- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:1357

Meitu (SEHK:1357): Assessing Valuation After Recent 5% Share Price Dip

Reviewed by Kshitija Bhandaru

Meitu (SEHK:1357) shares have seen a dip, with the stock slipping over 5% in recent trading. Investors are watching closely as the company navigates shifting market sentiment and re-evaluates its business strategies.

See our latest analysis for Meitu.

Meitu's recent slide comes after a year marked by dramatic momentum shifts, with the share price posting an impressive year-to-date return of 185.76%. Short-term volatility aside, long-term investors have enjoyed a stellar one-year total shareholder return of 224.55%. This signals that major gains have been rewarded to those sticking through recent swings.

If today’s wild moves have you wondering what other high-potential stocks are out there, it is the perfect moment to explore fast growing stocks with high insider ownership.

With the stock trading at a notable discount to analyst targets and earnings continuing to grow, the big question becomes: is this a rare value play, or are investors right to believe future potential is already priced in?

Most Popular Narrative: 36.9% Undervalued

The most widely followed narrative sets its fair value at HK$13.04, well above Meitu’s last close of HK$8.23, introducing a substantial gap between the market price and expectations. This projection raises the stakes and spotlights the assumptions powering that bullish target.

“Rapid international user growth, particularly outside of Mainland China, where monthly active users increased by 15.3% and revenue by 35.9%, signals Meitu is benefitting from expanding smartphone penetration and global demand for AI-enhanced imaging tools, likely to drive sustained increases in user base and recurring subscription revenue.”

Want to know what’s fueling this gap between price and potential? Massive revenue acceleration, bold margin calls, and premium multiples all collide in this narrative. Which factor is the linchpin for such a high valuation? The underlying growth engine and valuation math might surprise you. Click through to see the bold assumptions behind the story.

Result: Fair Value of $13.04 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition in AI imaging and Meitu's reliance on third-party models could undermine growth if there are setbacks in monetization or innovation.

Find out about the key risks to this Meitu narrative.

Another View: Market Ratios Signal a Different Story

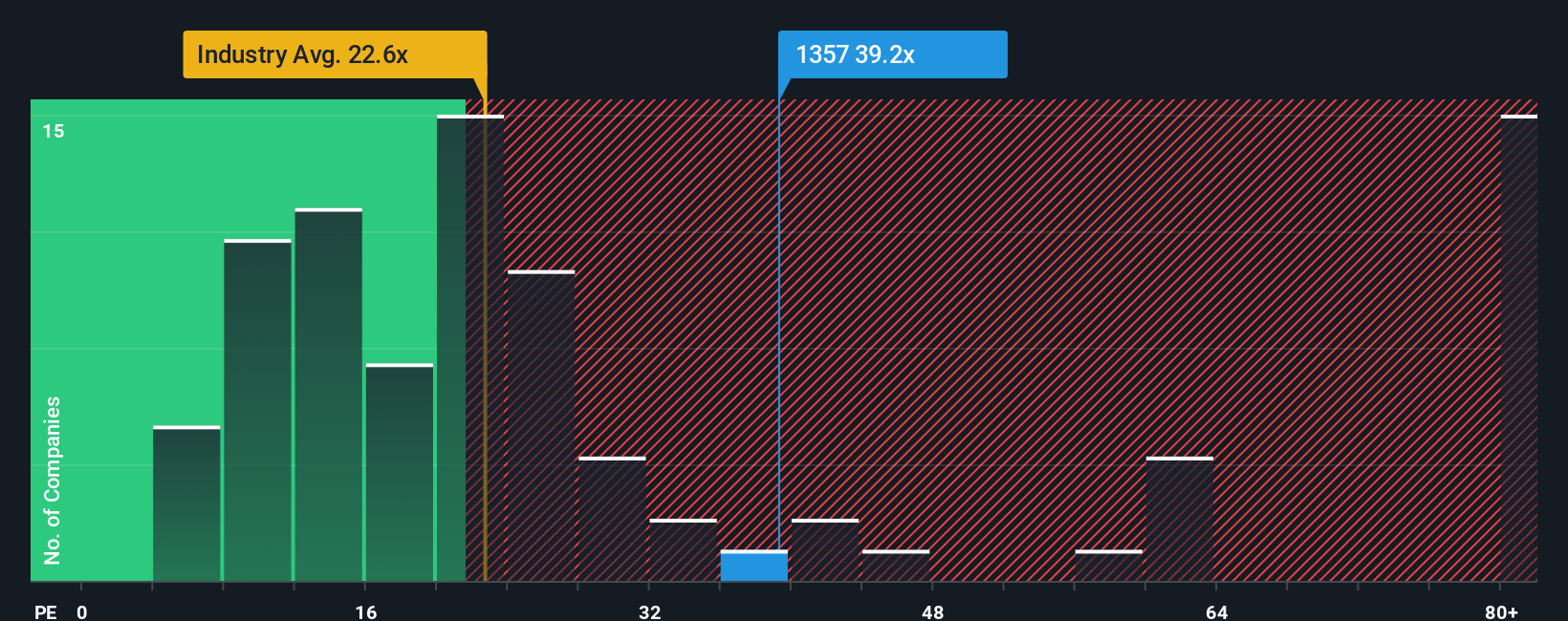

Looking at how the market values Meitu compared to peers tells a more cautious story. Its current price-to-earnings ratio is 38.4 times, which is well above both the Asian industry average of 22.3 and its peer group at 12.6, and it is also notably higher than the fair ratio of 24.6. Such a gap suggests investors may be paying up for growth, but also increases downside risk if expectations reset. Is Meitu’s premium justified, or is market enthusiasm overextended?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Meitu Narrative

If these narratives do not quite fit your own perspective, dive into the data and shape a story that makes sense to you in just a few minutes. Do it your way.

A great starting point for your Meitu research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't wait on the sidelines while others seize opportunities. Take action and target your next winner with these smart stock strategies from Simply Wall Street:

- Tap into high yields and boost your passive income by reviewing these 18 dividend stocks with yields > 3% returning over 3% in today's market.

- Catch tomorrow's tech leaders now by checking out these 24 AI penny stocks built around real-world artificial intelligence innovation and acceleration.

- Position yourself for long-term growth with these 878 undervalued stocks based on cash flows currently trading below what their cash flows suggest they are truly worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1357

Meitu

An investment holding company, engages in the development and provision of products that streamline the production of photo, video, and design with other AI-powered products in Mainland China and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives