- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:1753

Duiba Group Limited's (HKG:1753) Subdued P/S Might Signal An Opportunity

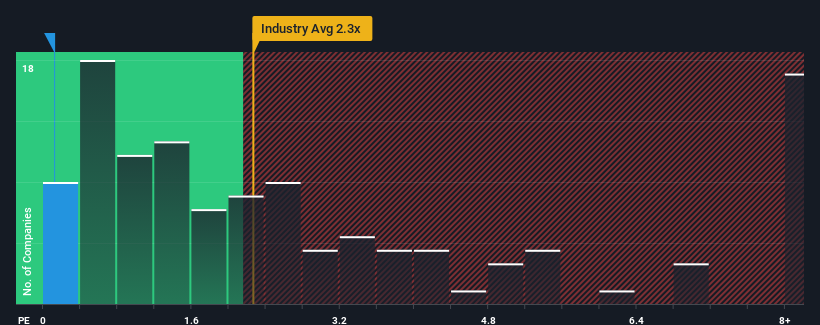

When you see that almost half of the companies in the Interactive Media and Services industry in Hong Kong have price-to-sales ratios (or "P/S") above 0.7x, Duiba Group Limited (HKG:1753) looks to be giving off some buy signals with its 0.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Duiba Group

How Duiba Group Has Been Performing

With revenue growth that's exceedingly strong of late, Duiba Group has been doing very well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Duiba Group's earnings, revenue and cash flow.How Is Duiba Group's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Duiba Group's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 63% last year. The latest three year period has also seen an excellent 35% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 11% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this information, we find it odd that Duiba Group is trading at a P/S lower than the industry. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

The Bottom Line On Duiba Group's P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

The fact that Duiba Group currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. When we see industry-like revenue growth but a lower than expected P/S, we assume potential risks are what might be placing downward pressure on the share price. medium-term

Plus, you should also learn about these 2 warning signs we've spotted with Duiba Group (including 1 which is potentially serious).

If you're unsure about the strength of Duiba Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1753

Duiba Group

An investment holding company, operates as a user management software as a service (SaaS) platform business in Mainland China.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives