Fitaihi Holding Group And Two More Penny Stocks With Promising Potential

Reviewed by Simply Wall St

In the wake of recent global market developments, where U.S. stocks have rallied to record highs driven by growth and tax optimism following a significant election outcome, investors are exploring diverse opportunities across different segments. The term 'penny stocks' might feel like a relic of past market eras, but the potential they represent is as real as ever. These smaller or relatively new companies can offer affordability and growth potential when paired with strong financials, presenting intriguing possibilities for investors willing to look beyond the big names in search of promising opportunities.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.22 | MYR343.4M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.785 | MYR135.97M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$545.92M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.475 | MYR2.36B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.865 | MYR287.13M | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.53 | MYR761.86M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.25 | £847.72M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.6075 | A$71.21M | ★★★★★★ |

| Seafco (SET:SEAFCO) | THB2.04 | THB1.67B | ★★★★★★ |

Click here to see the full list of 5,755 stocks from our Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Fitaihi Holding Group (SASE:4180)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fitaihi Holding Group specializes in gold, jewelry, and luxury products primarily in Saudi Arabia with a market cap of SAR1.13 billion.

Operations: The company's revenue is derived entirely from its operations in Saudi Arabia, totaling SAR36.67 million.

Market Cap: SAR1.13B

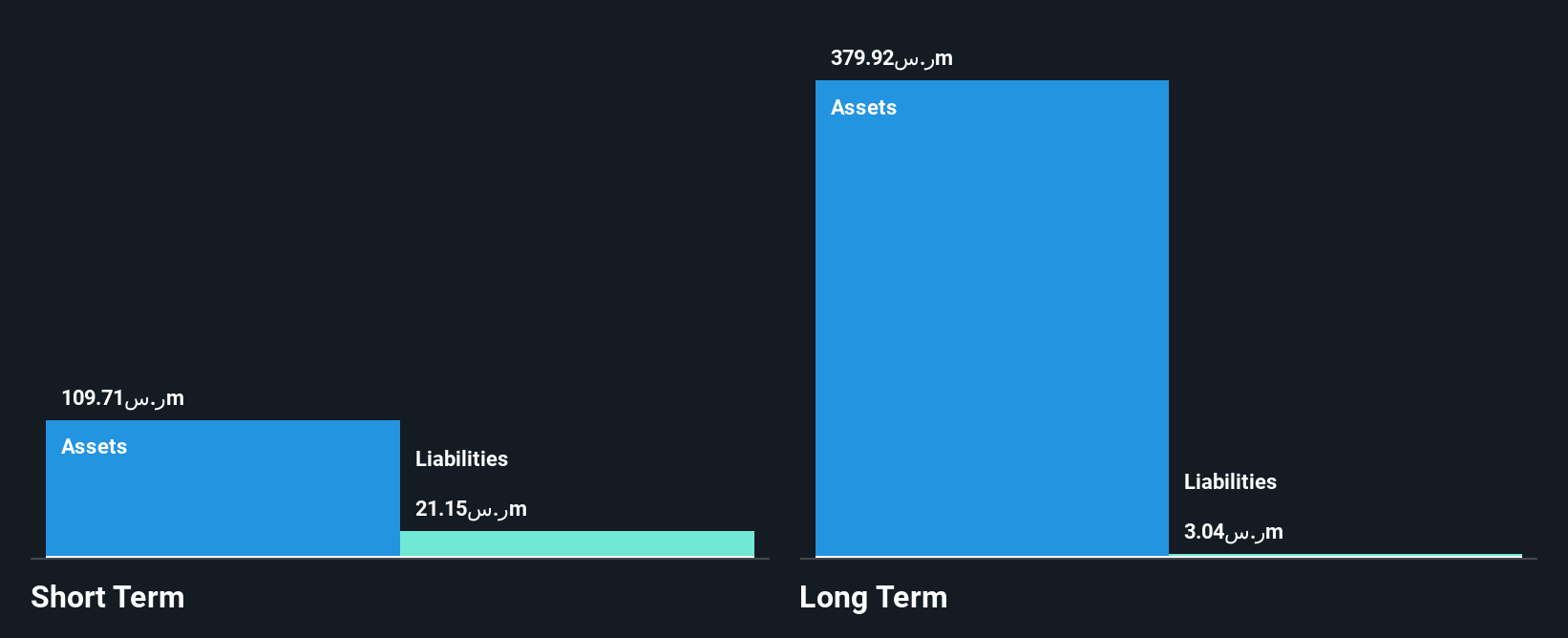

Fitaihi Holding Group, with a market cap of SAR1.13 billion, operates debt-free and has seen its earnings become profitable this year despite a historical decline of 16.2% annually over the past five years. The company's short-term assets (SAR118.6M) comfortably cover both short-term (SAR23.2M) and long-term liabilities (SAR3.5M). While its Return on Equity is low at 2.3%, Fitaihi's high-quality earnings and experienced board offer stability in the volatile penny stock landscape, although challenges remain in achieving substantial growth compared to industry standards.

