- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:1762

Wanka Online (HKG:1762) Seems To Use Debt Rather Sparingly

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Wanka Online Inc. (HKG:1762) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Our analysis indicates that 1762 is potentially undervalued!

How Much Debt Does Wanka Online Carry?

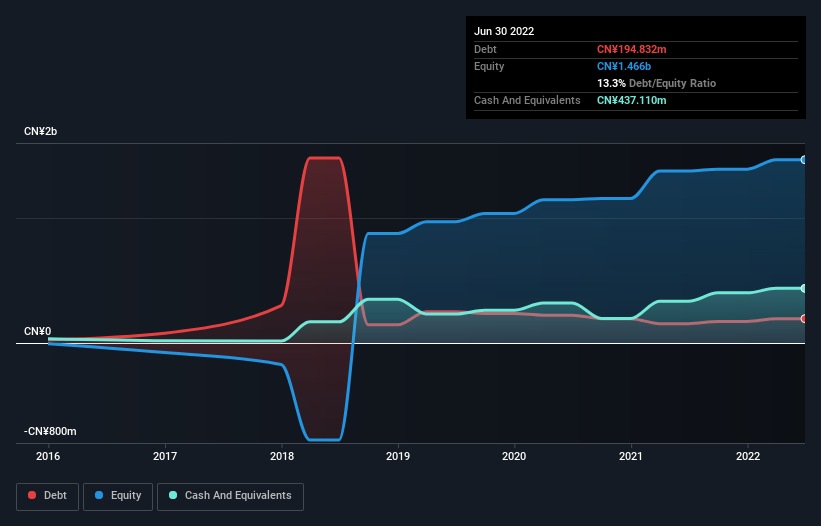

You can click the graphic below for the historical numbers, but it shows that as of June 2022 Wanka Online had CN¥194.8m of debt, an increase on CN¥155.0m, over one year. However, its balance sheet shows it holds CN¥437.1m in cash, so it actually has CN¥242.3m net cash.

How Strong Is Wanka Online's Balance Sheet?

According to the last reported balance sheet, Wanka Online had liabilities of CN¥443.4m due within 12 months, and liabilities of CN¥8.58m due beyond 12 months. On the other hand, it had cash of CN¥437.1m and CN¥658.5m worth of receivables due within a year. So it can boast CN¥643.6m more liquid assets than total liabilities.

This surplus strongly suggests that Wanka Online has a rock-solid balance sheet (and the debt is of no concern whatsoever). On this view, lenders should feel as safe as the beloved of a black-belt karate master. Succinctly put, Wanka Online boasts net cash, so it's fair to say it does not have a heavy debt load!

The good news is that Wanka Online has increased its EBIT by 5.1% over twelve months, which should ease any concerns about debt repayment. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Wanka Online will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While Wanka Online has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Looking at the most recent three years, Wanka Online recorded free cash flow of 37% of its EBIT, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Summing Up

While it is always sensible to investigate a company's debt, in this case Wanka Online has CN¥242.3m in net cash and a strong balance sheet. On top of that, it increased its EBIT by 5.1% in the last twelve months. So is Wanka Online's debt a risk? It doesn't seem so to us. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. To that end, you should be aware of the 2 warning signs we've spotted with Wanka Online .

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we're here to simplify it.

Discover if Wanka Online might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1762

Wanka Online

Provides android-based content distribution services in Mainland China.

Adequate balance sheet with acceptable track record.