- Hong Kong

- /

- Healthcare Services

- /

- SEHK:9860

July 2024's Top SEHK Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

In July 2024, the Hong Kong market has seen a mix of cautious optimism and strategic repositioning, reflecting broader global economic trends. Amid these shifts, growth companies with high insider ownership have garnered attention for their potential resilience and alignment with shareholder interests. When evaluating stocks in this environment, it's crucial to consider companies where insiders have significant stakes, as their vested interest often aligns management's goals with those of shareholders. This alignment can be particularly advantageous during periods of market volatility and economic uncertainty.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

| Name | Insider Ownership | Earnings Growth |

| iDreamSky Technology Holdings (SEHK:1119) | 20.2% | 104.1% |

| Pacific Textiles Holdings (SEHK:1382) | 11.2% | 37.7% |

| Tian Tu Capital (SEHK:1973) | 34% | 70.5% |

| Adicon Holdings (SEHK:9860) | 22.4% | 28.3% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 73% |

| DPC Dash (SEHK:1405) | 38.2% | 91.4% |

| Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.7% | 79.3% |

| Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 100.1% |

| Beijing Airdoc Technology (SEHK:2251) | 28.6% | 83.9% |

| Ocumension Therapeutics (SEHK:1477) | 23.3% | 93.7% |

Let's uncover some gems from our specialized screener.

Meitu (SEHK:1357)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Meitu, Inc. is an investment holding company that develops beauty-related digital solutions for image, video, and design production in China and internationally, with a market cap of HK$11.70 billion.

Operations: The company's revenue segment includes an Internet Business generating CN¥2.70 billion.

Insider Ownership: 36.6%

Earnings Growth Forecast: 26.4% p.a.

Meitu, Inc. demonstrates significant growth potential with earnings forecasted to grow 26.4% annually, outpacing the Hong Kong market's 11.3%. Recent guidance indicates a net profit increase of no less than 30% for H1 2024, highlighting strong performance. Despite recent executive changes and amendments to company bylaws, substantial insider buying suggests confidence in future prospects. However, large one-off items have impacted financial results and insider selling was noted over the past three months.

- Take a closer look at Meitu's potential here in our earnings growth report.

- According our valuation report, there's an indication that Meitu's share price might be on the expensive side.

Xiamen Yan Palace Bird's Nest Industry (SEHK:1497)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Xiamen Yan Palace Bird's Nest Industry Co., Ltd. and its subsidiaries focus on the research, development, production, and marketing of edible bird’s nest products in China, with a market cap of HK$6.99 billion.

Operations: The company's revenue segments include CN¥16.75 million from sales to online distributors, CN¥509.04 million from sales to offline distributors, CN¥824.40 million from direct sales to online customers, CN¥351.17 million from direct sales to offline customers, and CN¥262.89 million from direct sales to e-commerce platforms.

Insider Ownership: 26.7%

Earnings Growth Forecast: 14.8% p.a.

Xiamen Yan Palace Bird's Nest Industry exhibits steady revenue growth, forecasted at 12.5% annually, outpacing the Hong Kong market's 7.4%. Earnings are expected to grow 14.84% per year, higher than the market average of 11.3%. Recent guidance projects a revenue increase of up to RMB 1.09 billion for H1 2024 but anticipates a net profit decline by up to 50%, reflecting challenging conditions despite robust online sales growth and high insider ownership levels.

- Dive into the specifics of Xiamen Yan Palace Bird's Nest Industry here with our thorough growth forecast report.

- Our valuation report here indicates Xiamen Yan Palace Bird's Nest Industry may be overvalued.

Adicon Holdings (SEHK:9860)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Adicon Holdings Limited operates medical laboratories in the People’s Republic of China and has a market cap of HK$7.22 billion.

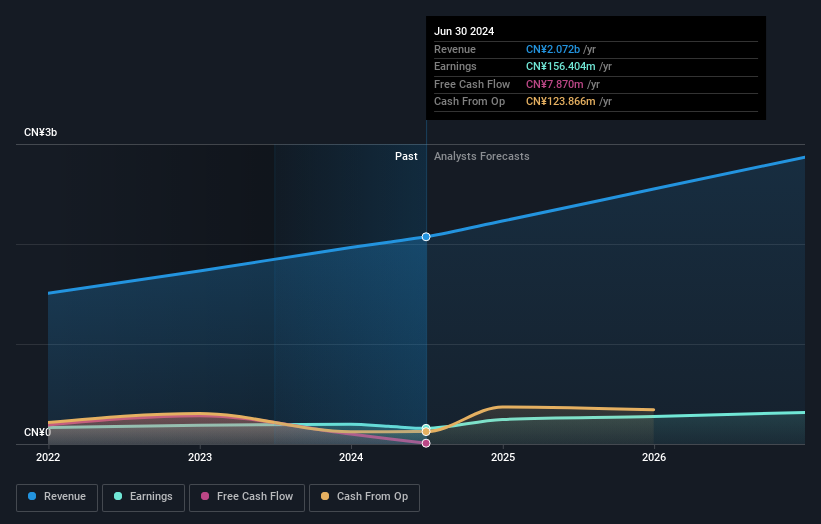

Operations: The company generates revenue of CN¥3.30 billion from its Healthcare Facilities & Services segment.

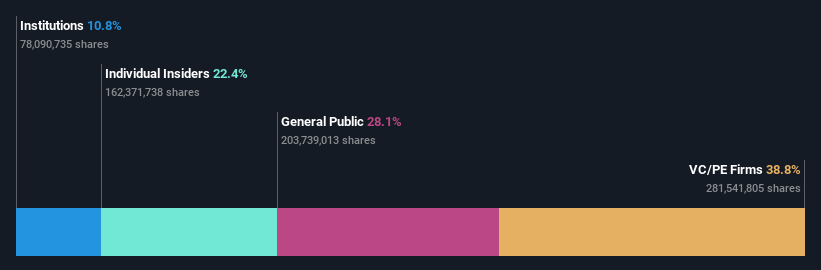

Insider Ownership: 22.4%

Earnings Growth Forecast: 28.3% p.a.

Adicon Holdings is forecast to achieve revenue growth of 14.3% annually, outpacing the Hong Kong market's 7.4%. Earnings are expected to grow significantly at 28.33% per year, with a high return on equity projected at 20.4%. Despite lower profit margins compared to last year, recent share repurchase programs and strategic board changes signal strong insider confidence and potential for increased net asset value and earnings per share.

- Delve into the full analysis future growth report here for a deeper understanding of Adicon Holdings.

- Insights from our recent valuation report point to the potential overvaluation of Adicon Holdings shares in the market.

Turning Ideas Into Actions

- Delve into our full catalog of 53 Fast Growing SEHK Companies With High Insider Ownership here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9860

Adicon Holdings

Operates medical laboratories in the People’s Republic of China.

Reasonable growth potential with adequate balance sheet.