- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:1762

Why Investors Shouldn't Be Surprised By Wanka Online Inc.'s (HKG:1762) 49% Share Price Surge

Wanka Online Inc. (HKG:1762) shares have had a really impressive month, gaining 49% after a shaky period beforehand. The last 30 days were the cherry on top of the stock's 940% gain in the last year, which is nothing short of spectacular.

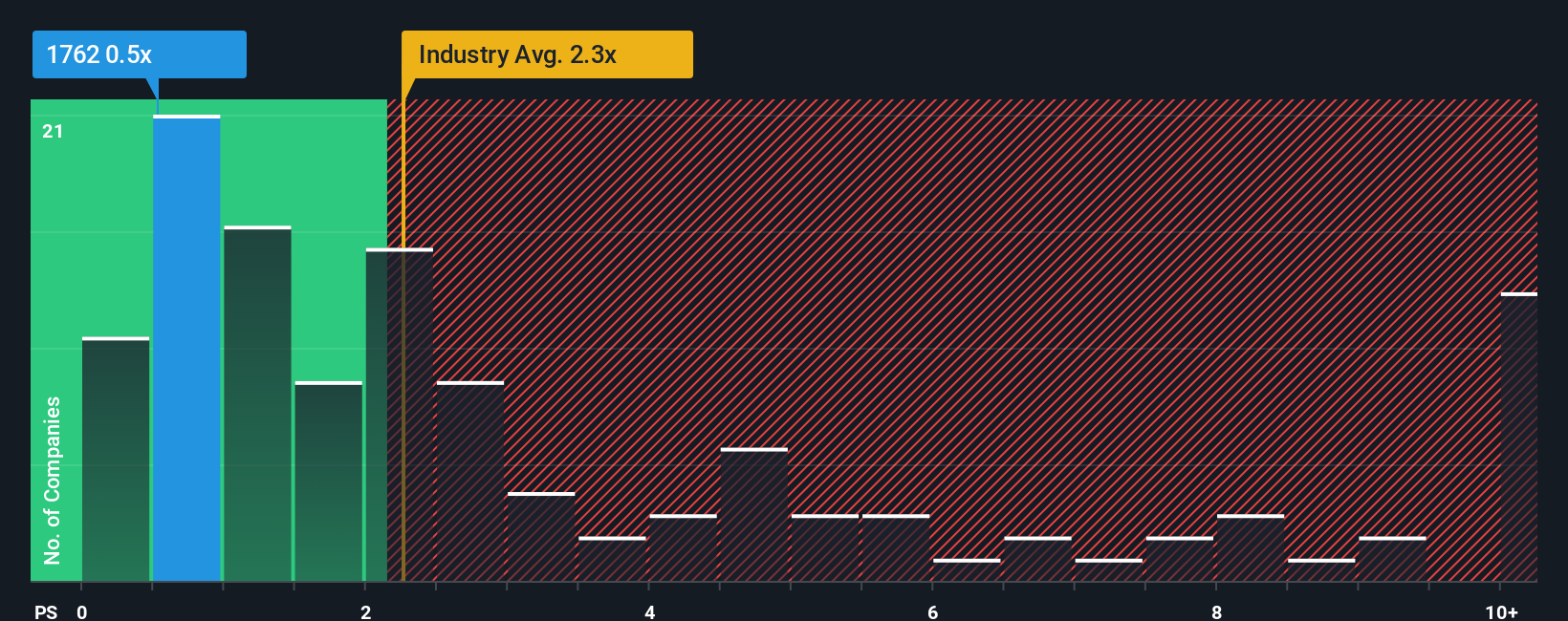

Even after such a large jump in price, it's still not a stretch to say that Wanka Online's price-to-sales (or "P/S") ratio of 0.5x right now seems quite "middle-of-the-road" compared to the Interactive Media and Services industry in Hong Kong, where the median P/S ratio is around 1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Wanka Online

What Does Wanka Online's P/S Mean For Shareholders?

Recent times have been quite advantageous for Wanka Online as its revenue has been rising very briskly. It might be that many expect the strong revenue performance to wane, which has kept the share price, and thus the P/S ratio, from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for Wanka Online, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Wanka Online's Revenue Growth Trending?

Wanka Online's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 36%. The latest three year period has also seen an excellent 37% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is predicted to deliver 11% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this information, we can see why Wanka Online is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

What We Can Learn From Wanka Online's P/S?

Wanka Online appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we've seen, Wanka Online's three-year revenue trends seem to be contributing to its P/S, given they look similar to current industry expectations. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Given the current circumstances, it seems improbable that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

You should always think about risks. Case in point, we've spotted 3 warning signs for Wanka Online you should be aware of, and 1 of them makes us a bit uncomfortable.

If you're unsure about the strength of Wanka Online's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Wanka Online might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1762

Wanka Online

Provides mobile advertising services in Mainland China and internationally.

Adequate balance sheet with low risk.

Market Insights

Community Narratives