- Click here to discover the nuances of Fitaihi Holding Group with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Fitaihi Holding Group's track record.

Oriental Enterprise Holdings (SEHK:18)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Oriental Enterprise Holdings Limited is an investment holding company involved in newspaper publication in Hong Kong and Australia, with a market cap of HK$995.14 million.

Operations: The company's revenue is primarily derived from the publication of newspapers, generating HK$564.18 million, supplemented by its money lending business which contributes HK$45.45 million.

Market Cap: HK$995.14M

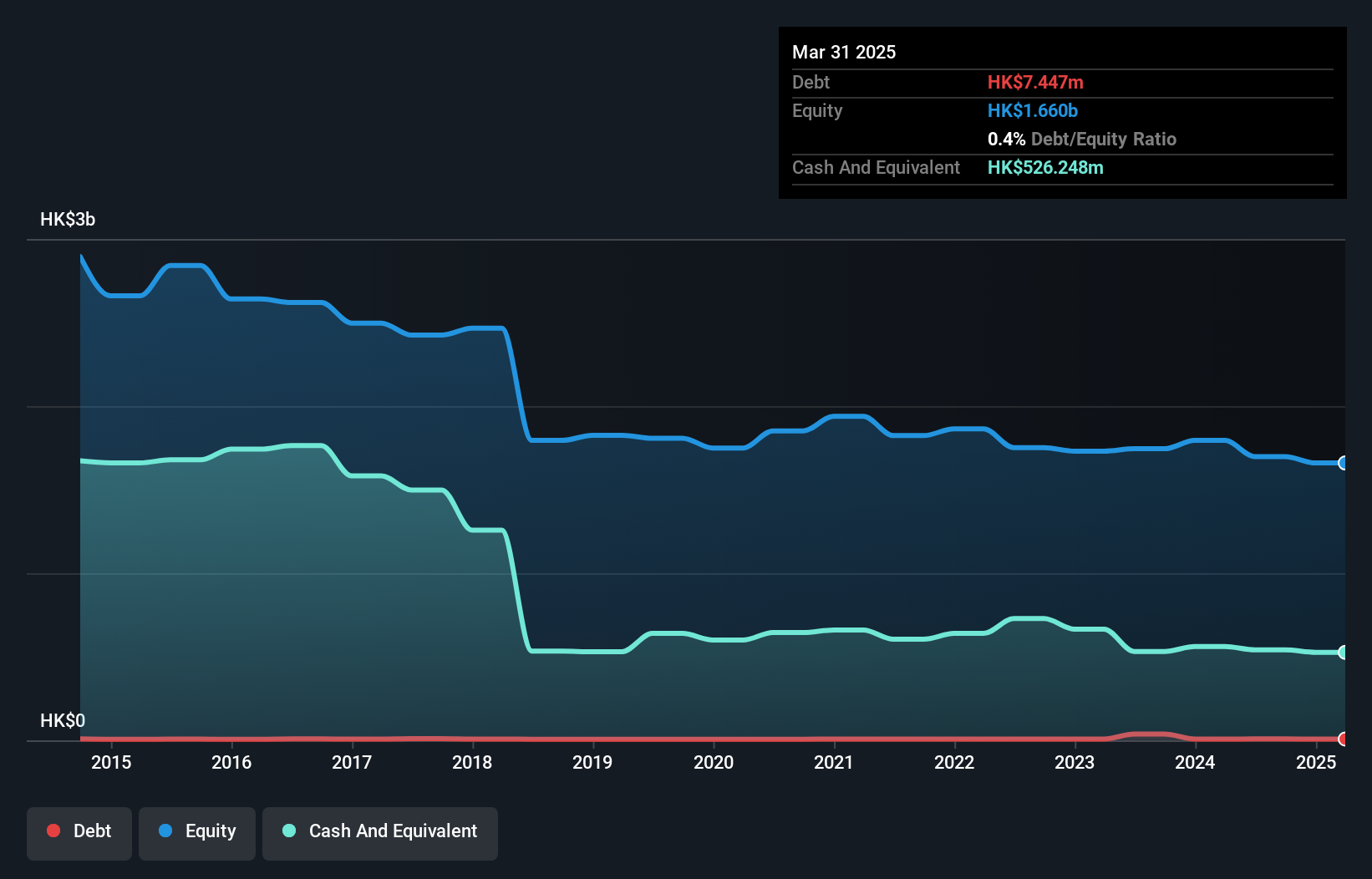

Oriental Enterprise Holdings Limited, with a market cap of HK$995.14 million, faces challenges as its negative operating cash flow leaves debt uncovered and its dividend yield of 14.46% is unsustainable by earnings or free cash flows. Despite these concerns, the company has high-quality past earnings and strong asset coverage for both short-term (HK$1.2 billion) and long-term liabilities (HK$83.3 million). Recent dividends include a final and special dividend of HKD 3 cents per share each, approved at the August AGM. However, recent negative earnings growth (-54.9%) contrasts sharply with previous five-year annual growth rates of 14.6%.

