- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:150

Shareholders Are Thrilled That The Hypebeast (HKG:150) Share Price Increased 156%

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But when you pick a company that is really flourishing, you can make more than 100%. For instance the Hypebeast Limited (HKG:150) share price is 156% higher than it was three years ago. How nice for those who held the stock! It's down 2.5% in the last seven days.

See our latest analysis for Hypebeast

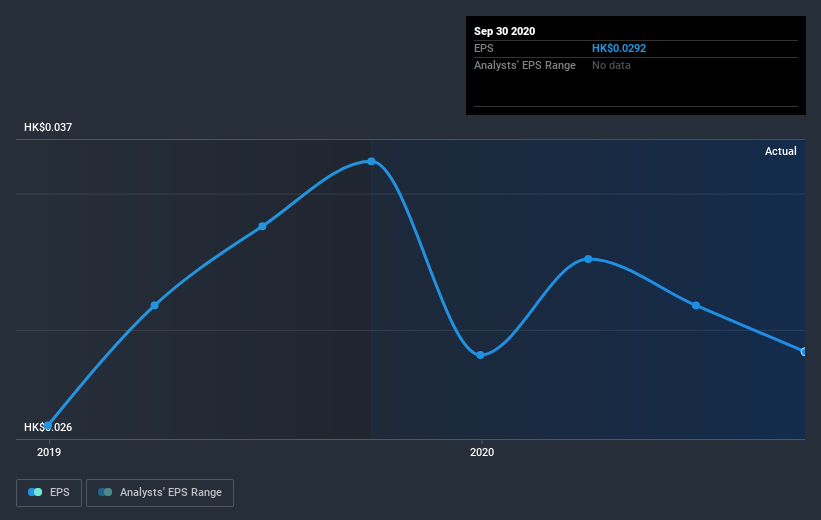

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Hypebeast was able to grow its EPS at 23% per year over three years, sending the share price higher. In comparison, the 37% per year gain in the share price outpaces the EPS growth. This indicates that the market is feeling more optimistic on the stock, after the last few years of progress. It's not unusual to see the market 're-rate' a stock, after a few years of growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

This free interactive report on Hypebeast's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Over the last year, Hypebeast shareholders took a loss of 39%. In contrast the market gained about 7.6%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Fortunately the longer term story is brighter, with total returns averaging about 37% per year over three years. The recent sell-off could be an opportunity if the business remains sound, so it may be worth checking the fundamental data for signs of a long-term growth trend. Before deciding if you like the current share price, check how Hypebeast scores on these 3 valuation metrics.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

When trading Hypebeast or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hypebeast might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:150

Hypebeast

Through its subsidiaries, operates as a digital media company in Hong Kong, the United States, the People’s Republic of China, and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives