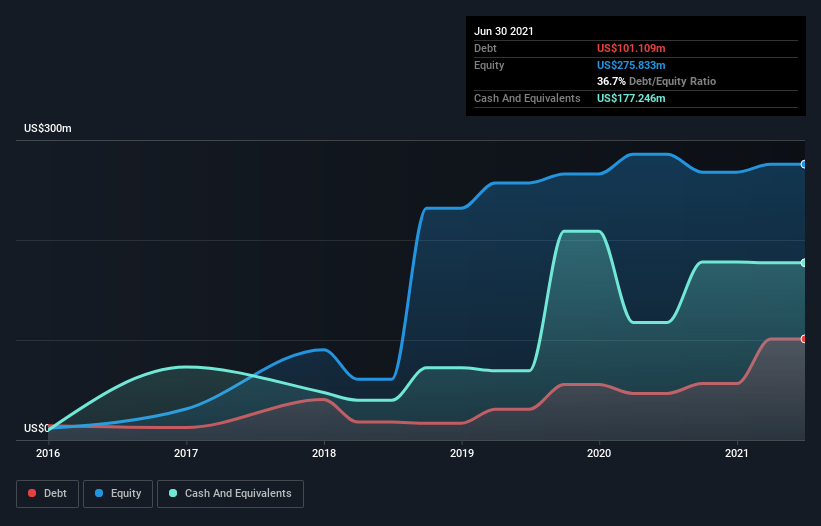

The image below, which you can click on for greater detail, shows that at June 2021 Mobvista had debt of US$101.1m, up from US$46.6m in one year. But it also has US$177.2m in cash to offset that, meaning it has US$76.1m net cash.

A Look At Mobvista's Liabilities

According to the last reported balance sheet, Mobvista had liabilities of US$305.5m due within 12 months, and liabilities of US$35.0m due beyond 12 months. On the other hand, it had cash of US$177.2m and US$314.7m worth of receivables due within a year. So it can boast US$151.5m more liquid assets than total liabilities.

This short term liquidity is a sign that Mobvista could probably pay off its debt with ease, as its balance sheet is far from stretched. Succinctly put, Mobvista boasts net cash, so it's fair to say it does not have a heavy debt load! When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Mobvista can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Over 12 months, Mobvista reported revenue of US$557m, which is a gain of 2.8%, although it did not report any earnings before interest and tax. We usually like to see faster growth from unprofitable companies, but each to their own.

So How Risky Is Mobvista?

Statistically speaking companies that lose money are riskier than those that make money. And in the last year Mobvista had an earnings before interest and tax (EBIT) loss, truth be told. And over the same period it saw negative free cash outflow of US$46m and booked a US$57m accounting loss. With only US$76.1m on the balance sheet, it would appear that its going to need to raise capital again soon. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 1 warning sign for Mobvista you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1860

Mobvista

Engages in the provision of advertising and marketing technology services required to develop the mobile internet ecosystem to customers worldwide.

Exceptional growth potential and good value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026