- Unlock comprehensive insights into our analysis of Oriental Enterprise Holdings stock in this financial health report.

- Explore historical data to track Oriental Enterprise Holdings' performance over time in our past results report.

Novolog (Pharm-Up 1966) (TASE:NVLG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Novolog (Pharm-Up 1966) Ltd operates in the healthcare services sector in Israel with a market cap of ₪801.83 million.

Operations: The company generates revenue through its Logistics Division (₪1.44 billion), Health Services Division (₪220.76 million), and Digital Division (₪26.23 million).

Market Cap: ₪801.83M

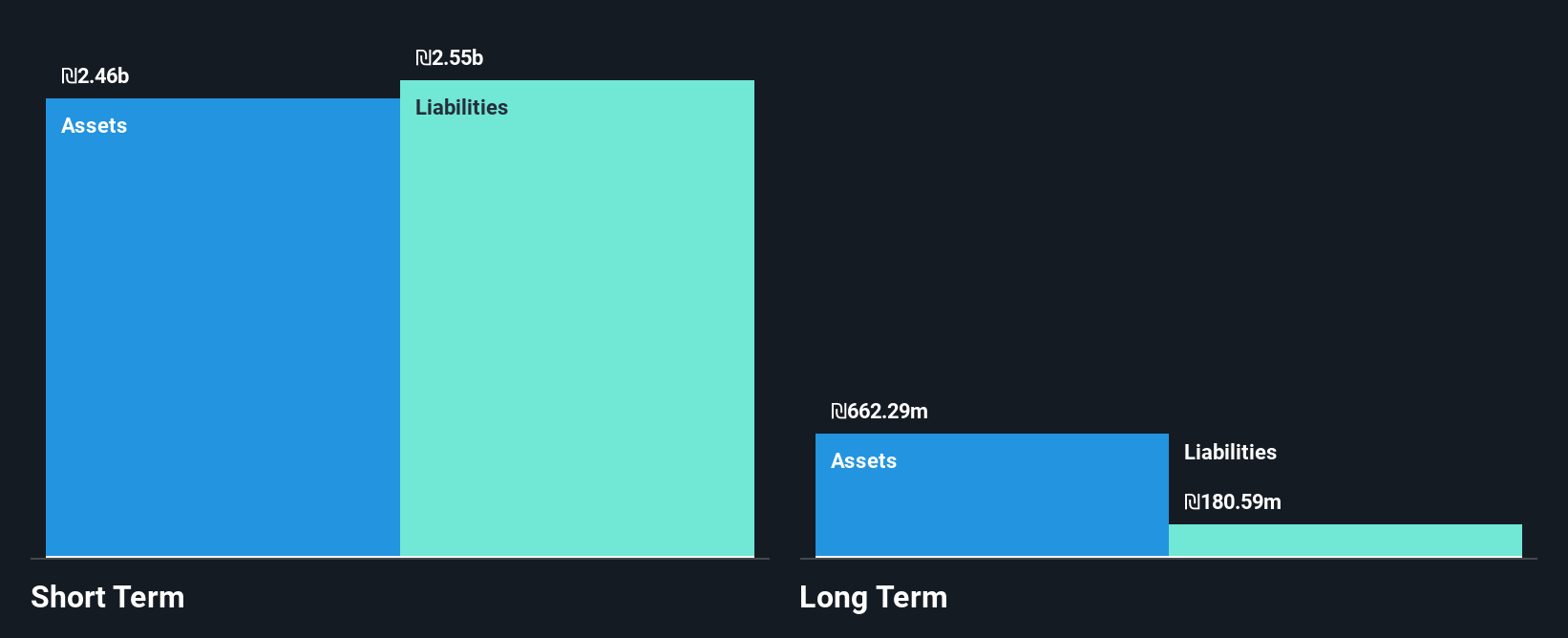

Novolog (Pharm-Up 1966) Ltd, with a market cap of ₪801.83 million, shows financial resilience despite being unprofitable, as its debt is well covered by operating cash flow and interest payments are well managed. The company has more cash than total debt and its short-term assets exceed long-term liabilities. However, the dividend yield of 3.74% is not supported by earnings or free cash flows. Recent earnings reports indicate an increase in sales to ₪866.02 million for the first half of 2024, with net income rising significantly to ₪25.26 million from a year ago's modest figure of ₪0.792 million.

- Take a closer look at Novolog (Pharm-Up 1966)'s potential here in our financial health report.

- Evaluate Novolog (Pharm-Up 1966)'s historical performance by accessing our past performance report.

Key Takeaways

- Click through to start exploring the rest of the 5,752 Penny Stocks now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:18

Oriental Enterprise Holdings

An investment holding company, engages in the publication of newspapers in Hong Kong and Australia.

Excellent balance sheet and fair value.

Market Insights

Community Narratives